It appears that our dear friend XRP has been on a rather splendid ascent these past few days, all thanks to a delightful dip in liquidation antics among its long-term holders (LTHs). Who knew that a little restraint could lead to such a jolly good time? 🎉

On-chain data, which sounds rather like something out of a detective novel, reveals a rather pronounced slowdown in the token’s movements among these investors. It seems our LTHs are holding their positions tighter than a butler clutching a tray of cucumber sandwiches, hinting at a sustained price rally in the near future. How positively thrilling! 🥳

XRP Shows Signs of Accumulation as LTH Selloff Activity Declines

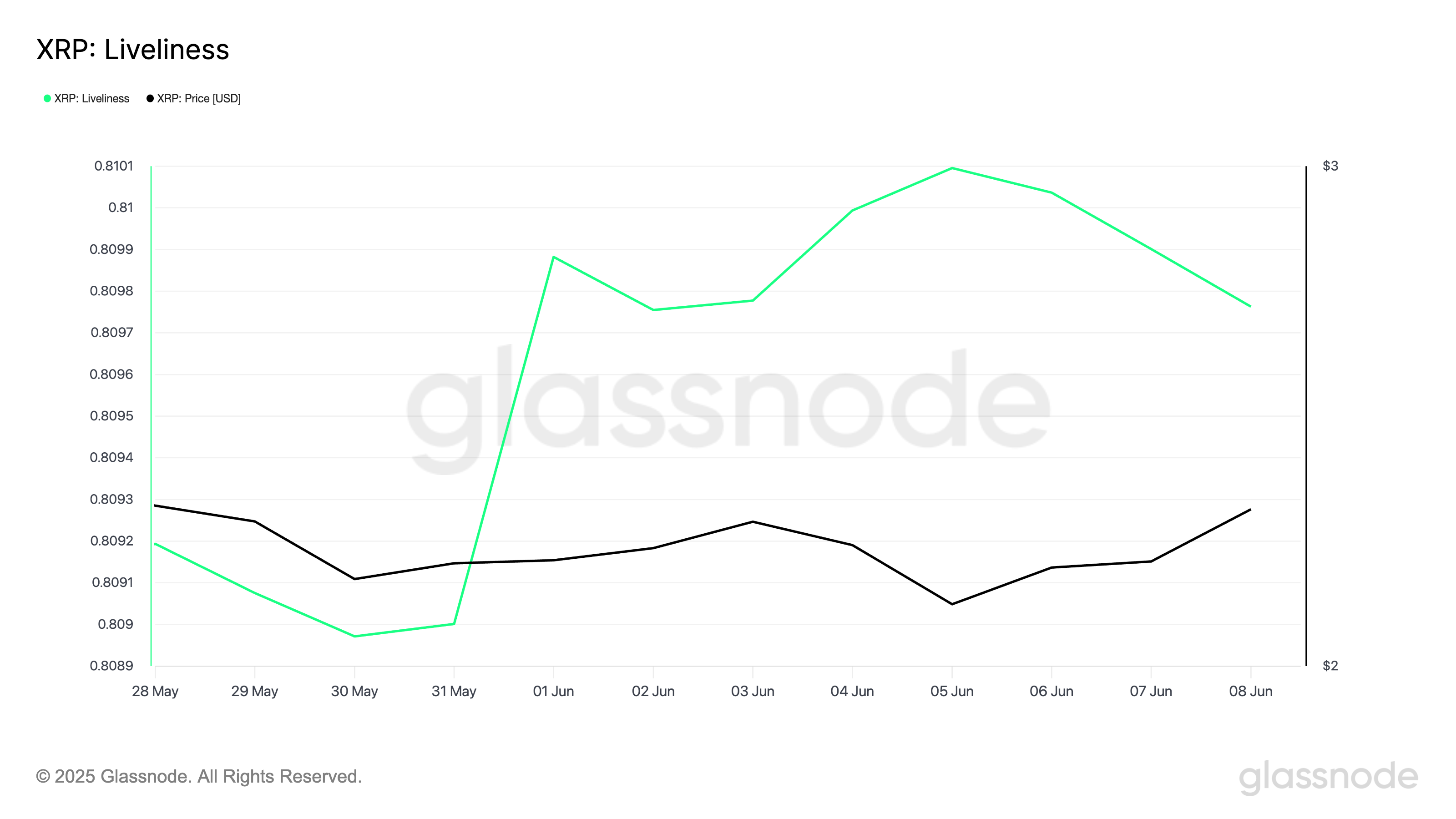

According to the ever-reliable data from Glassnode, XRP’s liveliness has been on a steady decline since June 5, slipping by a cheeky 1% to a rather unremarkable 0.809 as of June 8. This signals a delightful reduction in activity among our LTHs, who seem to be taking a well-deserved break from the hustle and bustle of trading.

