As an analyst with years of experience navigating the volatile and ever-evolving crypto market, I’ve witnessed my fair share of ups and downs. The FTX collapse was a stark reminder of the importance of transparency, security, and reserve management in this industry.

November signifies a milestone of two years since the collapse of the FTX cryptocurrency exchange. In that span, substantial Bitcoin holdings have expanded on prominent digital asset trading platforms.

The fact that FTX didn’t have enough reserves to fulfill user demands revealed significant issues with their management systems. Furthermore, this incident underscored the importance of increased transparency and dependable reporting of reserves across all cryptocurrency platforms.

Users have come to recognize the dangers that can arise when trading platforms don’t hold enough backup funds. Insufficient funds make it difficult to fulfill withdrawal requests, which in turn erodes user trust and exposes them to potential fund losses. Having ample reserves is essential for ensuring liquidity and executing orders effectively, especially during times of market volatility.

Given the current trend, CryptoQuant recently provided crypto.news with an analysis concerning the condition of exchange proof-of-reserves (PoR).

Table of Contents

How has crypto changed post-FTX?

The fall of FTX in November 2022 stands as one of the most impactful and shocking incidents in the evolution of the cryptocurrency sector. This event severely affected investors’ trust, leading to significant shifts in the makeup and operations of the crypto market.

During that period, the value of Bitcoin (BTC) and significant digital currencies noticeably dropped, mirroring apprehension and mistrust among institutional investors in the market. Consequently, numerous investors started questioning the security and reliability of cryptocurrency, leading them to withdraw entirely from the market.

The importance of addressing security concerns has grown significantly, prompting many cryptocurrency exchanges and initiatives to adopt additional safeguards. These measures include the use of two-factor authentication, surveillance systems, and scrutiny of transactions for potential fraudulent activity in order to secure users’ assets effectively.

Emerged are new security protocols and measures to safeguard funds from hacking and fraudulent actions. One such protocol is the Proof of Reserves (PoR) standard, a system used by cryptocurrency platforms to publicly verify that they possess sufficient reserves to cover every user’s account balance.

PoR encourages reliability and openness by enabling users to verify if an exchange is operating responsibly with their assets, avoiding excessive leveraging or poor asset management. This aspect has grown increasingly significant due to notable exchange failures within the crypto industry.

CryptoQuant

Major exchanges record Bitcoin outflow

Out of the significant cryptocurrency exchanges known for their substantial Bitcoin holdings, only Coinbase does not regularly disclose Proof-of-Reserves (PoR) reports. It is pointed out by experts that other notable exchanges frequently make these reports available, although with differing levels of openness.

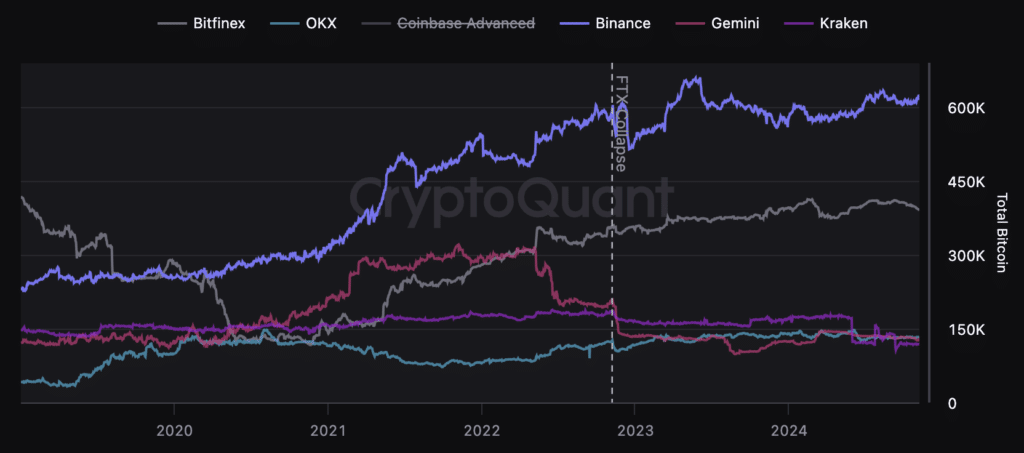

In 2023, Binance‘s Bitcoin reserves experienced a growth of approximately 5% (or 28,000 BTC), bringing the total to 611,000 BTC. This increase occurred despite the scrutiny from U.S. authorities. Compared to other major exchanges, Binance has shown the smallest decrease in reserves throughout the entire period, with a reduction of no more than 16%.

