As a seasoned financial analyst with over two decades of market experience under my belt, I find the current trend in Bitcoin and Ethereum exchange-traded funds (ETFs) intriguing yet not entirely surprising. The consistent outflows from these ETFs, especially Grayscale’s GBTC, suggest a cautious approach by investors amidst the volatile crypto market.

In the United States, Bitcoin exchange-traded funds (ETFs) have witnessed three straight days of net withdrawals, and Ethereum ETFs have resumed experiencing outflows as well.

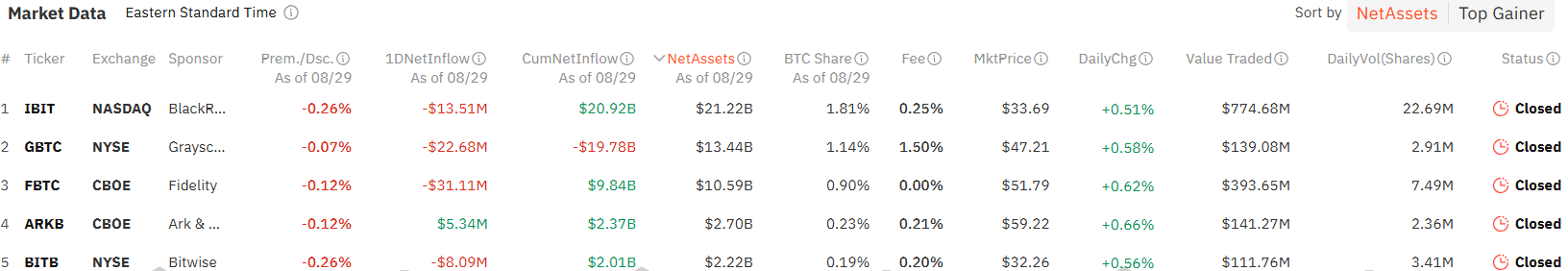

As reported by SoSoValue, Bitcoin exchange-traded funds (ETFs) experienced a total net withdrawal of approximately $71.73 million on August 29th. This marks the third straight day these ETFs have seen outflows.

1. On a notable day, Fidelity’s FBTC saw its largest outflows since August 6, totaling $31.1 million. Meanwhile, Grayscale’s GBTC has consistently experienced outflows, with $22.7 million being withdrawn on this occasion, bringing the cumulative outflows to a staggering $19.78 billion.

BlackRock’s IBIT, the largest Bitcoin ETF in terms of net assets, experienced its initial withdrawal of funds worth $13.5 million since May 1. However, it’s important to note that this outflow doesn’t change the total amount of money this fund has attracted so far, which is a significant $20.91 billion.

Different investment funds like Bitwise’s BITB and Valkyrie’s BRRR experienced withdrawals amounting to $8.1 million and $1.7 million respectively. In contrast, Ark and 21Shares’ ARKB was the sole Bitcoin ETF that recorded net inflows, accumulating $5.3 million.

On August 29th, the combined daily trade volume for the twelve Bitcoin Spot ETFs decreased to approximately $1.64 billion, a drop from $2.18 billion recorded the day prior. As I write this, Bitcoin (BTC) has dipped by 0.4% over the last 24 hours, with its current price being $59,342 according to data obtained from crypto.news.

On August 29th, there was a decrease in investment in Ethereum ETFs in the U.S., amounting to $1.77 million in net outflows, contrasting the moderate inflows of $5.84 million recorded on the previous day.

On that specific day, the only Ethereum ETF to experience outflows was Grayscale’s ETHE, amounting to $5.3 million. However, this was partially compensated by $3.6 million in net inflows into the Grayscale Ethereum Mini Trust. The other seven spot Ether ETFs did not record any activity on that day.

On August 29th, the combined trading value for the nine ETH ETFs decreased from $151.57 million on the previous day to $95.91 million. Meanwhile, Ethereum (ETH) was experiencing a 0.9% increase and was being traded at $2,529 as of the time this information was published.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- Brent Oil Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-08-30 11:02