As a seasoned analyst with over two decades of experience in the venture capital and technology sectors, I find Adam Cochran’s insights into the current state of crypto investments particularly enlightening. Having closely followed the evolution of the crypto market since its inception, I can attest to the fact that this sector has indeed shown remarkable growth potential. However, it’s not without its risks, which is why traditional VCs have been cautious in their approach.

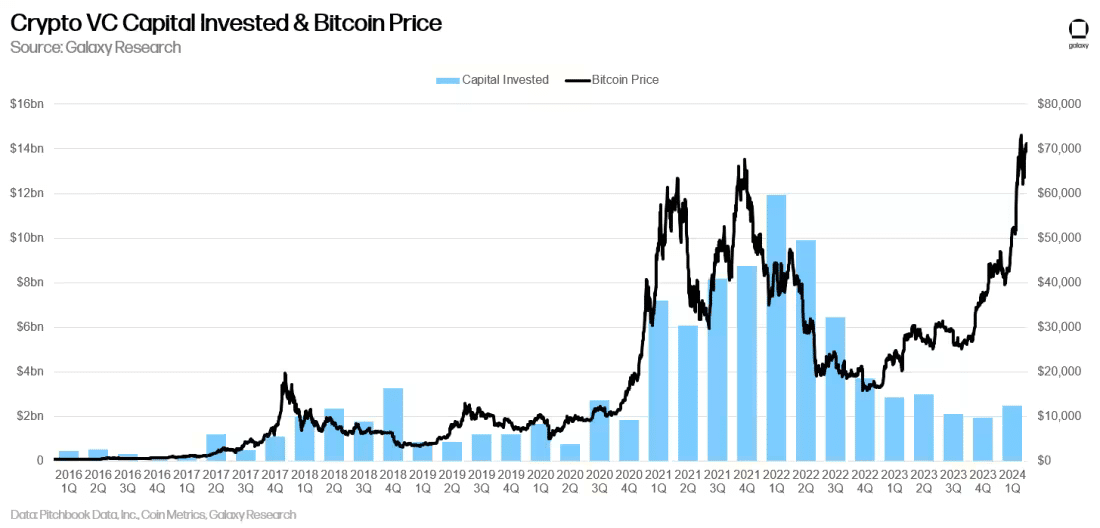

There are fewer crypto investments nowadays, according to venture capitalist Adam Cochran.

As a crypto investor, I frequently encounter expectations from my fellow investors (limited partners) who are predominantly keen on surpassing the returns provided by index funds.

The founder of CEHV, Cochran, recently shared insights on X.com about venture capitalists (VCs) and their involvement in crypto: “VCs have significantly reduced their investments in cryptocurrencies, and there’s a subtle explanation for this: 1. Many VCs have limited partners (LPs) who aim to outperform index fund returns. 2. Over the long term, the potential return on investment (ROI) from owning Bitcoin and Ethereum is expected to exceed that of index funds, with only early-stage investments potentially offering higher returns.”

See below.

Venture capitalists are significantly reducing their investments in cryptocurrencies due to a variety of factors:

— Adam Cochran (adamscochran.eth) (@adamscochran) August 9, 2024

As an analyst, I frequently focus on high-growth startups and cutting-edge technologies that showcase significant growth prospects, recognizing their potential for substantial returns.

To give you an example, the S&P 500 Index Fund, often used as a standard for evaluating U.S. stocks, has yielded about a 15% annual return on average over the past five years, based on information from curvo.eu.

Over the same timeframe I’ve been studying, I’ve found that Bitcoin (BTC) has significantly surpassed the performance of index funds. On average, it has yielded approximately 45% in yearly returns.

Financial expert Cochran emphasized that while cryptocurrency investments carry significant risks, they have traditionally surpassed index fund returns over a medium-term perspective, offering potential for substantial gains. Yet, he noted that venture capital firms are often hesitant to invest in the early stages of digital currencies due to their inherent risk.

A venture capitalist shared that numerous investors choose to keep their funds in cryptocurrencies like Bitcoin and Ethereum, as well as some promising up-and-coming projects. The aim is to earn fees and repay the initial investment capital.

According to Galaxy Research’s latest findings, around 80% of venture capital investments are expected to be directed towards early-stage businesses in Q1 of 2024, while the rest, about 20%, will likely go to more established companies.

Despite a decrease in interest from large generalist VC firms, which have either exited the crypto sector or significantly reduced their investments, crypto-focused early-stage venture funds have remained active.

A significant number of these funds continue to hold capital raised in 2021 and 2022, which provides an opportunity for budding crypto startups at early stages to obtain funding. On the other hand, later-stage startups encounter more challenges in securing capital because major venture capital players are less active.

Based on Cochran’s analysis, venture capitalists tended to invest more heavily in established apps like OpenSea during the previous market cycle, aiming to profit from the expansion of consumer demand at a later stage.

Furthermore, it’s his opinion that as the excitement around previous trends such as Non-Fungible Tokens (NFTs) and Automated Market Makers (AMM) forks, DeFi, and layer 2 solutions appears to be waning, and investors are looking forward to the next major breakthrough, Venture Capital firms seem to be in a period of waiting and observing.

A significant number of venture capital firms claim to be deeply involved in innovation and closely aligned with creators, but many do not invest in groundbreaking ideas; instead, they provide funds for popular emerging trends. This is primarily due to their lack of sufficient industry knowledge required to undertake risks in novel areas.

— Adam Cochran (adamscochran.eth) (@adamscochran) August 9, 2024

According to Cochlan’s observation, although some builders persistently innovate without external funding, identifying the next significant trend appears to be stuck.

In this scenario, the problem worsens due to venture capitalists thinking that their excess funds can generate significant profits in financial markets, which tends to reduce early-stage investment opportunities.

He mentioned that this idle phase acts as a trial for venture capital firms, showing their true dedication towards the cryptocurrency sector.

People who have a comprehensive grasp of the industry can effectively invest in promising startups and make significant contributions early on. On the other hand, those less familiar with the sector might only invest in more advanced stages, which could suggest they’re not fully committed to the field.

Read More

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD JPY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- EUR CNY PREDICTION

2024-08-10 18:46