Within the next two days, Bitcoin will experience its fourth reward reduction in mining, leading to a decrease in the number of new bitcoins created per block from 6.25 to 3.125.

Every four years, this occurrence takes place, temporarily decreasing the rate at which new Bitcoin supply enters the market. Based on historical data, past Bitcoin halvings have been preceded by prolonged bullish rallies lasting several months. Consequently, the crypto community expects a similar trend following this latest event.

Instead, Goldman Sachs warned its clients against assuming that future market trends would follow the same pattern as those seen in previous half cycles.

Goldman’s Fixed Income, Currencies and Commodities (FICC) and Equities team warned clients on April 12 that historical data shows Bitcoin (BTC) has typically risen in price after each halving event. However, they added a note of caution, emphasizing that the timeframe for reaching new record highs varies greatly and may depend on current market conditions. In simpler terms, the team suggested that while past trends suggest Bitcoin’s price might increase following a halving event, it is crucial to consider the current economic context before making assumptions about its future performance.

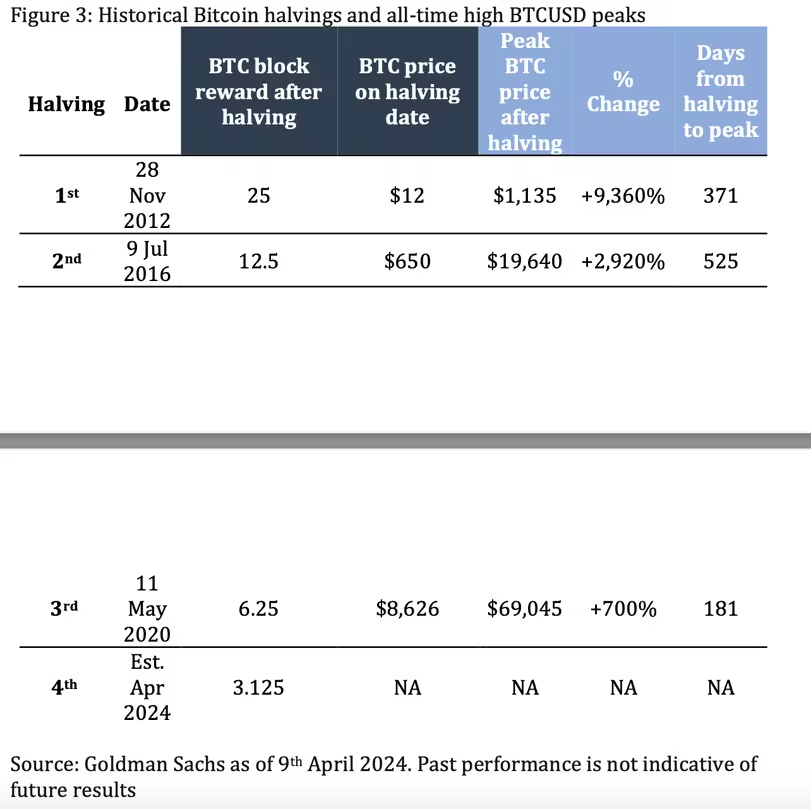

The graph illustrates how Bitcoin’s performance changed after its halving events on November 28, 2012, July 9, 2016, and May 11, 2020. After each halving, the bulls maintained control, but the height and length of the subsequent peak differed.

In contrast to the current era of high inflation and elevated interest rates, the economic landscape a year ago was markedly distinct. The growth in M2 money supply, which encompasses major central banks such as the People’s Bank of China, European Central Bank, Bank of Japan, and U.S. Federal Reserve, unfolded at an accelerated pace during that time.

In advanced economies, the benchmark interest rate remained at zero or even lower, leading investors to take on more risk in the financial market, including cryptocurrencies.

Goldman explains that the Bitcoin supply being cut in half serves as a psychological reminder for investors about the digital currency’s limited availability. The future outlook, however, hinges on the acceptance and implementation of Bitcoin ETFs.

In simpler terms, the team believes that whether Bitcoin’s upcoming halving will cause a “buy the rumor, sell the news” event next week may not significantly influence Bitcoin’s long-term trend. Instead, the price of Bitcoin is more likely to be influenced by the ongoing supply and demand dynamics and the growing demand for Bitcoin ETFs. The unpredictable nature of crypto markets further complicates matters.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-04-17 17:56