As an analyst with over a decade of experience in the financial industry and a keen interest in the ever-evolving world of cryptocurrencies, I must say that the issue of “dirty coins” is not just a theoretical concern but a practical reality for many crypto enthusiasts.

Users of cryptocurrencies often encounter the issue of “tainted” or “dirty” coins directly. These are coins that have been involved in illicit activities. The reason for the increased ease in tracking these assets is due to the growing sophistication and implementation of technologies like blockchain analysis tools, which help identify and trace the origins and transactions associated with specific cryptocurrency units.

Individuals who neglect to monitor certain ‘suspect’ cryptocurrencies might unknowingly end up receiving these tagged digital assets in their wallets. Major platforms often bar such wallets, making it at times difficult to prove one’s innocence.

Specialists who work with analytical systems have the ability to modify data linked to cryptocurrency accounts, allowing them to connect funds to illicit activities, regardless of how long ago those funds were initially acquired.

Centralized exchanges (CEX) are often one of the most compliant entities in the market. They typically adhere to the guidelines set by the Financial Action Task Force (FATF), an international organization that focuses on preventing money laundering, terrorism financing, and other illicit activities. Moreover, they employ sophisticated analytical tools to verify the authenticity of cryptocurrencies upon entry, thereby reducing the likelihood of “tainted” assets being accepted on these platforms.

Yet, a potential issue emerges when the exchange finds itself under sanctions. This means that any money linked to it could be designated as subject to those same sanctions.

On the other hand, decentralized exchange platforms (DEX) function outside traditional regulatory frameworks, often occupying a vague legal space, and may not enforce Anti-Money Laundering (AML) guidelines. This could potentially lead to the acceptance of “tainted” digital currencies.

How can ‘dirty’ coins end up in a wallet?

As a researcher delving into the realm of digital currencies, I focus on how regulated trading platforms and exchanges keep a watchful eye on the movement of cryptocurrencies linked to illicit activities. These platforms meticulously document any assets that have transacted illegally, providing crucial insights for understanding and mitigating such criminal activities within the digital currency ecosystem.

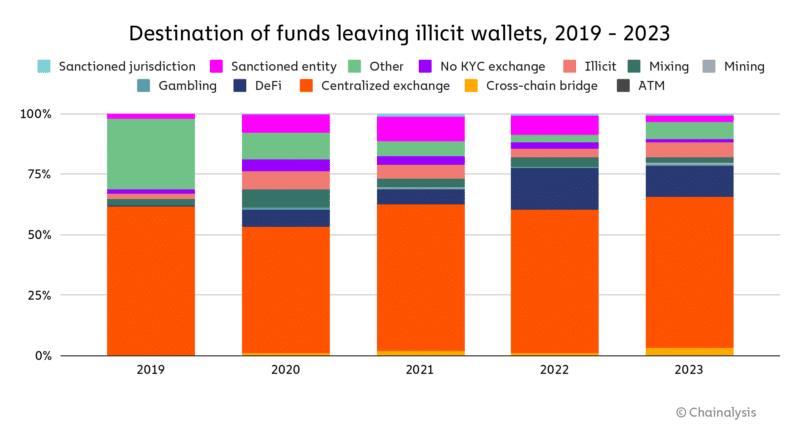

Swindlers employ numerous tactics to conceal their activities and “launder” cryptocurrency, such as using crypto tumblers, breaking down transactions into smaller parts, operating on unregulated platforms, gaming, gift cards, and automated teller machines for digital currencies (crypto ATMs).

Ultimately, it’s possible for ‘dirtier’ cryptocurrencies to find their way into the wallets of users who strictly follow the law. However, these assets are often not accessible through regulated exchanges and peer-to-peer services that enforce Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations as they don’t support such transactions.

Alternatively, users might choose to acquire digital assets from unsupervised marketplaces or questionable trading sites, or even receive them as forms of payment.

How to track ‘dirty’ coins

Trusted crypto exchanges closely track and manage the flow of potentially corrupted digital coins, adhering to regulatory guidelines. As of January 2020, the Fifth Anti-Money Laundering Directive from the European Union has been enforced, demanding platforms to scrutinize users’ transactions, store records, share data, and flag suspicious activities for reporting to relevant authorities.

