🤑🔒 “XRP‘s Secret Sauce: Regulated Receipts Coming Soon!” 🤑🔒

As the whispers of the wind through the trees of Wall Street grew louder, a tantalizing prospect emerged, like a butterfly from the cocoon of regulatory red tape. Qualified investors, those rare and elusive creatures, will soon be able to purchase XRP receipts through the Receipts Depositary Corporation (RDC) and Digital Wealth Partners (DWP), those stalwart sentinels of the financial world.

These depository receipts, those clever little paperweights that hold the power to unlock the gates of XRP, provide a way for investors to gain regulated exposure to the cryptocurrency without, heaven forbid, actually buying it directly from an exchange. No, no, no. Instead, they can purchase XRP DRs, which represent ownership of real XRP held at a regulated custodian, those bastions of stability and security.

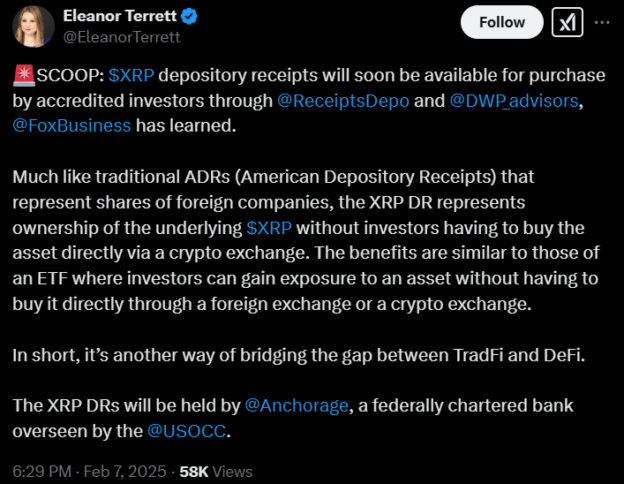

Eleanor Terrett, that wise and witty sage, confirmed this news on X, her Twitter account a beacon of hope for those seeking to navigate the treacherous waters of cryptocurrency regulation. ” $XRP depository receipts will soon be available for purchase by accredited investors through @ReceiptsDepo and @DWP_advisors” she tweeted, a message that will no doubt be met with the rapt attention of those who dwell in the shadows of the financial world.

The depository receipts will be held by Anchorage, that venerable institution, a federally chartered bank regulated by the U.S. Office of the Comptroller of the Currency (OCC), those guardians of the financial gatekeepers.

Each XRP DR works similarly to the American Depositary Receipts (ADRs), those clever little instruments that allow foreign companies to sell shares of their business with all the ease of a summer breeze. No need to trade on foreign stock exchanges, no need to navigate the labyrinthine corridors of international finance. Just pure, unadulterated XRP, held safely in the vaults of a regulated custodian.

Receipt Depositary Corp, (RDC), that start-up founded by former Citigroup executives, is leading this effort to introduce XRP-backed securities to institutional investors via the U.S-regulated market infrastructure, that great leveller of the financial playing field.

Unlike XRP ETFs and Trusts, which are still pending SEC approval, XRP DRs have already been established within a regulated framework, a veritable oasis in the desert of regulatory uncertainty. This makes them readily available to all qualified investors, those rare and elusive creatures who dwell in the shadows of the financial world.

The XRP DR program is DTC-eligible, meaning it is mainly integrated into institutional trading platforms with electronic settlement, that great facilitator of financial transactions. This allows banks and brokers to handle XRP investments just like any other security, no need to don the cloak of secrecy, no need to whisper in the darkness.

It also enables in-kind convertibility, so investors can create and redeem DRs for real XRP where regulations allow, that great liberator of the cryptocurrency from the shackles of regulatory uncertainty.

By using existing market infrastructure, XRP DRs make crypto investments as simple as trading stocks, a prospect that will no doubt send shockwaves through the financial world, like a stone cast into the still waters of a pond.

Moreover, depository receipts have long been used to help investors access assets that aren’t typically available in U.S. markets, a fact that will no doubt bring a smile to the faces of those who dwell in the shadows of the financial world.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- USD JPY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Gold Rate Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2025-02-07 23:49