As a crypto investor with a background in European politics, I strongly support Joana Cotar’s call for the German government to reconsider its approach towards Bitcoin. I have seen firsthand how digital currencies can offer protection against potential risks in traditional financial systems and promote innovation within a country.

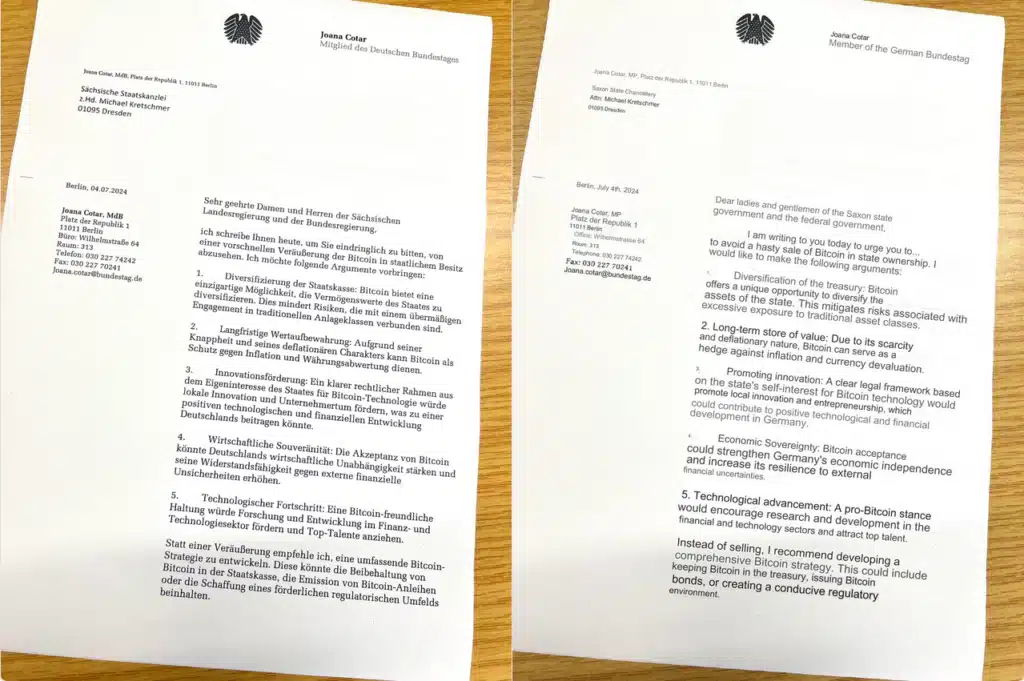

German parliament member and prominent Bitcoin supporter Joana Cotar urges the administration to put a hold on their swift disposal of Bitcoins.

Rather than promoting it, she endorses the use of Bitcoin as a “safe-haven currency” to shield against potential hazards within the conventional monetary system.

In a post on July 4th, the politican who is favorable towards cryptocurrencies expressed an opinion that Bitcoin (BTC) could help Germany expand the variety of its treasury assets. It could function as a safeguard against inflation and potential currency depreciation while simultaneously fostering technological advancement within the nation.

Instead of holding #Bitcoin as a strategic reserve currency, as it is debated in the USA, our government sells it off in large quantities. I have informed @MPKretschmer, @c_lindner, and @Bundeskanzler @OlafScholz of why this is not only meaningless but also…

— Joana Cotar (@JoanaCotar) July 4, 2024

As a researcher studying economic trends, I believe it is crucial to acknowledge that further selling off of Bitcoin at this point may not be prudent, as such actions could ultimately prove counterproductive for our nation’s interests. To encourage my colleagues and peers to consider the potential advantages of Bitcoin, I have extended invitations to four esteemed German lawmakers to attend the “Bitcoin Strategies for Nation States” event taking place on October 17th.

According to information from the crypto intelligence platform Arkham, the German government has sold 8083 Bitcoins, equivalent to approximately $462.1 million based on current market prices, since July 19th.

After recent bitcoin sales, Germany’s total holdings now amount to approximately 41,774 coins, valued at around $2.27 billion.

Cotar strongly urged a stop to the widespread Bitcoin sales, believing this action could strengthen Germany’s economic self-reliance and increase its ability to withstand financial instability from external sources.

Instead of selling off Bitcoin, I propose formulating a thorough Bitcoin plan for the state treasury. This plan might involve holding onto Bitcoin, offering Bitcoin-backed bonds, or establishing favorable regulations. (Cotar’s statement, paraphrased)

One approach for implementing this strategy involves setting up a regulatory structure that encourages the development of Bitcoin-related technologies and draws in talented individuals from around the world.

In my analysis as a cryptocurrency expert, I’d rephrase it this way: According to crypto.news, I discovered that back in June, the German Federal Criminal Police Office (BKA) took control of around 50,000 Bitcoin from the people behind the piracy movie website Movie2k.to in 2013. The BKA gained possession of these Bitcoins in mid-January through a “voluntary transfer” initiated by the suspects.

At present, the German government has not announced its intentions regarding selling the remainder of its Bitcoin holdings.

I’ve come across some intriguing news where Justin Sun, the founder of Tron, has proposed to purchase approximately $2.3 worth of Bitcoin for the nation. This move is intended to mitigate potential market damage.

The continuing sale of Bitcoins by Germany and the massive $9 billion reparation plan being implemented by Mt. Gox are believed to be the primary causes behind the recent decrease in Bitcoin’s value.

The cost of a Bitcoin unit has been on a downward trend, dipping under the $55,000 mark once more, bringing us back to prices last experienced in February.

The selling of Bitcoin has gained momentum after reports surfaced that Mt. Gox, the defunct cryptocurrency exchange, moved approximately 47,000 Bitcoins (equivalent to around $2.6 billion) to a new digital wallet prior to its planned $9 billion payout.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-07-05 12:27