Approximately three major exchange platforms – Coinbase Pro, Binance, and Bitfinex – collectively hold around 75% of all Bitcoins that are stored in exchanges. Specifically, Coinbase Pro possesses about 830,000 BTC, followed by Binance with approximately 615,000 BTC, while Bitfinex holds close to 395,000 Bitcoins.

Combined, these platforms store approximately 1.836 million Bitcoins, accounting for about 9.3% of all existing Bitcoins. The rest, around 684,000 Bitcoins, are held by 17 other exchanges.

Reserves landing

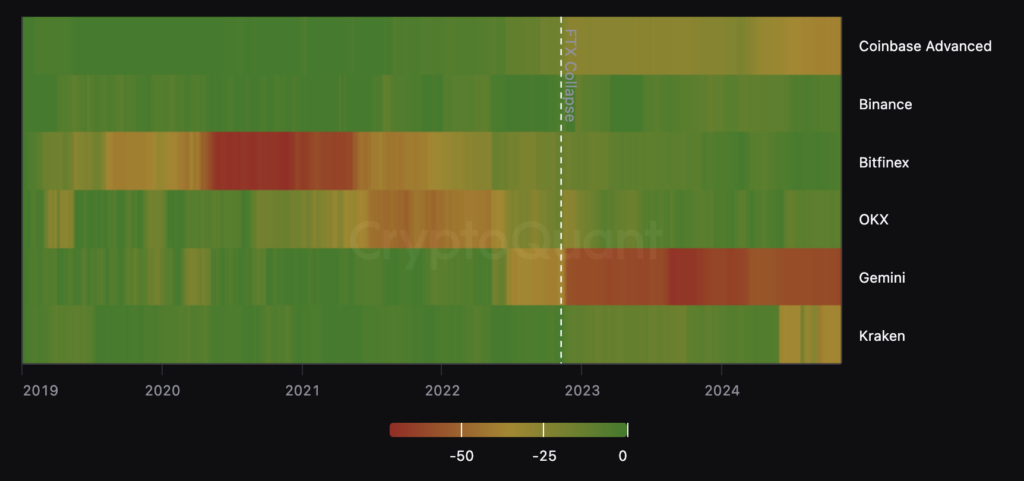

At present, Binance, Bitfinex, and OKX are exhibiting slight reductions in their reserves. Interestingly, Binance is the only platform that seems to have avoided major withdrawals throughout its history.

Examining how these reserves fluctuate helps us understand if they can satisfy users’ needs consistently over a period.

Large reductions might suggest that users are heavily pulling out their resources, potentially signifying a drop in confidence or financial difficulties.

In December 2022, following the collapse of FTX, Binance experienced a substantial drop of approximately 15% in its reserves. This event sparked a good deal of skepticism and mistrust towards Binance’s reserve statements.

Meanwhile, it’s worth noting that Binance’s reserves have bounced back and now show a decrease of just 7%. Similarly, other major platforms such as Bitfinex and OKX have experienced minor drops. Bitfinex is currently off by 5%, while OKX has dipped by 11%.

Although key figures such as Binance and Bitfinex have strengthened their reserves following the FTX collapse, the atmosphere remains uncertain. The lack of Proof-of-Reserves reports from companies like Coinbase implies that complete openness is still a distant goal. However, the current reserve trends hint at an effort to enhance transparency and boost user confidence.

In a statement to Crypto News, the expert highlighted the importance of crypto trading platforms demonstrating they possess sufficient assets as a direct consequence of the collapse of FTX.

As a result of this incident, there has been a trend among users favoring exchanges that publicly demonstrate their asset ownership via blockchain transactions. This preference has prompted the industry to incorporate Proof-of-Reserves methods, which in turn helps restore trust and guarantees that platforms can verify the balances of their users’ funds.

Nick Pitto, head of marketing at CryptoQuant

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-11-10 18:48