As a seasoned analyst with years of experience in the ever-evolving world of cryptocurrencies, I find it intriguing to observe the dynamic dance between blockchains and scammers. The recent announcement by the drainer operators to abandon TON might suggest a lack of lucrative opportunities, but I’d be remiss not to consider the possibility that these scammers are simply following the money.

It was reported that crypto scammers employing malicious software to pilfer digital holdings chose not to target TON users. Yet, the situation may not be as straightforward as it seems.

According to the team at Scam Sniffer, the people behind a commonly used scam method chose not to utilize the TON network.

In a post on an undisclosed Telegram group, the developers behind Drainer officially declared they were shutting down their operation within the TON blockchain network. Their primary explanation was insufficient presence of large cryptocurrency investors, or ‘crypto whales.’

A Ton wallet drainer is shutting down its services.👇

— Scam Sniffer | Web3 Anti-Scam (@realScamSniffer) October 7, 2024

The creators of the harmful software are shifting towards the Bitcoin network, potentially opening up a multitude of new avenues for swindlers to exploit.

“What’s coming up next? If you found the TON network enjoyable, then you’ll surely appreciate draining Bitcoins as well.

As a crypto investor, I’ve noticed that one potential reason for fewer ‘whales’ in The Open Network (TON) could be the abundance of airdrops. These airdrops seem to have oversaturated the market, making traditional fraudulent activities less profitable. In fact, phishing schemes on TON yield minimal returns, which appears to diminish scammers’ interest due to the reduced potential for financial gain.

Yet, according to SlowMist founder Yu Xian, evaluating whale activity on the TON network might require a more intricate approach. He suggests that the draining team should give greater consideration to the capabilities of the TON blockchain.

A phishing group operating on the TON network plans to disband, claiming that they perceive TON as having few ‘whale’ participants and being a relatively small community. Instead, they have moved towards the Bitcoin ecosystem… Seems plausible. Or perhaps this group isn’t very intelligent.

Yu Xian, SlowMist founder

How the TON blockchain became a new haven for scammers

2024 saw TON emerge as one of the standout successes, boasting a token value increase exceeding 100% since the start of the year. Furthermore, its integration with the widely-used Telegram messenger (boasting over 900 million users) solidified its status as a promising platform for widespread cryptocurrency circulation.

In the context of TON’s swift expansion, scamming activities have surfaced, escalating since at least November 2023 as a result of growing attention and investments towards this blockchain.

The primary motivation stems from the rising trend of mini-applications. These apps have capitalized on the growing fame of initiatives like Notcoin and Hamster Kombat. Often, the perpetrators targeted the popularity of click-to-win games.

Kaspersky Lab observed that con artists promoted the opportunity to earn Toncoin (TON) by using bots and referral links as a method of deceiving users more effectively. To bolster their deception, these scammers created instructional videos, text guides, and numerous explanatory screenshots.

Tonkeeper clarified that fraudsters frequently leverage recent fads within the market. For instance, they developed a token amidst the buzz generated by Hamster Kombat’s launch, thus the names and symbols of counterfeit tokens tend to resemble those of well-known initiatives.

Typically, fraudsters may issue tokens ahead of a legitimate cryptocurrency’s official listing. Always verify token release details from credible and official resources.

Tonkeeper team

Specialists at BlockAid pointed out that the attackers employed similar leaking tools as those seen in past attacks on Ethereum and Solana networks. A significant number of over 300 malicious decentralized applications (dapps) were launched on TON in September, underscoring the increasing danger to this platform.

What is the most popular blockchain for fraud?

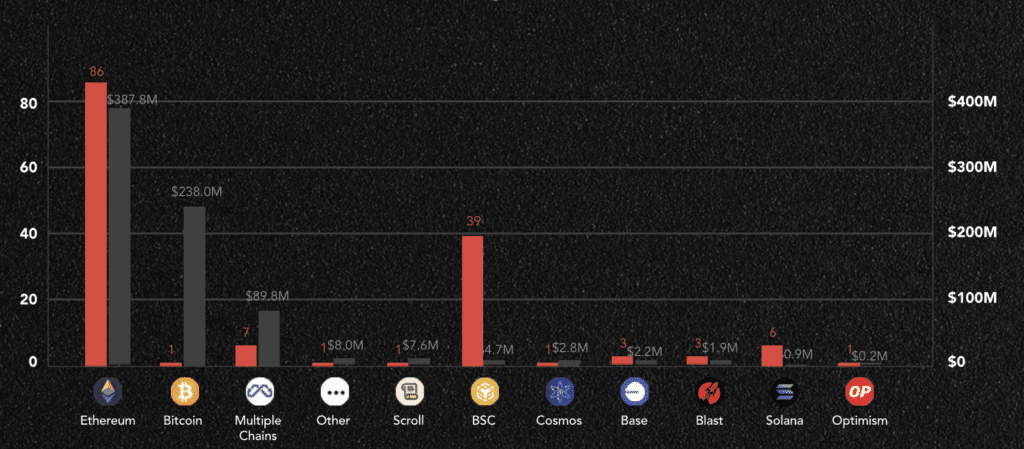

Although TON’s reputation is increasing, there’s currently no significant evidence that it’s being widely used by fraudsters, as suggested by data from the REKT Database.

Consequently, Ethereum took the lead in phishing incidents during the previous year, incurring damages exceeding $65 million, accounting for 91% of the total loss. Additionally, Arbitrum experienced losses worth $5.2 million, and Bitcoin saw losses of approximately $768,000.

When it comes to exploits, Ethereum suffered the greatest impact among all blockchains, totaling approximately $482.7 million in losses. Meanwhile, Binance experienced the highest number of exit scams, resulting in a loss of around $74.5 million.

In relation to the trend of attackers targeting the Bitcoin blockchain, CertiK, a recognized name in the realm of blockchain security, has highlighted an uptick in scammers’ interest. This surge is largely due to Bitcoin’s high transaction volumes, vast user community, and substantial Total Value Locked (TVL).

In the past few months, there’s been a substantial surge in phishing attempts targeting Bitcoin users. A prime example of this is the recent incident where a large Bitcoin holder (often referred to as a “whale”) suffered a loss of approximately $238 million. This event underscores the rising dangers within the Bitcoin ecosystem.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD JPY PREDICTION

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-10-23 05:50