As a seasoned crypto investor with a decade of experience under my belt, I must admit that the recent moves by Grayscale have always been a reliable indicator of potential growth in the market. The launch of their MakerDAO Trust is no exception. Having witnessed the bull runs and bear markets, I’ve learned to read between the lines of such announcements.

As an analyst, I’ve observed a notable increase in whale activity involving Maker tokens, following Grayscale’s announcement about the launch of its MakerDAO Trust. This suggests that these large-scale investors are showing renewed interest in MakerDAO and its ecosystem.

As an analyst, I noted on August 13th, Grayscale, a prominent crypto asset manager, introduced its MakerDAO (MKR) investment fund. In contrast to their publicly accessible Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds, this MakerDAO Trust is exclusive to “accredited investors” only.

Delighted to share the news about launching a unique crypto investment fund focused on a single asset, the Grayscale MakerDAO Trust ($MKR). This opportunity is exclusively accessible via private placement to qualified accredited investors. For more details, check out our press release.— Grayscale (@Grayscale) August 13, 2024

MakerDAO stands as a well-known entity within the realm of decentralized finance. It’s the self-governing body responsible for managing the third-largest stablecoin, Dai (DAI), in the market.

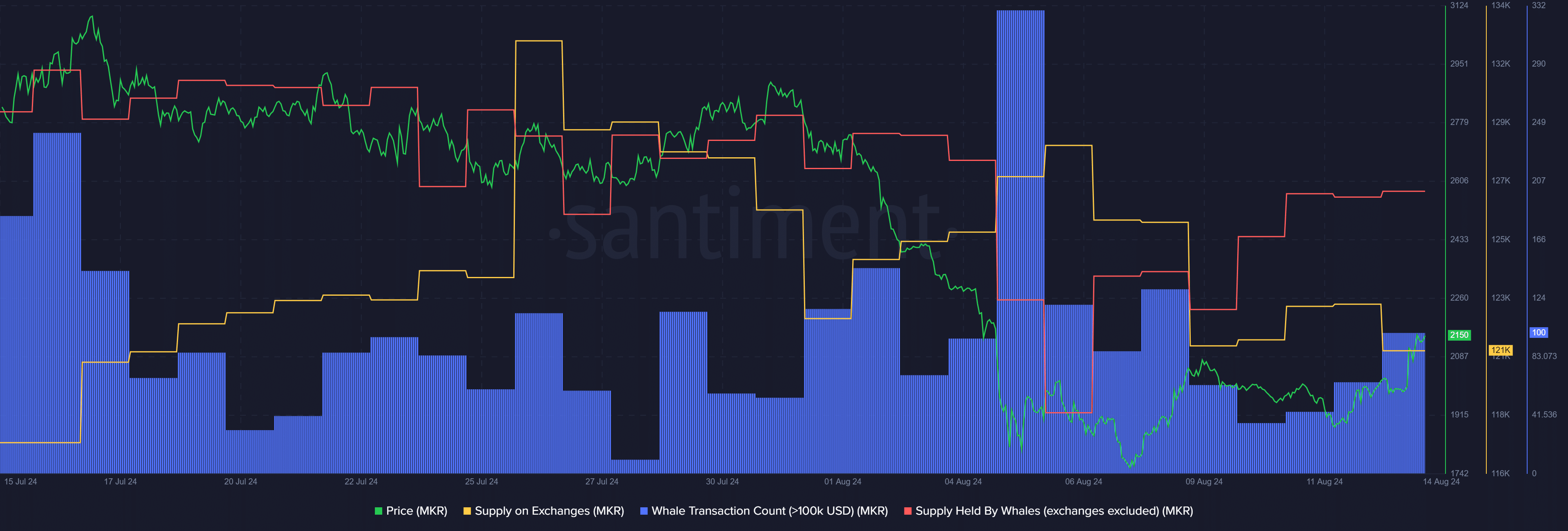

Thanks to the bullish announcement from Grayscale, MKR is up by 7.9% in the past 24 hours and is trading at $2,150 at the time of writing. The asset’s market cap surpassed the $2 billion mark, making it the 39th-largest cryptocurrency.

Maker’s daily trading volume also increased by 64%, reaching $144 million.

Over the last day, there has been a significant increase in the number of ‘whale’ transactions involving at least $100,000 worth of MKR. The data from Santiment shows that this figure climbed from 65 to 100 distinct transactions.

Conversely, it appears that the number of MKR tokens on exchanges has dropped from 123,100 to 121,340, according to Santiment’s data. This decrease suggests that larger investors (whales) may be buying up MKR as the announcement by Grayscale has sparked greater demand for it.

As a crypto investor, I’ve noticed some interesting insights from our market intelligence platform. It appears that a staggering 78.4% or approximately 729,330 MKR tokens in the circulating supply of Maker are controlled by what we call ‘whales.’ This means a relatively small number of entities hold a significant portion of the total supply.

Given the current situation, it’s not unusual to see greater price volatility in MKR due to the substantial whale involvement with the asset.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-14 12:49