As a seasoned analyst with over two decades of experience in the financial markets, I have seen countless bull and bear runs, but the crypto space remains one of the most intriguing and dynamic sectors I’ve encountered. Ripple’s current position is a classic example of such dynamics.

After hitting a low of $0.5078 on October 3, due to the unveiling of its new US dollar-backed coin, Ripple‘s token has bounced back.

At a price point of $0.5500, Ripple (XRP) was exchanged, thereby elevating its total value to approximately $31.2 billion. This position places XRP as the seventh most significant digital currency in terms of market capitalization.

As an analyst, I find it noteworthy to mention that XRP’s performance this year has been relatively lackluster compared to the broader cryptocurrency market. Specifically, XRP has dropped by about 6.3%, whereas Bitcoin (BTC) has experienced a substantial increase of 54.4%. Interestingly, an obscure coin called Pepe (PEPE) has seen an extraordinary surge, soaring close to 800% this year.

This year, Ripple managed to reach numerous noteworthy achievements. The fine it received in its prolonged legal dispute with the Securities and Exchange Commission was set at a comparatively reduced amount of $125 million, which is substantially less than the initial demand of $2 billion.

Ripple introduced its own stablecoin, called RLUSD, as part of an effort to challenge established players such as Tether, Circle, and PayPal. According to reports from last week, this new stablecoin will first be accessible on various platforms including Uphold, Bitstamp, and MoonPay.

It’s clear that stablecoins can be highly lucrative within the financial sector, as evidenced by Tether’s impressive profits. New disclosures have shown that Tether outperformed Blackrock, a company handling more than $11 trillion in investments.

Stablecoin creators earn money by placing their resources into safe investments such as U.S. Treasury bonds. Nevertheless, a difficulty faced by emerging issuers is overcoming Tether, which manages an impressive $120 billion in assets. For example, PayPal’s PYUSD holds only $632 million, ranking it ninth among stablecoins.

Ripple not only developed XRP Ledger but also designed it as a potential replacement for Ethereum and Solana, boasting an open-source blockchain structure. While it experienced rapid expansion in the beginning, the value locked within the network has since leveled off at approximately $14.6 million. However, recent data from Santiment indicates that the number of wallets connected to the chain has seen a noticeable rise.

🌐 The number of active XRP Ledger wallets has skyrocketed, with as many as 35,799 unique wallets carrying out at least one transaction in a 24-hour period – the highest figure in more than three months. Furthermore, an impressive 3,858 new wallets were established within a day, marking the most significant daily creation in over seven months!

— Santiment (@santimentfeed) October 20, 2024

XRP price may have a bearish breakout

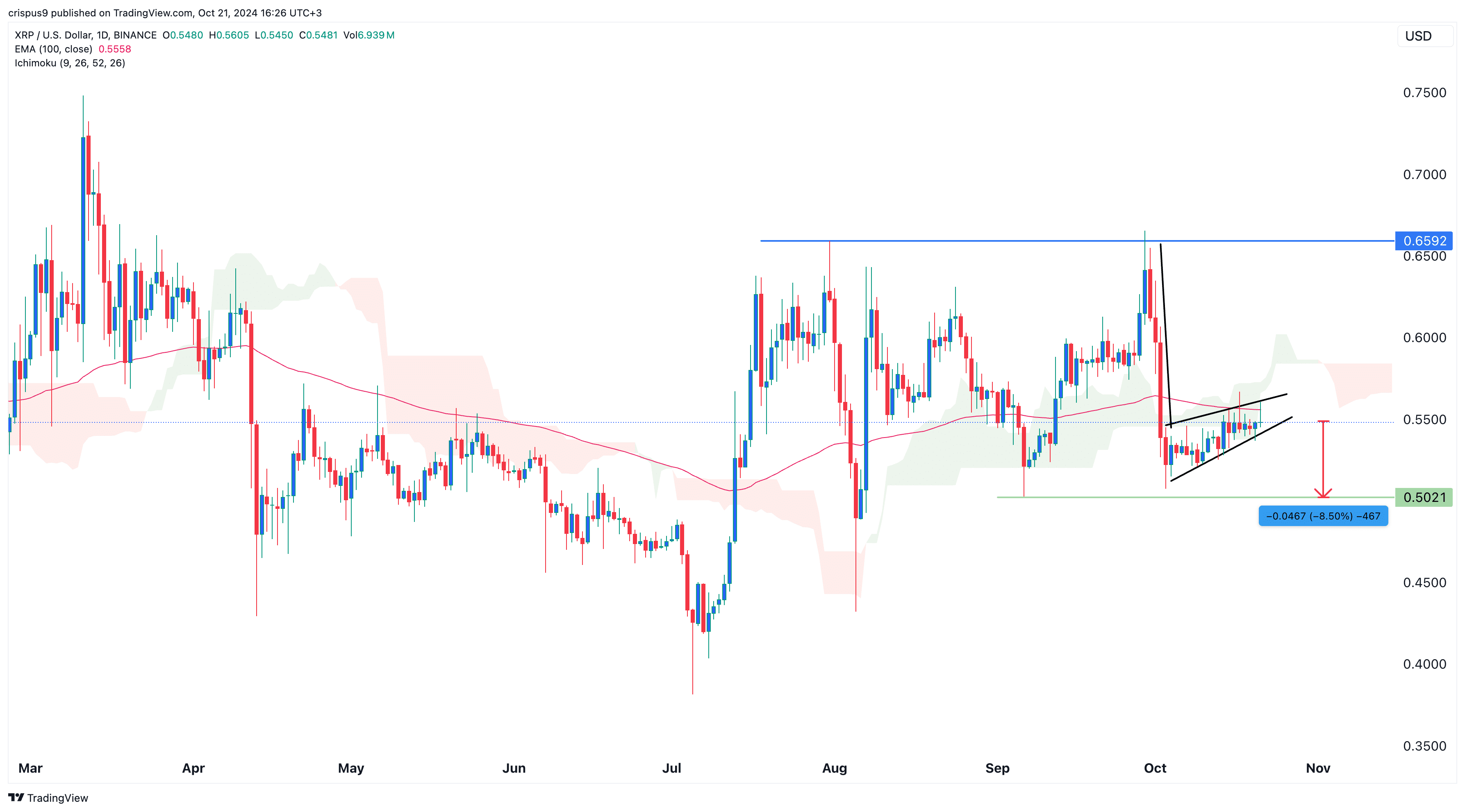

This month, Ripple’s token has been steadily increasing. However, on its daily chart, it has dipped beneath the Ichimoku cloud, which is typically seen as a bearish sign.

XRP has additionally developed a bearish flag structure, identifiable by a prolonged flagpole followed by a flag-like shape. Notably, the flag part appears to take on the form of a descending wedge, another indication pointing towards a potential bearish trend.

Ripple currently hovers beneath its 50-day moving average and has developed a double-top formation at approximately $0.6592. Consequently, there’s a strong possibility that the token will soon experience a downturn. If this occurs, the key area to keep an eye on will be around $0.5021 – representing the neckline of the double-top pattern, which is roughly 8.50% lower than its current value.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-10-21 17:13