As a researcher with experience in the blockchain and cryptocurrency industry, I’m excited to see Injective’s recent progress and the positive impact it’s having on the price of its INJ token. The integration of PayPal’s PYUSD stablecoin through Wormhole is a significant development that could attract more users to the platform and increase liquidity.

The injective price has recovered ground since mid-May, with traders keeping a close eye on the project’s expanding ecosystem following recent developments.

The INJ token reached a peak of $30 and has remained close to its highest point since mid-April. It has experienced a significant surge, gaining more than 60% from its previous low in April. Notably, Injective, the fintech-centric blockchain platform supported by Mark Cuban, has recently welcomed PYUSD, the new stablecoin initiated by PayPal, into its system.

Developers announced that their layer-1 platform marked a milestone by becoming the initial supporter of the $400 million stablecoin, enabling seamless transition of the token from Ethereum and Solana to Solana.

As a researcher exploring the latest developments in the blockchain space, I’m excited to share that Injective is taking a significant step forward by integrating PYUSD, making it one of the first Layer 1 platforms to support PayPal and Paxos’ stablecoin. This integration marks an important milestone in the crypto world.— Injective 🥷 (@injective) June 12, 2024

“Wormhole, a leading bridge network in the blockchain sector, enabled the seamless connection between the two systems.”

As of late, Mito Finance – a new liquidity management entity on Injective – has introduced permissionless vaults into operation. Consequently, users are now empowered to establish their own vaults on Mito and initiate trading activities. To date, some users have already initiated the creation of GME/INJ, ZIG/INJ, and NLT/INJ pairs within the platform.

Despite its growing presence, Injective’s DeFi ecosystem remains smaller than some of its newer competitors. As reported by DeFi Llama, the network currently hosts 17 decentralized finance (DeFi) applications with a combined total value locked (TVL) exceeding $159 million. Notable projects within this ecosystem include Hydro Protocol, Dojoswap, Helix, and Neptune Finance.

While the Base and Merlin networks, which were launched previously, have assets valued at approximately $1.68 billion for Base and $1.17 billion for Merlin, the more recent addition to the scene, Blast, boasts an impressive asset value of over $2.07 billion.

As a researcher, I’ve noticed that Helix, the leading decentralized exchange (DEX) on its platform, has experienced significant growth recently. Based on data from CoinMarketCap, this platform facilitated approximately $101 million worth of transactions within the last 12 hours. This impressive volume places Helix among the top 16 DEXs in terms of trading volume in the entire crypto industry.

As a crypto investor, I believe one significant factor that could boost Helix’s market presence is the ongoing success of meme coins. Lately, meme coins like Bonk and Dogwifhat built on Solana have contributed to the surge in popularity for decentralized exchanges (DEXs) such as Raydium, Orca, and Jupiter, pushing them into the top-5 ranks.

Injective price forecast

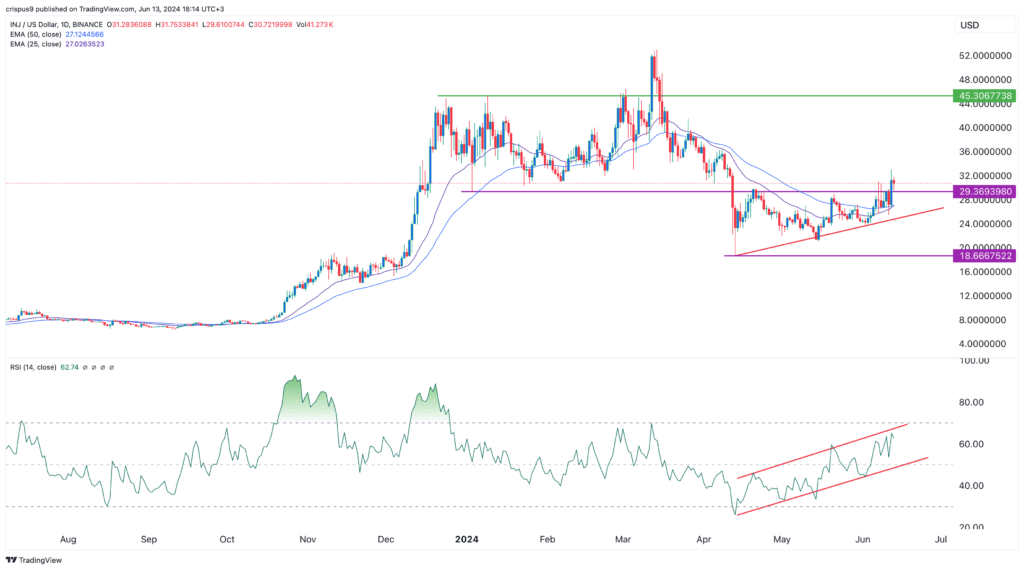

In April, the INJ token reached a low of $18.66. Since then, it has bounced back and surpassed the significant resistance level of $30 for the first time since April and May. This is also the lowest price it had reached in January.

As an analyst, I’ve noticed an intriguing development in the market trends. The 25-day and 50-day moving averages have crossed each other, with the 25-day moving average now lying above the 50-day one – a bullish sign. Additionally, the Relative Strength Index (RSI), depicted in red on the chart, has been forming an ascending channel.

Based on current market trends, the token’s prospect looks optimistic with the upcoming resistance level to keep an eye on at $45, which was its peak price on January 9th. This prediction indicates a potential increase of 46% from the present value.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-06-13 19:25