As a seasoned researcher with over two decades of experience in the ever-evolving world of finance and technology, I find myself intrigued by the current state of Injective (INJ). Having closely followed the trajectory of numerous blockchain projects, I must admit that this Cosmos-based chain for decentralized finance has caught my attention.

The well-known blockchain platform for decentralized finance, known as Injective, has been experiencing a withdrawal, sparked by worries over its overall system.

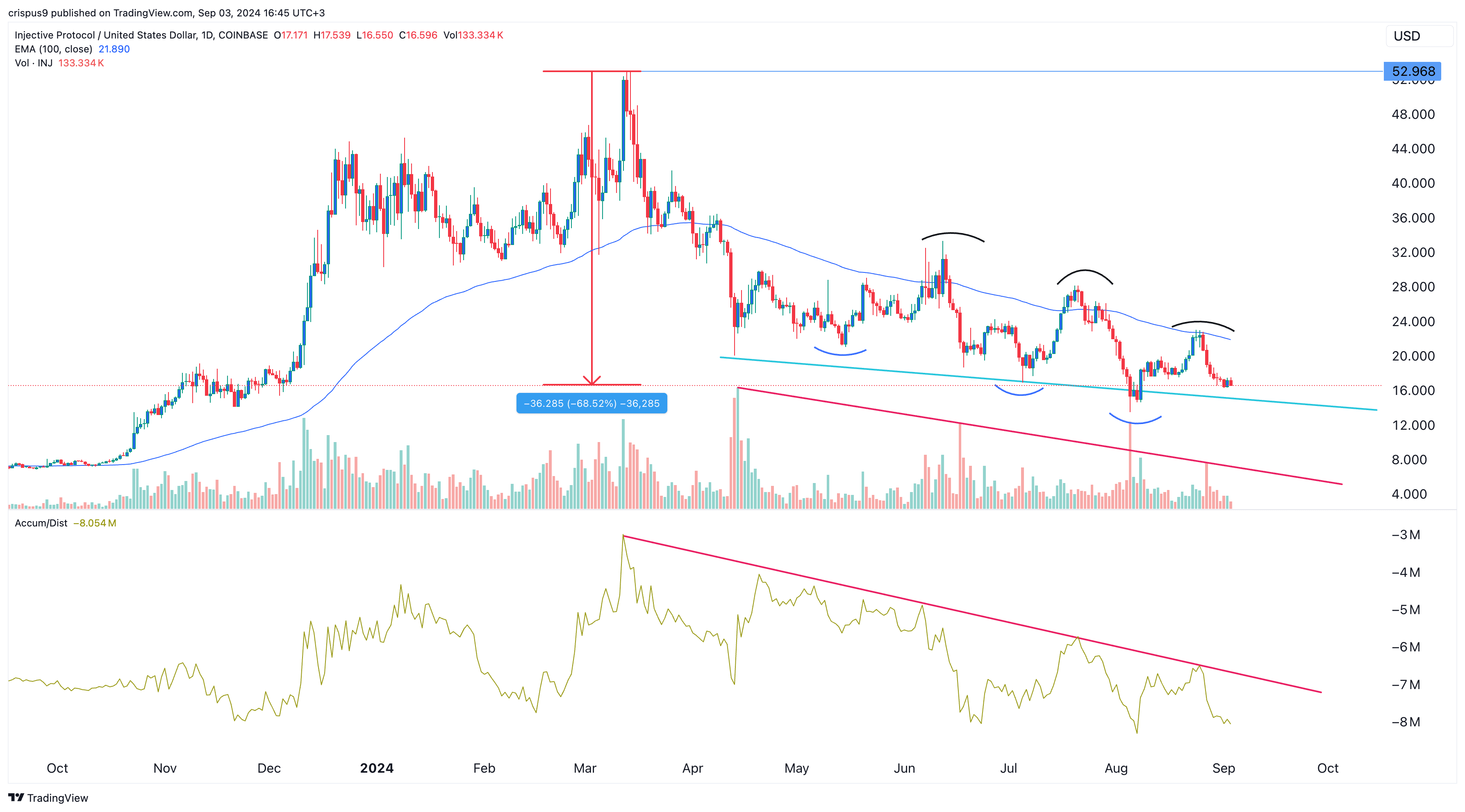

The INJ token hit a new low for the month at $16.90 on September 3, which was its lowest point since August 8. This represents a significant drop of more than 67% from its peak this year, effectively undoing much of the growth it achieved in 2023. The token’s market capitalization has decreased from over $4.8 billion in March to $1.65 billion now.

Ecosystem challenges remain

The price movement of Injective aligns with the widespread selling of other altcoins, as the Crypto Fear & Greed Index stays steady at its neutral level of 47.

