After BlackRock revealed its plans on April 13 to tokenize its money market fund on the Hedera Blockchain, Hedera’s native cryptocurrency, HBAR, experienced a significant rise of around 100% and is now priced at about $0.13 – an increase triggered by this development from BlackRock.

With the assistance of Archax, a digital asset company based in London, and Ownera, a significant step was taken last year in the tokenization of real-world assets. Previously, Aberdeen Standard Investments (abrdn), the leading wealth manager in the UK, also tokenized funds on Hedera. In simpler terms, these companies have made it possible to represent real-value assets as digital tokens using Archax and Ownera, with abrdn being a notable example of this practice on the Hedera platform last year.

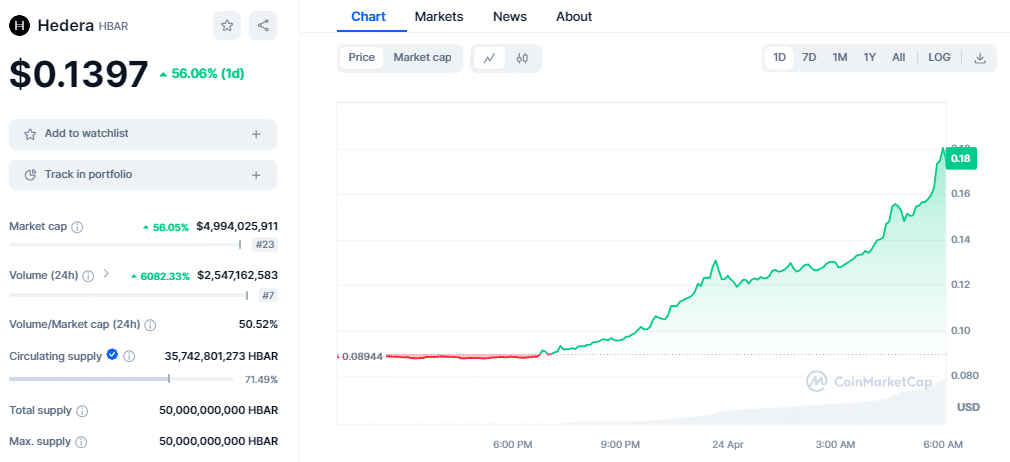

HBar’s trading volume experienced a massive surge of over 6000%, reaching $2.5 billion. This significant increase caused its price to surpass the $0.15 mark for the first time in two years. The RSI indicator hints at potential further growth, potentially reaching heights around $0.20 or even $0.30.

Yet, taking profits may cause price drops, notably around $0.1096. Dropping below the 21-day average at $0.1038 could initiate a slide down to the $0.0815 support level.

The announcement of BlackRock’s plans to tokenize assets on the Hedera network has led to a surge in HBAR price and trading activity, indicating strong interest in blockchain for asset management. However, this trend could reverse if investors cash in their profits around significant support levels.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-04-24 10:28