As a seasoned analyst with over two decades of experience in the financial markets, I must admit that the recent surge in Hedera Hashgraph (HBAR) has piqued my interest. The rebound, which coincides with the Santa Claus rally, seems to be more than just a festive cheer in the crypto market.

For the third day in a row, the value of Hedera Hashgraph increased, reflecting a reappearance of the Santa Claus rally phenomenon in the cryptocurrency market.

On Christmas Eve, I witnessed a significant surge in the value of my Hedera Hashgraph (HBAR) investment, reaching as high as $0.3300. This marked an impressive increase of more than 30% compared to its lowest point from the previous week.

The bounce back occurred since other well-known alternative cryptocurrencies started recovering. Notable standouts among the leaders were Helium (HNT), JasmyCoin (JASMY), and VeChain (VET).

Without any Hedera-related news triggering the surge, it’s reasonable to assume that the rally was primarily driven by trader sentiment and technical factors. The positive shift in Hedera’s sentiment among traders can be attributed to Canary Capital’s filing for the lead position in the first Hedera Exchange Traded Fund (ETF) back in November.

As a researcher, I, Eric Balchunas at Bloomberg, anticipate a straightforward approval of the HBAR fund by the Securities and Exchange Commission. In my view, the agency has not classified HBAR as a security in the same manner it has with other tokens such as Solana and Ripple.

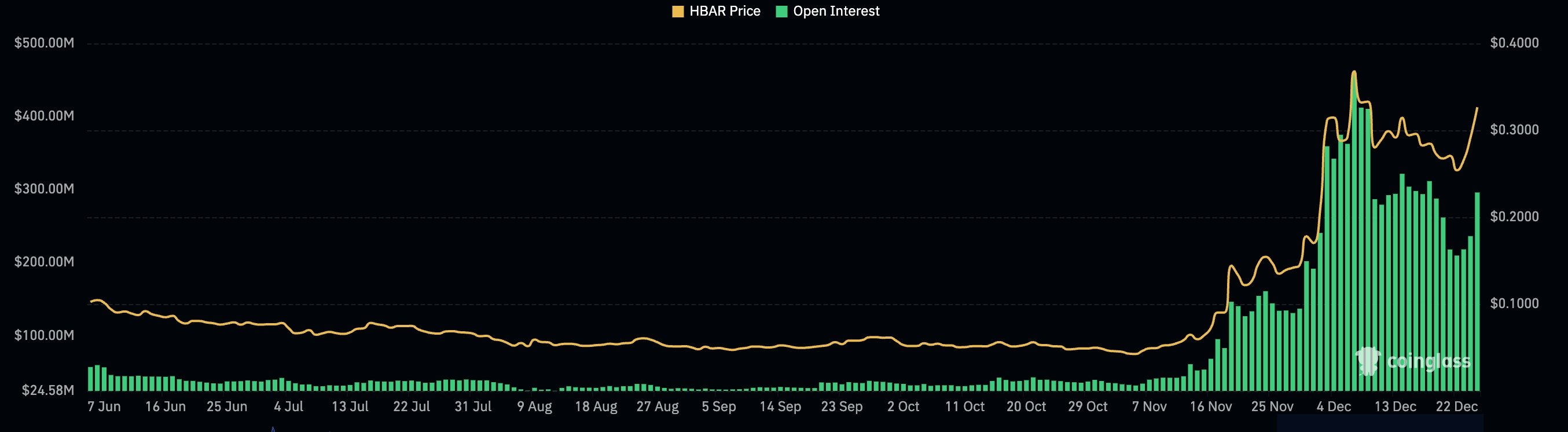

After the open interest for Hedera’s futures fell to $209.7 million on December 22 (from its peak of $460 million last month), there was a recovery in Hedera’s value. It is common for many cryptocurrencies to recover when the open interest and trader sentiment decrease.

Hedera Hashgraph price formed two bullish patterns

It’s highly plausible that the recent rise in HBAR’s price can be attributed to the forecast made by crypto.news last week. In their analysis, they pointed out that the coin exhibited a double-bottom formation at $0.2350, with the neckline situated at $0.3310, its highest peak on December 13. Typically, such a bottom suggests that short sellers are hesitant to place their bets below this price level, which might explain the rebound in HBAR’s price.

As a researcher, I’ve noticed an intriguing chart pattern in Hedera that resembles a falling wedge, depicted in purple for clarity. This pattern is formed by connecting the peak on Dec 7th, 18th, and 20th at the upper end, while the lower end links significant dips this month. Historically, a falling wedge often precedes further growth.

The price of HBAR additionally shaped up as a bullish pennant structure, which includes a lengthy flagpole leading to a triangle formation.

Hedera continued to stay above its 50-day moving average, suggesting that the bulls continue to hold sway even during the recent pullback. Notably, it has now created a three-candle formation known as the “three white soldiers,” which consists of three successive candlesticks.

Consequently, it appears that the HBAR price trend is positive, and a key milestone to monitor will be reaching the year-to-date peak of $0.40, which represents a 20% increase from its current value.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD JPY PREDICTION

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-12-24 18:24