Ah, the grand performance of our dear old inflation, a tightrope walker teetering charmingly under the weight of fiscal calamity: US inflation blissfully dropped in the merry month of March, sowing seeds of optimism that the enigmatic Federal Reserve might take a gentle turn toward dovishness in their tantalizing meetings to come—lifting crypto prices like a hopeful balloon in a tempestuous sky. 🎈

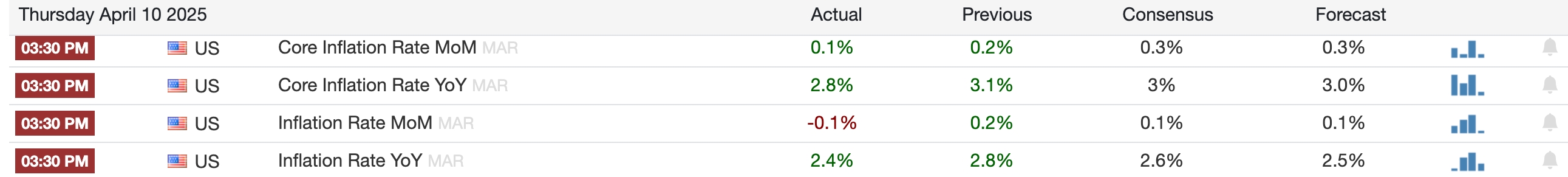

Figures spill forth from the Bureau of Labor Statistics, painting a picturesque decline in the headline Consumer Price Index from a modest 0.2% in February to a rather audacious -0.1% in March. Annual inflation took a scenic detour from 2.8% to 2.4%, practically tangoing its way toward the Fed’s desired 2.0% target, don’t you think? 💃

Let us not overlook the star of the evening: the core CPI, which, in its elegant exclusion of the ever-fluctuating food and energy prices, also slipped gracefully from 0.2% to a whispery 0.1% month-over-month. Verily, the annual core figure now lounges at 2.8%, marking a deliciously celebratory occasion—the first time in aeons that it hath dipped below the vaunted 3%. 🎉

This jubilant decline occurs with remarkable audacity, despite the U.S. now draping new tariffs over imported goods like an unwelcome guest at a tea party. President Trump, that master of economic theatrics, exultantly raised tariffs on Canadian and Mexican imports to a daring 25%, blissfully ambushing the USMCA deal he orchestrated during a previous act. And lo! The stakes with China escalate as tariffs swell by an extravagant 20%. 🍵😆

Moreover, the U.S. hath introduced new tariffs on imported steel and aluminum, alas, used in construction and manufacturing—because why not complicate things just for the fun of it? ⚒️

Consequently, this latest barrage of inflation data is poised to add joyful pressure on the Fed to return to their interest rate-slashing antics. Perhaps the downward inflation trend, like a mischievous cat, may persist, especially as our dear Trump pauses the Liberation Day tariffs—like putting on the brakes in a grand magical sleigh ride. 🛷✨

Impact on Bitcoin, Ethereum, XRP, and Altcoin Prices

The downfall of inflation made quite the dramatic entrance just as Bitcoin (BTC) and its charming entourage of altcoins—Ethereum (ETH) and Ripple (XRP)—bounced back from their woefully low weekly crescendos. Behold! Bitcoin has risen and now lounges comfortably at an eyebrow-raising $82,000, while Ethereum and XRP waltz their way to $1,600 and a humble $2, respectively. 💰

U.S. stocks too joined the jubilant celebration following Trump’s audacious decision to halt certain tariffs and invite trade representatives for tea—with over 70 countries, mind you. However, the ever-volatile tariffs on Chinese imports surged like an errant wave to 125%, putting a staggering $500 billion in goods at risk of being swept away into the murky abyss! 🌊

This delightful cocktail of decisions has led to a noticeable dip in recession odds, with Goldman Sachs—bless their heart—being the first Wall Street bard to scale back their recessionary ballad. A Polymarket poll worth a hefty $2.2 million now hints at a 50% chance of recession, a giddy decrease from a robust 66% earlier this week. 🎭

The plummeting inflation, especially as economic festivities slow to a gentle waltz, could nudge the Fed toward a merry round of interest rate cuts—an outcome that would serve as a sumptuous catalyst for Bitcoin and its boisterous brethren. The joyful crypto bull run of early 2023, one might remember, was partly ignited by the sweet whispers of the Fed easing monetary policy as inflation took its delightful nosedive. 🐂💨

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-04-10 15:55