Despite a substantial rise in on-chain transactions, there’s still been a decrease observed (in the network). As stated on their site, Injective has processed more than 918 million transactions since it was launched.

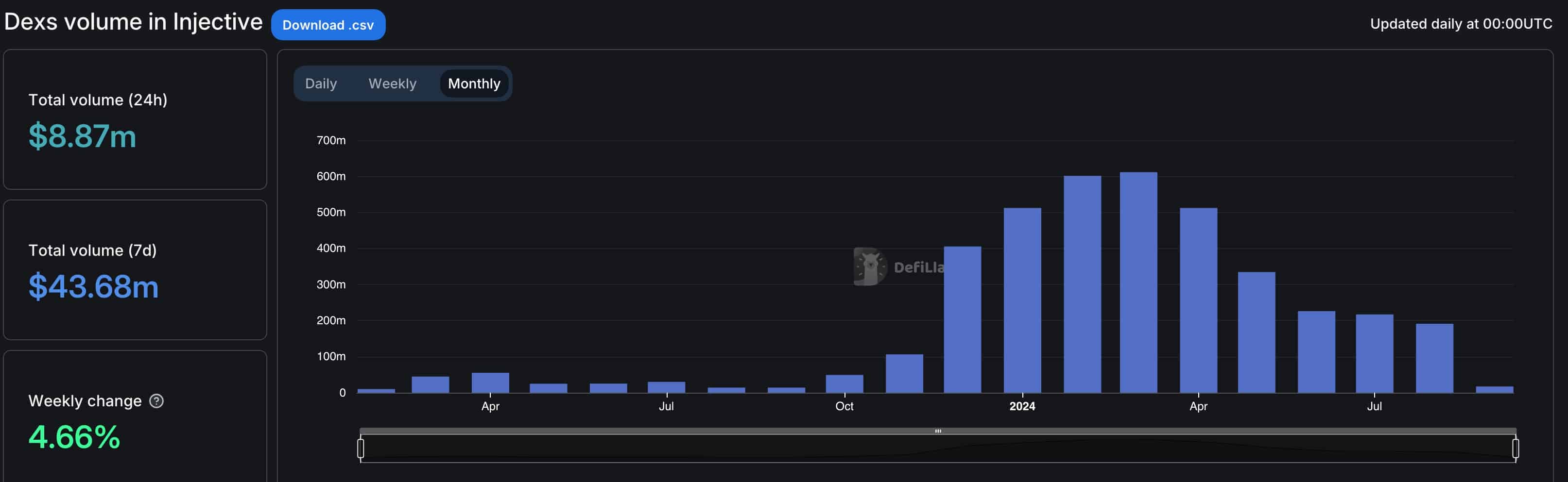

Despite ongoing worries regarding its ecosystem impacting its overall evaluation, data from DeFi Llama reveals that its decentralized exchange protocols processed approximately $43.7 million over the past week. This places it as the 23rd largest chain in the market, trailing behind platforms such as Osmosis, Mantle, and Blast.

The trading volume on Injective’s DEX has been consistently decreasing since it reached a high of $611 million in March, suggesting that the DEX environment associated with it is failing to expand.

The combined worth secured within the Injective system has shrunk to approximately $46.5 million, positioning it as the 51st largest blockchain network. This total value locked (TVL) has been on a downward trend since reaching a high of $72 million earlier in the year. Furthermore, the circulation of stablecoins within its system has dwindled to about $22.6 million.

Notable is Injective’s performance within the DeFi sector, as it strives to establish itself as a blockchain tailored specifically for financial services.

The injection of tokens into the network has decreased due to a drop in staking inflows. It’s been observed that the network has witnessed outflows over the past two days, and the yield on staking has fallen to 10.4%, having peaked at 18.7% last month.

Trader cautions on Injective

The INJ token has retreated from its peak of $52.96 reached in March, and it’s been showing a pattern of decreasing highs and lows, suggesting that the bears are dominating the market. In a statement, Altcoin Sherpa, a popular trader with approximately 222,000 followers on social media, cautioned that the token could still experience additional declines.

From my perspective, the overall trend of the chart remains bearish and I don’t anticipate a change in that trend just yet. There are lower highs across all areas, suggesting a possible bounce at some point, but pinpointing the exact bottom is challenging for me. I’m not certain if it will reach its previous All-Time High during this cycle, but there’s always a chance I might be mistaken.

— Altcoin Sherpa (@AltcoinSherpa) September 3, 2024

The injective figure has persistently stayed beneath the 50-day moving average, and simultaneously, the accumulation/distribution indicator shows a persistent decrease, suggesting more distribution is occurring.

The decrease in its volume persists, implying potential further reduction. If it dips beneath the downward sloping trendline linking the lowest points since April 12, this decline will be substantiated.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Silver Rate Forecast

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

2024-09-03 17:23