As a seasoned analyst with extensive experience in both traditional finance and the burgeoning digital asset landscape, I find myself at a crossroads regarding the SEC’s actions towards Flyfish Club and other NFT projects.

According to reports, the American Securities and Exchange Commission (SEC) has imposed a penalty of $750,000 on Flyfish Club, a restaurant venture, in a settlement agreement. The charges stem from accusations that they illegally offered unregistered digital asset securities for sale.

On September 16th, a cease and desist notice was given to Flyfish Club. This notice came after they had sold approximately 1,600 NFTs (Non-Fungible Tokens) to U.S. investors, earning them $14.8 million. The Securities and Exchange Commission (SEC) asserts that these NFTs, which were supposedly for access to a future Manhattan restaurant, functioned like securities. As such, they should have been registered according to the SEC’s regulations.

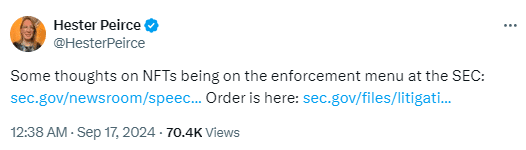

Nonetheless, Commissioners Hester Peirce and Mark Uyeda of the SEC have expressed robust disapproval towards this action. They contend that the NFTs issued by Flyfish Club were essentially an innovative method for selling restaurant memberships, and should not be subject to securities regulations.

In a disputing correspondence, I, as an analyst, articulate my apprehension that this enforcement measure might hinder innovation in the realm of NFTs. I am of the opinion that creators ought to be granted greater liberty to explore and experiment with Non-Fungible Tokens (NFTs), without being burdened by intricate legal interpretations. Thus, I advocate for the Securities and Exchange Commission (SEC) to provide clearer directives, enabling NFT innovators to proceed fearlessly, without the looming threat of regulatory retaliation.

Under the terms of the settlement, the Flyfish Club, spearheaded by entrepreneur Gary Vaynerchuk who rose to prominence during the 2021 NFT craze, has decided to eliminate all remaining Non-Fungible Tokens (NFTs) and will not collect royalties from future NFT sales. Expected to open this month, the restaurant marks a new chapter in its operations.

This move forms part of a wider clampdown by the SEC on Non-Fungible Token (NFT) initiatives. It includes recent allegations against Impact Theory and Stoner Cats 2, as well as a notice sent to OpenSea, one of the biggest NFT marketplaces.

The manner in which the Securities and Exchange Commission (SEC) is handling the situation has sparked debate over how to strike a harmonious balance between regulatory oversight and technological advancement, particularly within the fast-paced environment of Non-Fungible Tokens (NFTs).

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

2024-09-17 09:58