As a seasoned researcher with a keen interest in cryptocurrencies and their potential impact on global economies, I find myself deeply intrigued by the German government’s decision to sell its Bitcoin stash. With my background in financial markets, I can’t help but ponder what could have been if they had held onto those 50,000 bitcoins.

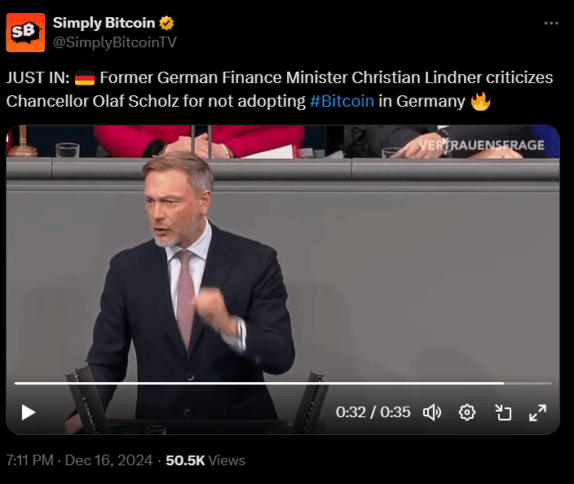

During a recent gathering, ex-German Finance Minister Christian Lindner voiced criticism towards Chancellor Olaf Scholz, suggesting he should have considered Bitcoin as a strategic reserve currency. In his view, integrating Bitcoin into Germany’s assets would provide diversification and lessen dependence on conventional financial instruments. He posits that having such reserves could have had financial benefits for Germany.

At the start of this year, I learned that the German government held approximately 50,000 Bitcoins, valued at around $2.88 billion, seized as part of their efforts against criminal activities. Yet, they chose to sell every last coin, a decision that has sparked significant criticism from various political figures.

In my role as an analyst, I’m sharing that back in July, I initiated the process of selling off the German government’s Bitcoin holdings. On a significant day, 25th July 2024, the final 3,846 bitcoins were disposed of, marking the completion of our liquidation process. These bitcoins were bought by two prominent digital asset exchanges, Coinbase and Kraken.

If the government had held onto their Bitcoins instead of selling them, their value would likely have skyrocketed significantly. Since Donald Trump became president in November 2016, Bitcoin has seen a surge of over 150%. At present, each Bitcoin is trading at an all-time high (ATH) of approximately 106,830 dollars. In essence, the government’s stash of 50,000 Bitcoins could now be valued at over $4.47 billion.

The decision to sell the bitcoins brought a lot of debate about its impact on the market. Those in favor of retaining the holding say it could offer a unique opportunity to diversify state-owned assets and reduce risks associated with traditional asset classes.

Justin Sun, creator of Tron, expressed a readiness for discussions with the German government about potentially buying Bitcoin privately, aiming to mitigate market disruption. It’s unconfirmed whether such a purchase ever took place.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-12-16 22:28