As a seasoned crypto investor who’s been through the bull and bear markets alike, I must admit that the recent surge of Fantom (FTM) has caught my attention. With over 12% gain in just a day, it’s hard not to notice such a significant move. The strategic update from Sonic Labs seems to have ignited a fire under FTM, pushing its price up to $0.48 and placing it among the top performers in the market.

As a researcher, I’m observing an impressive surge of more than 12% in the value of Fantom’s native token, FTM, within the past day. This significant increase can be attributed to a strategic update announced by Sonic Labs.

The recent increase in activity has brought attention to Fantom (FTM), making it the leading performer among the top 100 cryptocurrencies based on market capitalization, causing its price to rise from $0.43 to $0.48.

Today, the value of this token has reached a peak not seen since August 27, causing its market cap to soar to an impressive $1.36 billion. As a result, it now stands as the 59th largest digital asset worldwide, based on CoinGecko’s latest data.

One significant factor fueling FTM‘s recent surge was a September 9 blog post by Andre Cronje, Chief Technology Officer of Sonic Labs, revealing plans for the Sonic blockchain to develop credit scores for digital wallets. This project intends to tap into the vast global unsecured lending market, estimated to be worth over $11 trillion.

A possible rephrasing of your statement could be: One factor that might impact FTM‘s price is Sonic’s recently launched test network. This testnet managed to achieve transaction finality in just 720 milliseconds, which is a notable achievement. In the world of blockchain, finality refers to a situation where a transaction, once confirmed and logged onto the blockchain, cannot be changed or undone.

The renewed optimism resulted in a doubling of trading volume within 24 hours, further fueling bullish momentum for FTM.

Based on information from Coinglass, the daily open interest of FTM increased by 33% to reach $162.46 million. Combined with an increase in trading volume, this indicates a rise in investor engagement, which could be contributing to the continued upward trend of FTM.

Examining FTM‘s price movements, the token is getting close to $0.4825 on the daily graph, gently touching the upper boundary of the Bollinger Band. The Relative Strength Index stands at 60, suggesting a bullish momentum with potential for additional growth before potentially reaching the oversold region.

After consistently climbing above the midline at approximately $0.4381, the surge in transaction activity indicates significant investor attention, implying an upward trend might be likely.

For traders and investors monitoring FTM, the immediate resistance to watch is the upper Bollinger Band at $0.5296. A sustained break above this level could open the way for further gains, potentially aiming for a higher resistance level at $0.60. If FTM continues on this trajectory, it has the potential to double its current value and approach the $1 milestone.

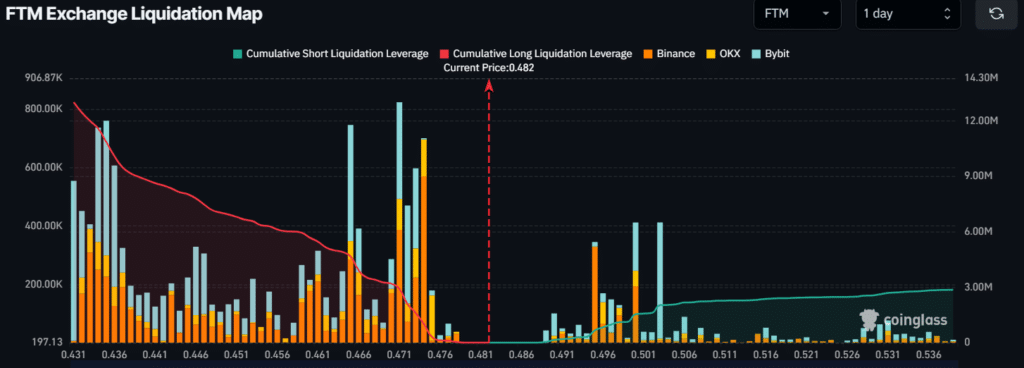

Major liquidation levels

At the moment, the crucial liquidation levels for FTM are around $0.471 on the lower end and $0.503 on the upper end, as reported by Coinglass. There appears to be a significant use of leverage among day traders at these price points.

If market conditions change and the value of FTM drops to approximately $0.471, it may lead to the liquidation of nearly $2.9 million worth of long positions. On the other hand, if the market sentiment improves and the price increases to around $0.503, an estimated $2.02 million in short positions could be liquidated.

Currently, the data shows that bears have the upper hand, possibly leading to the forced selling of long positions when prices drop.

Read More

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Grimguard Tactics tier list – Ranking the main classes

- Brent Oil Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

2024-09-10 11:38