As a seasoned researcher who has been closely following the crypto landscape for years, I find the latest findings from Chainalysis both heartening and concerning. On one hand, it’s reassuring to see that illicit blockchain activity is on a decline, indicating growing legitimacy in the sector. However, the surge in stolen funds and ransomware inflows serves as a stark reminder of the evolving tactics employed by cybercriminals.

According to experts from Chainalysis, the amount of illegal transactions on blockchains has decreased by almost 20% this year, but the flow of stolen assets and ransomware payments is still increasing.

Illegal cryptocurrency transactions have decreased by close to 20% this year so far, suggesting increasing legitimacy within the industry, as per the mid-year report released by blockchain analysis company Chainalysis.

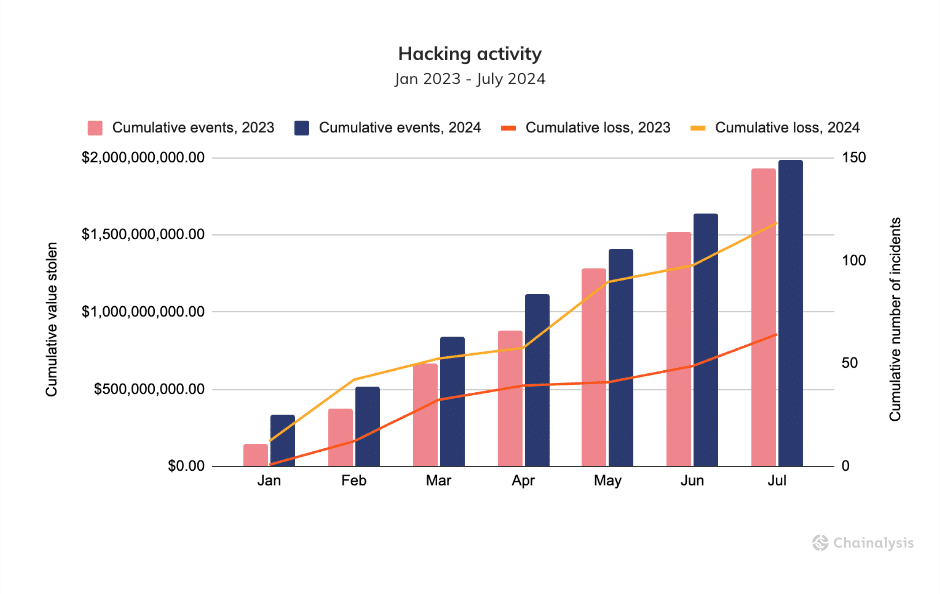

Even though there’s been a decrease, it’s important to acknowledge that certain patterns related to specific cybercrimes remain worrisome. The company pointed out that the amount of money stolen through crypto heists almost doubled, reaching $1.58 billion, and the inflows from ransomware increased by 2%, totaling $459.8 million during the first six months of 2024.

Chainalysis links the increase in stolen funds to a renewed wave of attacks on centralized exchanges, marking a shift from hackers primarily targeting decentralized finance. Despite the slight rise in the total number of cyber-attacks compared to 2023, the average amount stolen per incident has jumped by nearly 80% in 2024, largely due to escalating cryptocurrency prices, according to the New York-based firm.

“The typical loss per incident has grown significantly, jumping by approximately 79.46% since the start of 2023 up until now in 2024. This increase is from an average of $5.9 million per incident between January and July 2023 to a current average of $10.6 million per incident.”

Chainalysis

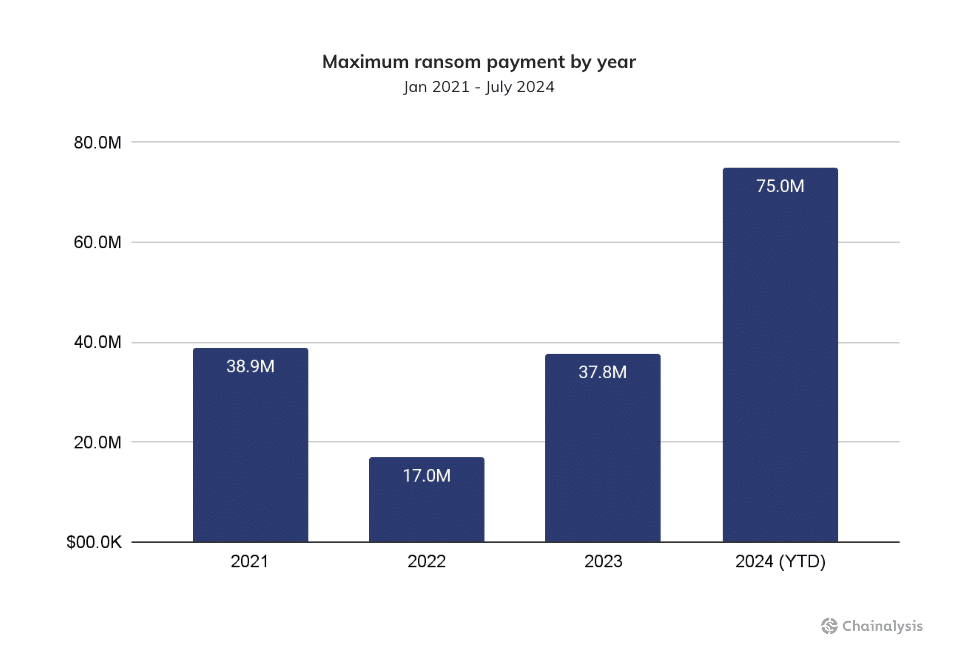

As a researcher, I’m constantly monitoring the cybersecurity landscape, and it’s alarming to see that ransomware attacks continue to pose a significant threat. It seems that we might surpass last year’s record of $1 billion in ransom payments with 2024, which is concerning indeed. Interestingly, Chainalysis has reported the largest ransomware payment ever recorded this year, approximately $75 million paid to the Dark Angels ransomware group. This underscores the need for robust cybersecurity measures and vigilance against such attacks.

Over time, the terrain of ransomware has become more diverse due to legal actions against significant groups such as ALPHV/BlackCat and LockBit. Nevertheless, certain accomplices have shifted towards less potent variants or introduced new ones, with a growing focus on larger corporations, as indicated in the report.

As an analyst, I’m cautiously optimistic about the general decrease in illicit activities, but it’s crucial to acknowledge the persistent increase in funds being stolen and ransomware payouts. This trend highlights the adaptability and changing strategies employed by cybercriminals, which necessitates ongoing vigilance and countermeasures on our part.

Elephant in the room

Decentralized cryptocurrency exchanges are often safer from hackers and less involved in laundering stolen assets compared to centralized ones. Research by Chainalysis has revealed that these trading platforms have received approximately $100 billion worth of cryptocurrencies originating from identified illicit sources since 2019, indicating a concerning lack of international collaboration on anti-money laundering measures.

Based on the company’s findings, approximately one third of cryptocurrencies traced back to illegal sources ultimately get transferred to sanctioned platforms, such as the Russian exchange Garantex. The highest volume of this “tainted crypto” interacting with these services was observed in 2022, amounting to around $30 billion, serving as a stark reminder of the ongoing struggles in preventing cryptocurrency-facilitated money laundering.

Read More

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Gold Rate Forecast

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-08-16 09:03