As a seasoned crypto investor with over a decade of experience navigating the volatile digital asset market, I have learned to appreciate the resilience and potential of projects like Helium (HNT). Despite its recent retreat amidst profit-taking and worsening sentiment across the industry, I remain optimistic about HNT’s prospects.

On August 15, there was a change in direction for the Helium token, due to investors cashing out and a deteriorating mood within the cryptocurrency market.

The price of the HNT cryptocurrency dipped back to $6.50, representing a drop of more than 13% from its peak this week, suggesting that it has entered a temporary downturn or adjustment in its current market trend.

HNT is up by 126% from August low

Regardless of its recent dip, HNT continues to be among the top-performing cryptocurrencies, particularly since August 5, when many other tokens experienced a downturn. It has skyrocketed by more than 126% from its lowest point this month, which has boosted its market capitalization beyond $1 billion.

The decrease in the Helium supply occurred at a time when the Crypto Fear and Greed Index dipped from its monthly peak of 57 to 43. If this trend persists, the index might dip further into the ‘fear’ range, falling below 40.

The drop also took place as Bitcoin (BTC), Ethereum (ETH), and other alternative coins experienced a pullback. Bitcoin dropped from this week’s peak of more than $60,000 to $58,000, while Ether, Solana (SOL), and Binance Coin (BNB) saw declines exceeding 4% within the past 24 hours.

Helium has solid fundamentals

In recent months, Helium has emerged as one of the leading performers among cryptocurrencies, largely due to the expansion of its ecosystem.

It’s said that the network is negotiating with two significant U.S. telecom companies, who are currently testing the transfer of their data to our MOBILE network. One carrier boasts around 185,000 subscribers, whereas the other has approximately 122,000 users involved in the trial.

Should it be effective, the carriers might reduce costs and enhance their service quality, while Helium stands to gain more users and revenue, funneling proceeds to hotspot operators.

The @helium Carrier Offload Program is one of the most exciting developments in recent memory.

Telecom carriers are leveraging Helium with clear synergies for both parties:

– Carriers save $$ and offer better coverage.

– Helium receives more traffic routed through the network…— Nick Garcia (@NickDGarcia) August 13, 2024

Based on their statistics, there are nearly 20,000 active Helium MOBILE hotspots, while their IoT solution covers approximately 360,000 locations. These figures continue to increase over time.

HNT formed a golden cross

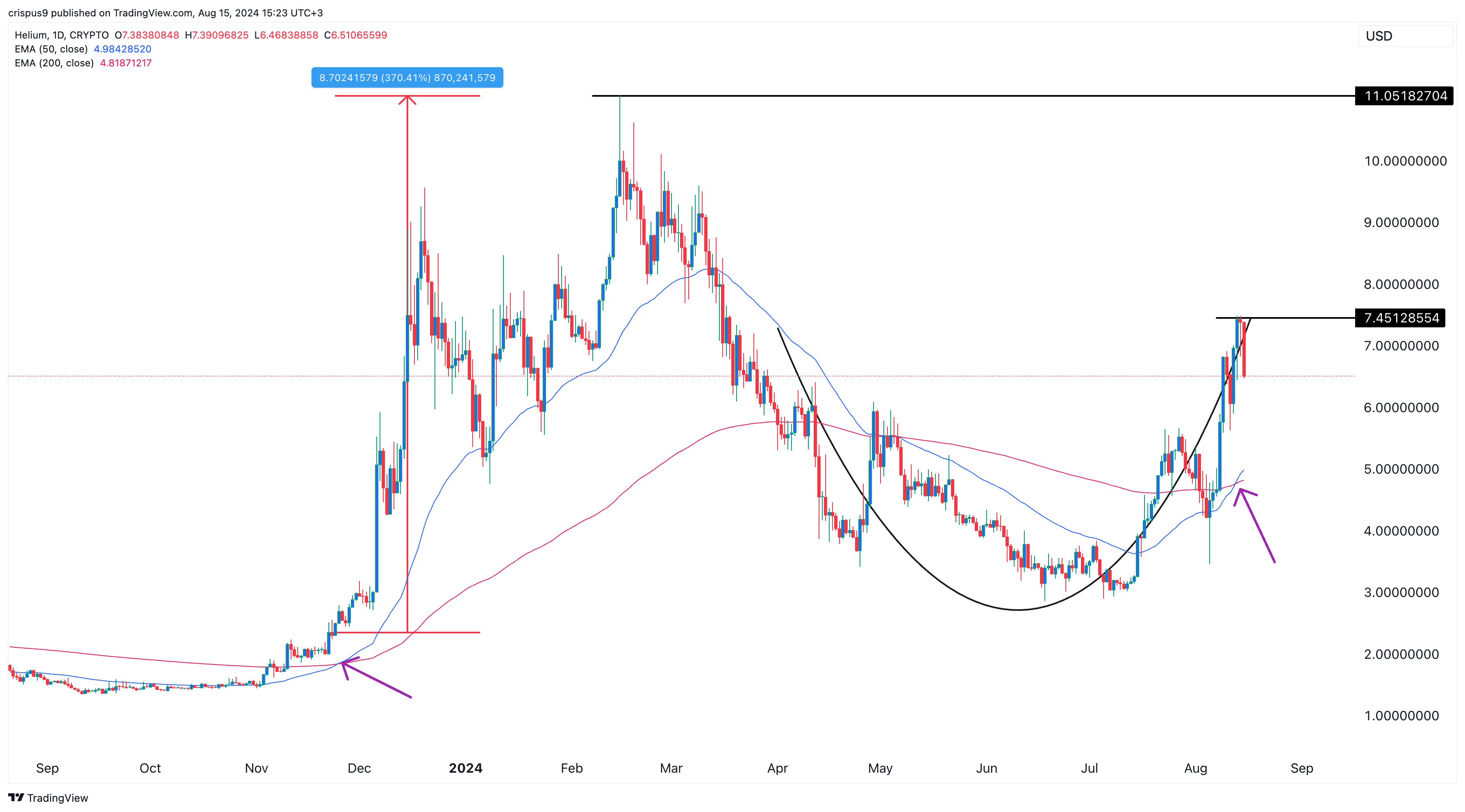

Based on technical analysis, there’s a possibility that the HNT token might continue to rise due to the formation of a ‘golden cross’ pattern. This pattern appears when the short-term moving average (50-day) crosses above the long-term moving average (200-day), a typical bullish signal in chart analysis.

Typically speaking, following this pattern tends to result in even more gains. To illustrate, when HNT exhibited this same pattern back in November 2023, the value of the Helium token skyrocketed by an astounding 370% and more.

Helium’s chart has taken the shape of a ’rounded bottom’, another positive indicator for potential price increase. If we see a line crossing above this week’s peak of $7.45, it might suggest further gains, with investors aiming for the year-to-date high of $11.05 – representing a potential 70% rise from its level on August 15th.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-15 16:40