As an analyst with a background in economics and a strong interest in emerging markets, I find the growing adoption of cryptocurrencies in Latin America particularly intriguing. The region’s unique blend of economic instability, innovative spirit, and technological savvy creates a fertile ground for digital currencies to take root.

In Latin American nations, which have previously experienced economic instability, there’s a growing interest in cryptocurrencies. The scenario unfolding in these countries involves an increasing adoption and exploration of digital currencies.

Table of Contents

Review

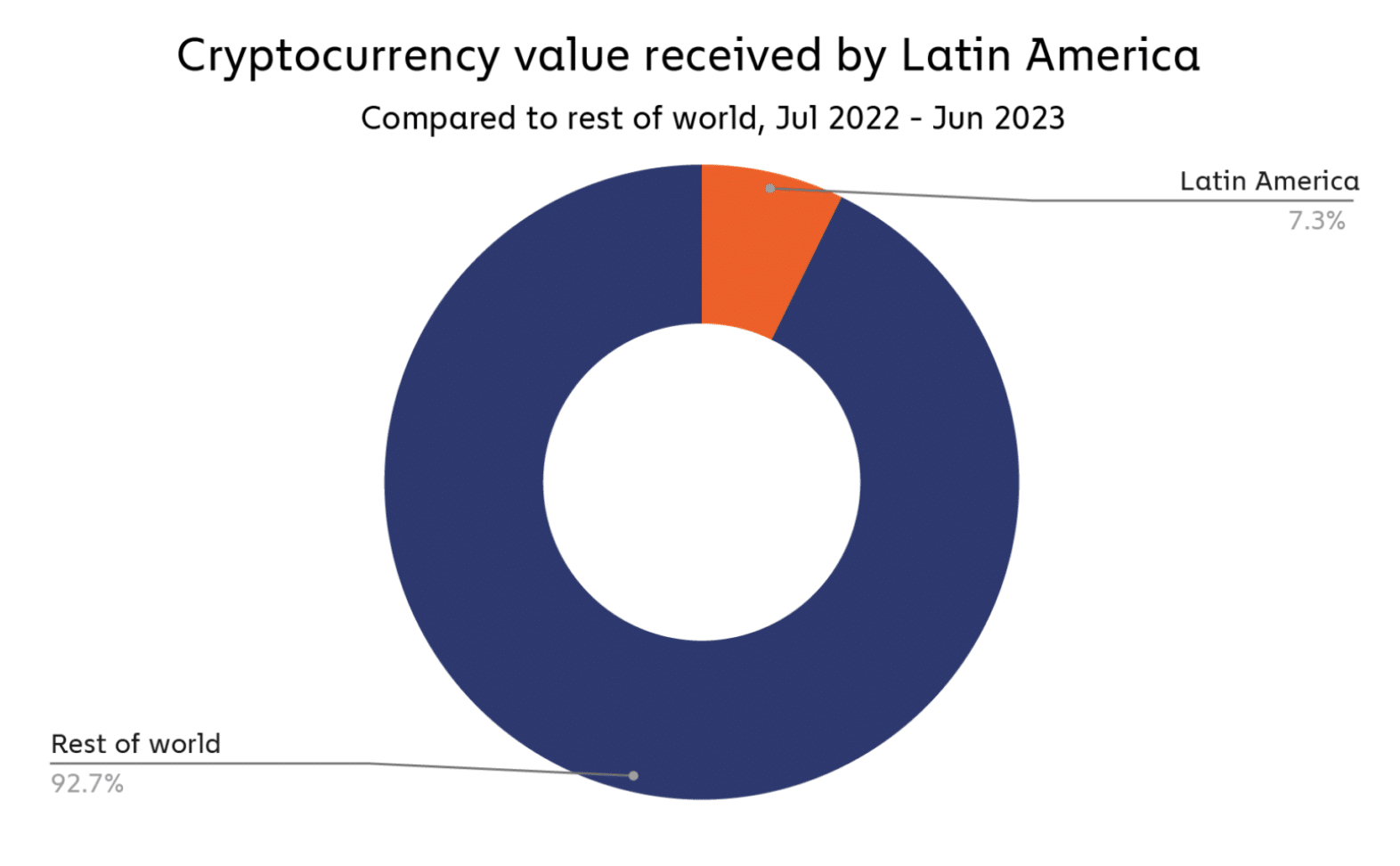

Based on Chainalysis’ findings, Latin America ranks seventh in terms of crypto economics worldwide, contributing approximately 7.3% to the market. In this region, people frequently employ digital assets as a means of preserving value due to currency depreciation and as a tool to resist authoritarian regimes.

By the close of 2023, there’s a growing trend toward widespread use of blockchain technology and cryptocurrencies in everyday life, with Latin America taking the forefront in this transition. Between mid-2022 and 2023, approximately half (51%) of the region’s population engaged in transactions using digital currencies.