As a crypto investor, I’m always mindful that large trading platforms have dedicated teams to scrutinize potential suspicious activities. They use a combination of bots, automated alerts, and manual checks to flag “tainted” cryptocurrencies. Exchanges offer tools like mixers, programs, and services designed for anonymizing transactions and laundering funds. However, it’s essential to remember that these exchanges do not inquire about the intent behind using such anonymization tools. This could potentially lead to account restrictions or closure if any suspicious activity is detected.

While global Anti-Money Laundering (AML) regulations don’t specifically ban the use of coin mixers, cryptocurrency exchanges tend to exercise caution. Accounts that have been traced as having used a coin mixer aren’t necessarily blocked, but they are closely monitored. These wallets undergo enhanced scrutiny.

Most platforms primarily rely on third-party tools for enhancing their Anti-Money Laundering (AML) procedures, focusing on identifying suspicious transactions. Notable solutions in this area include Chainalysis, CipherTrace, and Elliptic. These tools are utilized by both regulated trading platforms, individual brokers, as well as law enforcement entities.

Example: Similar to CipherTrace, this tool primarily follows the majority of digital assets. It keeps tabs on cryptocurrency transactions, evaluating wallets based on a ten-point scale according to whether the funds were linked to fraudulent schemes, money laundering services, illegal marketplaces, cyber attacks, ransomware, illicit drug trade, and terrorist financing activities.

Any wallets or coins deemed compromised are added to a blacklist, which can be accessed by trading platforms utilizing CipherTrace technology. Subsequently, these exchange systems simply need to block suspicious funds and shut down accounts that fail to meet Anti-Money Laundering (AML) regulations.

Anonymous cryptocurrency

Cryptocurrencies that don’t reveal the identity of their users (anonymous), are engineered with technology mainly focused on maintaining transaction privacy and anonymity. Unlike other services like external crypto mixers, these technologies are built-in to the system, keeping the details of transactions private without involving third parties.

Among the well-known anonymously issued digital currencies, one stands out – Monero, represented by XMR. Its unique feature lies in the fact that every transaction involves blending the exchanged tokens with numerous others, making it nearly untraceable where Monero is being sent from or to.

As an analyst, I’ve observed that while Monero (XMR) is known for its emphasis on anonymity, questions about its true level of anonymity have been raised. Prior to February 2017, there were significant issues with Monero’s anonymity that were quite noticeable. However, the developers addressed these concerns by modifying the code. As a result, transactions made before this time can be traced. Even after the code change, some vulnerabilities persist which could potentially allow for the identification of transaction senders. Notably, researchers from esteemed institutions such as Princeton University, Carnegie Mellon University, Boston University, Massachusetts Institute of Technology, and the University of Illinois at Urbana-Champaign have identified these loopholes.

The selection of Monero mixins allows for an easy differentiation between them and genuine coins, as their age distribution patterns differ significantly. Essentially, the original input is often the most recently received input.

An empirical analysis of traceability in the Monero blockchain

The anonymity feature of Monero is a more recent development; in 2024, there were instances where it was discovered that the so-called anonymous digital currency could be traced.

In January, it was reported that the Finnish National Bureau of Investigation traced XMR linked to hacker Julius Kivimäki’s activities.

Towards the end of September, a video released by the data analysis firm Chainalisy suggested that it might be possible to trace Monero transactions.

Initially, the company accidentally posted a video which they swiftly removed. Nonetheless, users managed to save and repost the content on YouTube. This video dates back to August 2023.

Chainalysis deployed numerous nodes across various regions, utilizing multiple internet service providers to collect IP addresses associated with transactions and timestamp data.

This approach could weaken Monero’s anonymity, making it possible to trace the locations of wallets that communicate with a suspected malicious server.

Anonymity: myth or illusion?

Although cryptocurrencies were initially conceived as untraceable forms of currency, it’s now clear that this isn’t completely accurate. Over the past 16 years, governments, corporations, and even individuals have adapted to the decentralized nature of digital money and developed new monitoring methods.

In any case, complete anonymity will always remain a utopia for fans of decentralization.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-11-17 16:56