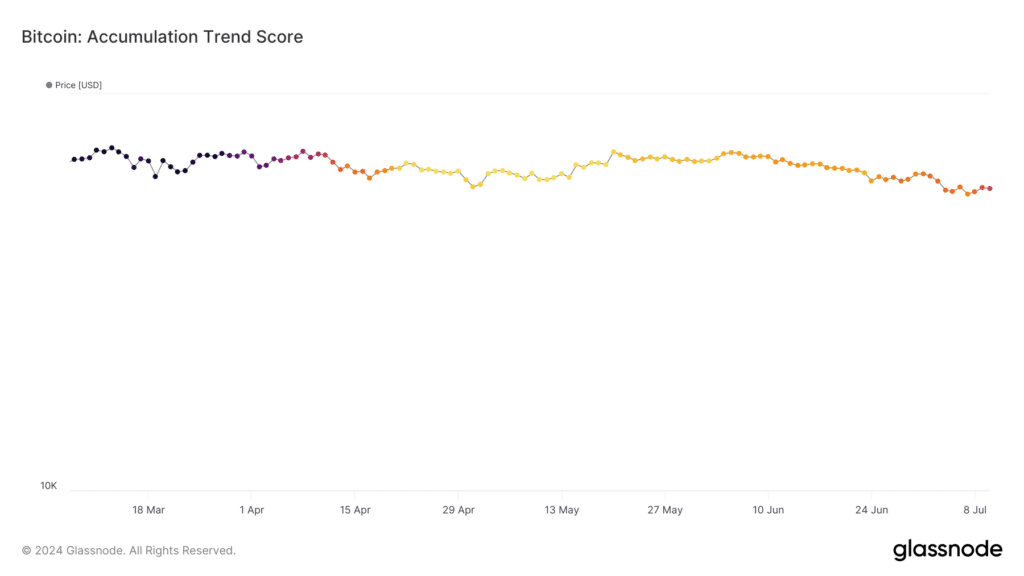

As a seasoned crypto investor with a keen eye for market trends, I see the current Bitcoin (BTC) price trend as an accumulation phase. The BTC price dipping below $60,000 for over a week has sparked a surge in accumulation, as indicated by the rising Bitcoin Accumulation Trend Score on Glassnode, which hasn’t been this high since late April when BTC was trading around $70,000.

It appears that the accumulation stage for Bitcoin (BTC) has begun, with the cryptocurrency’s price hovering beneath the $60,000 threshold for an extended period.

Based on Glassnode’s data, the trend of Bitcoin accumulation noticeably increased from a minimal 0.05 on June 1 to a significant 0.44 by July 10. This level has not been observed since April 11, a time when Bitcoin was valued at approximately $70,000.

As a crypto investor, I’ve noticed that the Bitcoin indicator began to climb while Germany was selling off its Bitcoins during the last week. This mass selling pressure created a pessimistic market sentiment and fueled fear, uncertainty, and doubt (FUD). Ultimately, this led to the Bitcoin price dipping below the $54,000 threshold.

On July 10, according to CryptoQuant’s report, Bitcoin large investors or whales began purchasing more Bitcoins as the market showed signs of ambiguity, thereby enhancing their holdings by approximately 6.3% every month.

According to Glassnode’s figures, there was a slight increase from 1,640 to 1,643 in the number of cryptocurrency holders possessing over 1,000 BTC, equivalent to approximately $58.2 million at the reporting times. This growth indicates that large investors remain optimistic about the market recovery, despite recent bearish actions taken by the German government.

30 ET (12:30 UTC) release. Consequently, the total market capitalization of crypto has decreased by approximately 1%, currently resting at a value of $2.24 trillion.

I’ve analyzed the current market situation, and BTC has experienced a 1.35% decrease in value over the past 24 hours. At present, its price stands at $58,200. The market capitalization of this asset is stabilizing around $1.14 trillion, while daily trading volumes are approximated to be around $25 billion.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Silver Rate Forecast

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

2024-07-11 12:10