The vibrant developer community behind Circle contributes to this company’s agility. Approximately a million people in the region are engaged in offshore development, thereby amplifying the influence of this sector on Latin America’s financial market. These developers play a pivotal role in enhancing the worth and reachability of the financial industry in this region.

In simple terms, the strong market need in Latin America, along with favorable policies and extensive use of the US dollar, make this region an ideal candidate for the wider implementation of stablecoins.

Circle research

As a researcher studying the adoption and abandonment of cryptocurrencies in Latin America, I’ve discovered that there are several additional factors at play beyond what has been previously reported. These contributing factors have influenced the active introduction or withdrawal of these digital currencies in the region.

The most prominent countries in the implementation of cryptocurrencies: an overview

Significant differences exist in patterns of digital asset use across jurisdictions in the region.

El Salvador

Nayib Bukele, the present-day President of El Salvador, has pioneered the recognition of Bitcoin (BTC) as a legitimate tender in the international community. In accordance with his pro-cryptocurrency initiative, he vowed to procure one Bitcoin every day for the country.

As a crypto investor following the developments in Latin America, I’m excited to share that over the past two years, our region’s government has amassed an impressive Bitcoin fortune worth over $300 million. The president, Bukele, shows no signs of selling this digital gold. Instead, he is committed to utilizing BTC as a tool for fostering innovation, tourism, and economic growth in our country.

As a crypto investor, I’m excited about El Salvador’s recent moves in the cryptocurrency space. Not only have they introduced the possibility of gaining citizenship through investments in digital currencies, but they’re also tapping into renewable energy sources to mine Bitcoin using volcanic power. These innovative initiatives showcase their commitment to the crypto industry and sustainability, making it an intriguing market to watch.

Argentina

As a researcher studying economic developments in Argentina, I’d like to share an intriguing turn of events that occurred last year. Javier Milei, a known advocate for cryptocurrencies, assumed the presidency of Argentina. With a vision to drastically reshape the economy, he pledged several transformative measures: reducing the size of the public sector and government spending, tackling triple-digit inflation head-on, dismantling the Central Bank, and proposing the use of the U.S. dollar instead of the Argentine peso as the national currency.

He is known for being vocal in his opposition to central banks and is a proponent of Bitcoin. In his view, the primary advantage of digital gold lies in its restricted availability. Following Milei’s election win, the value of Bitcoin in relation to the Argentine peso reached an all-time high.

“Using legal tender, governments deceive you through inflation taxes… #Bitcoin serves as a response to central bank deceit; it’s a means to make money a private matter once more.” – Javier Milei, Argentine President.

— Dylan LeClair 🟠 (@DylanLeClair_) November 19, 2023

After that point, there has been a noticeable surge in interest and commitment to cryptocurrencies within the country. Currently, the regulatory landscape for the digital asset sector is advancing rapidly. As a result, in January, the Argentinian government, under the leadership of its President, opted against imposing a new tax on previously unreported cryptocurrencies.

As a crypto investor, I’m keeping an eye on the ongoing discussions between Argentine and El Salvadoran regulators regarding the regulation of Bitcoin and other digital assets. It’s exciting to hear that they are planning to establish a financial alliance, where Bitcoin is expected to play a significant role. This potential partnership could lead to interesting developments in the crypto space for both countries.

The Argentine regulatory body’s representatives commended El Salvador’s government for establishing a welcoming environment for utilizing the first cryptocurrency and enacting laws that foster the expansion of cryptocurrency businesses within the country.

Paraguay

In October 2023, Bitcoin mining company Sazmining initiated the first renewable energy-powered mining farm in Paraguay. Drawn to Paraguay by its immense energy resources and minimal tariffs, Sazmining established this farm to minimize carbon footprint in Bitcoin mining.

After initially entertaining the idea of banning Bitcoin mining, Paraguay has since changed course and started improving the conditions for miners instead. This shift in policy came about following the submission of a proposed ban bill in early April, which was later put on hold.

Through this approach, Paraguay can draw extra financing for its infrastructure initiatives without hiking up energy costs for citizens. As a result, the country is becoming more welcoming towards cryptocurrency miners, potentially boosting Paraguay’s growing mining sector.

