As a seasoned researcher with years of experience navigating the tumultuous world of crypto and its associated industries, I must admit that the recent surge in FTX Token (FTT) following the announcement of its bankruptcy payout plan is a fascinating development to witness.

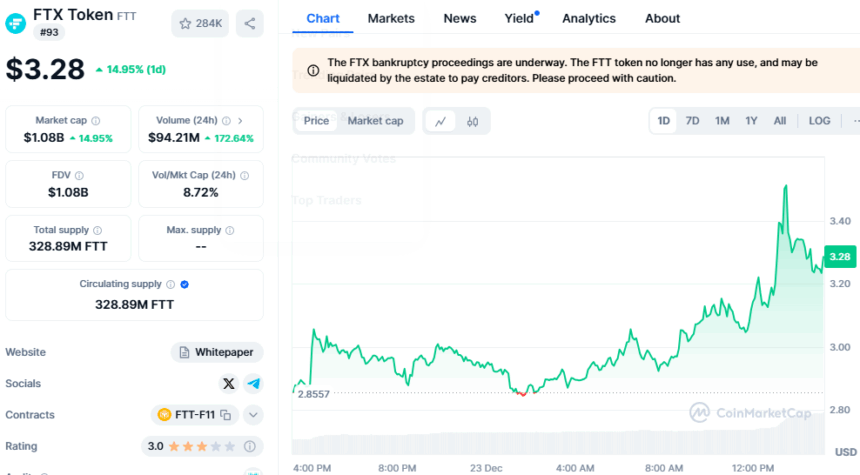

The FTX Token (FTT) experienced a 15% rise following the news that FTX intends to start repaying creditors and customers in early 2025, which is part of their Chapter 11 bankruptcy proceedings. This represents a significant advancement in the company’s reorganization process under Chapter 11.

As the appointed analyst, I’m sharing that the court-endorsed bankruptcy plan, finalized on October 2024, is set to be enacted on January 3, 2025. This significant date also marks as the “record date” for the initial distribution of payments to certain creditors.

As per their announcement, FTX intends to initiate payouts sixty days following the activation of the plan, starting first with the “Convenience Classes” compensation claims.

The announcement led to an immediate increase in FTX Token’s price to $3.28, boosting its market capitalization to $1.08 billion. This surge in trading volume by 170% indicates that investors are optimistic about potential favorable outcomes for those impacted by the exchange’s collapse in 2022.

While these payments signify progress, it’s important to note that the FTX Chapter 11 proceedings are merely getting underway. The future termination of this company is still uncertain, given its intricate legal and financial predicaments. It may take years for recovery, with much of it hinging on the liquidation of assets and resolution of ongoing legal disputes.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-12-23 15:01