As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market volatility and sentiment shifts. Sui (SUI) is a fascinating case study right now. The partnership with Major League Soccer and the launch of USDC on its mainnet were undoubtedly catalysts for its rapid rise, reaching an all-time high of $2.36 just last month. However, the current negative sentiment around SUI is a cause for concern.

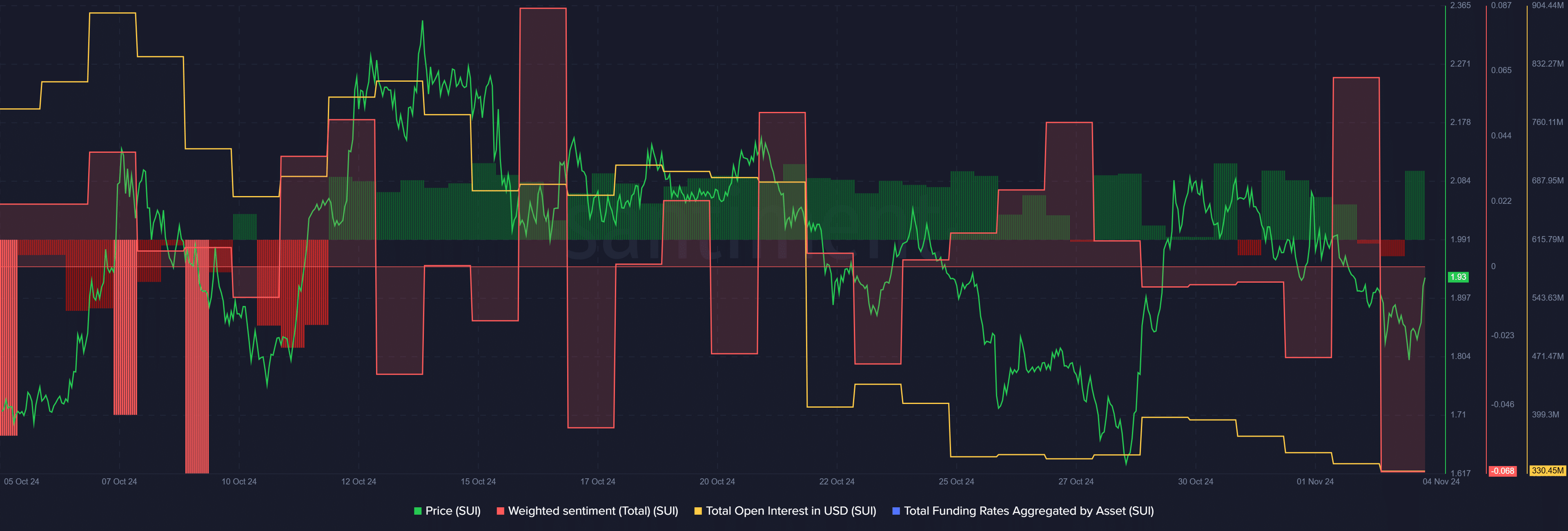

Over the last month, Sui’s trajectory has been quite erratic, which seems to be fueling growing pessimism about the asset.

On October 14th, SUI attained its peak at $2.36 as the cryptocurrency sector experienced a strong bullish surge. The favorable vibe surrounding SUI was further boosted by the launch of MLS Quest, a non-fungible token platform themed around Major League Soccer, in collaboration with Sweet, a blockchain startup that specializes in gamification.

Another key driver was launching USD Coin (USDC) on Sui’s mainnet.

Nevertheless, the positive momentum surrounding SUI weakened within a fortnight following its all-time high, due to a wider correction in the crypto market.

Triggering negativity

Based on information from Santiment, there has been a significant change in the overall sentiment towards Sui on social media platforms, moving from a neutral score of 0.06 to a negative one (-0.06) within the past two days.

In simpler terms, when people feel negative about something, it often stems from fear, hesitation, or ambiguity – which we often abbreviate as FUD – and this typically leads to a decrease in its value or price.

According to our market data source, the combined number of outstanding SUI perpetual contract positions dropped significantly. On October 7th, when the overall bullish trend began, it was approximately $895 million. However, as we speak, this figure has decreased to about $330 million.

SUI’s open interest is currently at its two-month low.

Regardless of the growing pessimism, today SUI’s funding rate transitioned from a negative 0.002% to a positive 0.01%, following its price crossing the $1.95 threshold earlier.

SUI is up 0.3% in the past 24 hours and is trading at $1.88 at the time of writing. It’s still the 18th-largest crypto asset with a market cap of $5.3 billion. SUI’s daily trading volume increased by 30%, reaching $630 million.

Significantly, if SUI undergoes additional adjustments, prolonged liquidations might cause unease among investors, which could result in a mass selling-off, driven by the unfavorable opinion towards the asset.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-11-04 09:58