Brazil

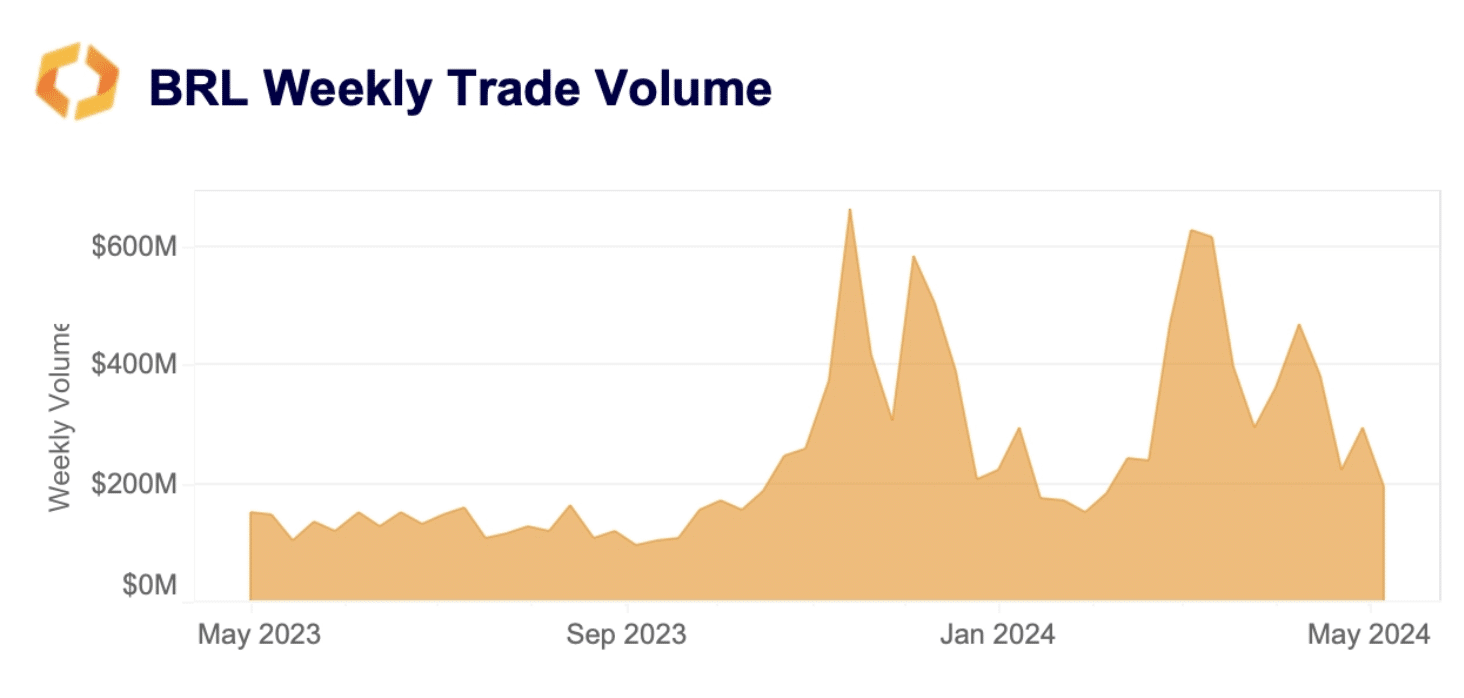

As an analyst, I’ve examined Kaiko’s data and found that digital currency trading volume in Brazil grew by 30% in the year 2024. In the first four months alone, the value of transactions involving cryptocurrencies surpassed $6 billion. Notably, Brazil ranks seventh globally in terms of the volume of fiat-crypto currency transactions.

Amidst growing public curiosity regarding cryptocurrencies, the Central Bank of Brazil is diligently working on implementing regulations for digital assets. The regulatory framework is predicted to become effective by the close of 2024.

The government intends to roll out a phased initiative for regulating digital asset transactions within the country. To begin with, the Central Bank is spearheading an effort to register cryptocurrency firms. These entities will be required to secure a license and be added to a distinct database of virtual asset service providers (VASPs).

In the second phase, we’ll gain more authority over virtual currency exchanges. A special focus will be placed on monitoring stablecoins.

Mexico

Back in 2018, I found myself part of history as Mexico took the lead among Latin American nations by initiating the regulation of crypto exchanges and similar platforms facilitating transactions using digital currencies.

As a crypto investor, I’d rephrase it as follows: According to Chainalysis’ expertise, Mexico ranks number two globally in terms of cross-border cryptocurrency transactions. Approximately $61 billion in assets move between countries annually, with a significant portion coming from the United States.

Information about the evolving laws concerning cryptocurrencies in Mexico is essential. At the same time, Mexican officials are engaged in developing a digital version of their currency, known as the digital peso.

Those involved in the industry are expected to closely watch if the percentage of this share increases in the near future, not just for Mexico but also for other Latin American nations with significant remittance flows.

Chainalysis research

The regulator plans to utilize the asset’s capabilities to introduce features like automation and customization. The Bank of Mexico accelerated the digital peso rollout schedule from 2024 to 2025 in the year 2023.

Summing up

As a crypto investor with a focus on Latin America, I can confirm that this region is rapidly emerging as a hub for global cryptocurrency development. Retail investors here are particularly drawn to the potential of tokens, and their interest is truly noteworthy. Moreover, companies in the region are increasingly recognizing the benefits of using this instrument for seamless cross-border capital transactions.

As a market analyst, I’ve observed a rising trend in the adoption of cryptocurrencies across Latin America. Currently, Brazilian importers are among the pioneers in this space, utilizing digital currencies to settle transactions with Chinese suppliers, thereby reducing transaction costs and enhancing cross-border trading efficiency.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- Brent Oil Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

2024-05-30 11:42