As a seasoned analyst with over two decades of experience in the technology and finance sectors, I have witnessed the rise and fall of countless projects in their lifecycle. The recent surge of Helium (HNT) has piqued my interest, as it appears to be a promising player in the Internet of Things (IoT) space.

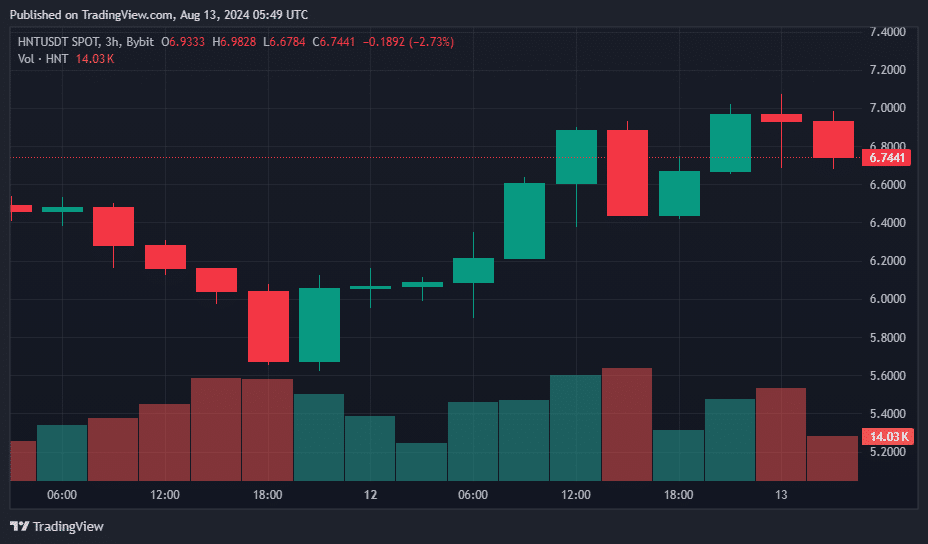

On August 13th’s morning, Helium, a blockchain system specifically tailored for IoT (Internet of Things), saw a noteworthy 12% price increase. This made it one of the top performers in the cryptocurrency market.

Currently, as I speak, Helium (HNT) is being traded for approximately $6.79 each, based on information from crypto.news. This digital asset saw a significant increase in its daily trading volume by about 56%, reaching around $25.2 million. Its market capitalization currently stands at $1.14 billion, placing it at number 65 among the largest cryptocurrencies.

The token’s price has jumped by 20% since its drop to $5.66 yesterday, when Bitcoin fell by 4%, and the global crypto market witnessed a slump with over $156.4m in liquidations.

Although HNT has returned to prices similar to those seen on March 21st, it’s important to note that this cryptocurrency is currently 88% lower than its peak price of $55.2 achieved back in November 2021.

Helium Incorporated, founded in 2013, has created a globally distributed blockchain system designed for seamless wireless communication among Internet of Things (IoT) devices. Unlike traditional telecommunication services, this network provides a scalable and affordable option by enabling users to establish network nodes through Hotspots.

The recent increase is due to Helium’s collaboration with two significant American telecom companies. These companies are currently testing the transfer of their mobile data to the Helium Network, which could result in a move towards a more distributed network structure.

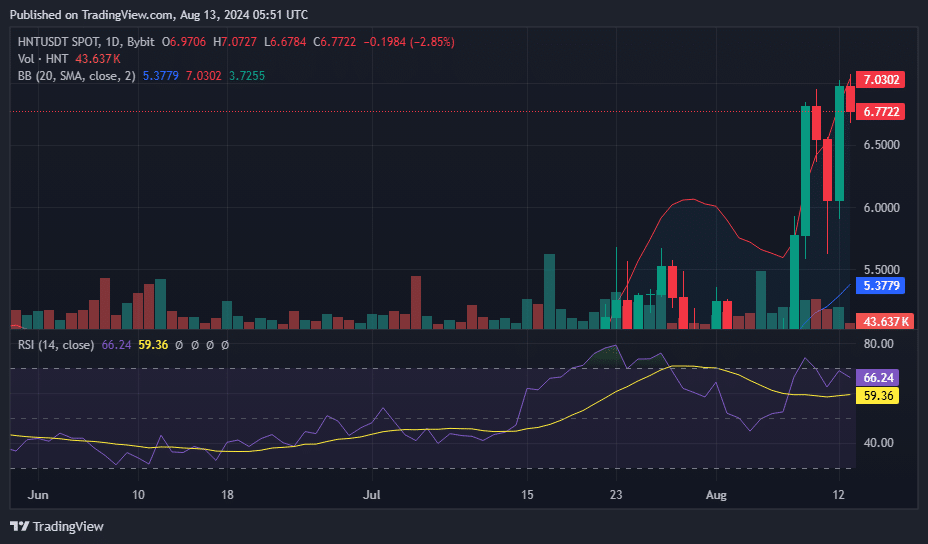

Helium’s price stands at approximately $6.77, noticeably higher than the midpoint of the Bollinger Band ($5.38). It’s close to the top end of the band, which is around $7.03. This proximity indicates a potential strong upward trend within its trading range.

When we get near the maximum level, it could signal overbought conditions, but it also shows strong bullish power. This pattern might mean there’s still space for the price to rise more before encountering significant obstacles or perhaps a reversal.

Moreover, with the Relative Strength Index (RSI) currently at 66.24, it’s moving towards the level of 70, which is considered overbought. This suggests that a potential correction or retracement might occur soon, given the increasing tension in market conditions.

Nonetheless, market analysts continue to be bullish about Helium’s future potential.

On August 13, as shared on platform X, an analyst under the pseudonym Decilizer pointed out that Helium has surpassed its secondary pattern, suggesting a robust uptrend could be imminent. This upward movement might propel HNT prices to approximately $8.3 in the near future.

As a crypto investor, I’ve noticed that the recent surge in Helium’s price might not just be an isolated event. It seems plausible that the broader uptrend in the cryptocurrency market could also be playing a significant role. This upward momentum appears to have been primarily driven by Bitcoin (BTC), which has seen a 6.5% increase over the past week.

On August 13th, the value of Bitcoin fluctuated between $58,015 and $60,499, eventually settling at $59,456. Over a 24-hour period, this digital currency’s price saw these variations. Furthermore, it’s worth noting that in the past day, the cumulative value of all cryptocurrencies increased by approximately 1.9%, reaching an impressive total market cap of $2.19 trillion.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-13 10:28