Liveliness, which sounds like a rather sprightly dance, tracks the movement of long-held or dormant tokens. It measures the ratio of an asset’s coin days destroyed to the total coin days accumulated. When this metric climbs, it means our LTHs are either moving their coins or, heaven forbid, selling them. But when it falls, as it has, it indicates that LTHs are moving their assets off exchanges, a bullish signal of accumulation. Quite the plot twist! 🕵️♂️

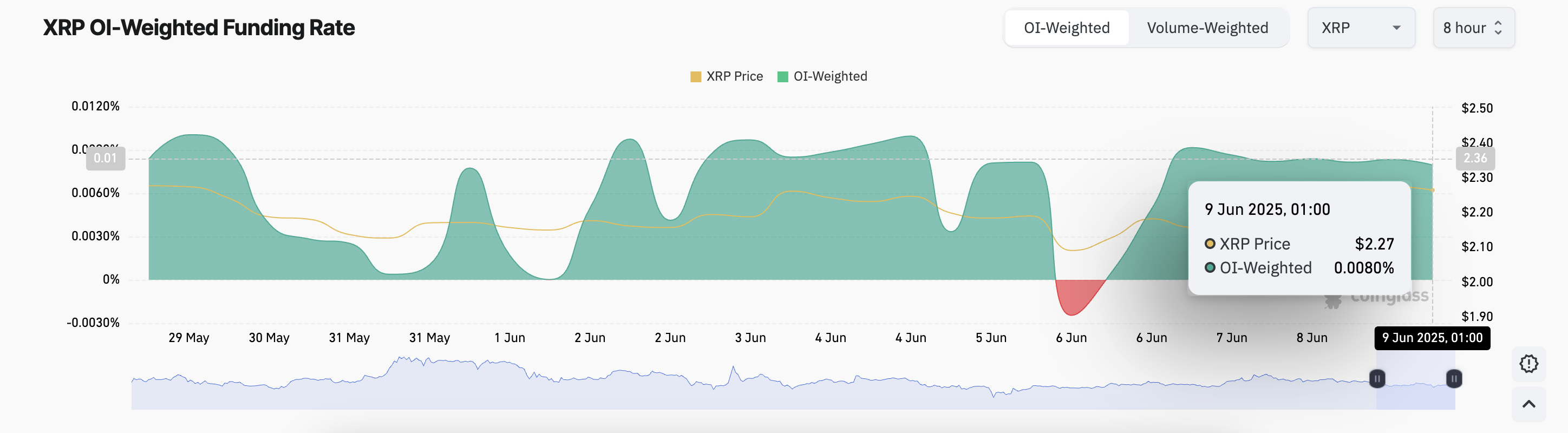

Moreover, this positive shift in holder behavior is echoed in the XRP derivatives market, where the funding rate has been as consistently positive as a cheerful chap at a garden party since June 6. As of this very moment, it stands at 0.0080%, suggesting that most traders are betting on continued upside. How positively optimistic! 🌞

The funding rate, a rather fancy term, is a periodic fee exchanged between traders in perpetual futures markets to keep contract prices aligned with the spot price. When it’s positive, it implies that long positions are dominant, and short sellers are willing to pay to keep their positions open. A strong indicator of bullish sentiment, indeed! 🤑

XRP Teeters Between Breakout and Pullback as Golden Cross Looms

Readings from the XRP/USD one-day chart confirm the potential bullish shift, as the token’s Moving Average Convergence Divergence (MACD) indicator hints at the formation of a golden cross. This occurs when the MACD line (blue) prepares to cross above the signal line (orange), a setup widely regarded as a bullish momentum signal. Quite the dramatic turn of events! 🎭

The MACD indicator, which sounds like a rather posh club, identifies trends and momentum in an asset’s price movement. It helps traders spot potential buy or sell signals through crossovers between the MACD and signal lines. When the MACD line is above the signal line, it indicates bullish momentum, suggesting that the asset’s price may continue to rise. How splendid! 🌈

A successful formation of the golden cross will confirm XRP’s rally and could push its price past the resistance at $2.29, toward the lofty heights of $2.50. A veritable treasure hunt! 🏴☠️

On the flip side, a bearish resurgence could cause the altcoin to lose some gains and tumble down to $2.08. A rather unfortunate turn of events, but one must always be prepared for a spot of bother! 😬

Read More

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Brent Oil Forecast

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Pi Network (PI) Price Prediction for 2025

2025-06-09 17:42