As an experienced analyst following the cryptocurrency and ETF markets closely, I view this development with cautious optimism. Fidelity’s Ethereum FD Beneficial INT fund (FETH) being included on the DTCC list signals progress in the long-awaited journey for a U.S. spot Ethereum ETF. However, it is essential to remember that this does not guarantee an immediate launch.

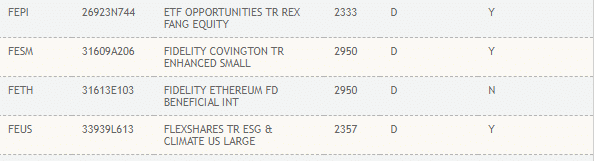

The anticipation for a U.S.-listed Ethereum ETF from the United States persists, but progress has been made with Fidelity Investments’ offering. Notably, the Depository Trust and Clearing Corporation (DTCC) has added Fidelity’s Ethereum Investment Trust (FETH) to its roster of exchange-traded funds (ETFs).

Although being added to the DTCC list is a promising sign, it doesn’t necessarily mean an imminent debut for FETH as an ETF. The DTCC explains that the “N” notation under the create/redeem column denotes FETH as a “pre-launch” ETF and remains untradeable until it obtains all required approvals.

The DTCC’s decision to incorporate FETH (Fidelity Ethereum Trust) follows a trend set by other companies like VanEck, Franklin Templeton, and BlackRock in proposing spot Ethereum ETFs. Nevertheless, it is important to note that the DTCC’s action does not signify SEC approval for the FETH ETF. This is simply a standard process.

Last week, the SEC granted significant progress by endorsing the 19b-4 forms for eight proposed spot Ethereum ETFs, including Fidelity’s application. Nevertheless, there is a crucial step left – the SEC’s approval of the S-1 registration statements for each ETF. Both Fidelity and BlackRock have recently submitted amended S-1 forms for their respective ETF projects.

The newly introduced BlackRock bitcoin spot ETF from BlackRock is currently the largest in its class, generating significant anticipation for potential future spot Ethereum ETFs.

Fidelity’s Ethereum ETF being added to the DTCC list signifies a step forward. However, keep in mind that the Securities and Exchange Commission (SEC) still needs to grant approval for this ETF before trading can commence.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-05-30 10:12