On Fridays, the cryptocurrency market experienced significant sell-offs instigated mainly by growing apprehensions over potential clashes between Iran and Israel, as reported by QCP Capital.

Over the years, turmoil in international politics has typically caused investors to shy away from volatile assets such as cryptocurrencies and instead opt for safer investments that offer more stability.

In many cases, this change can lead to the selling off of assets considered high risk, as was seen during the more recent market decline.

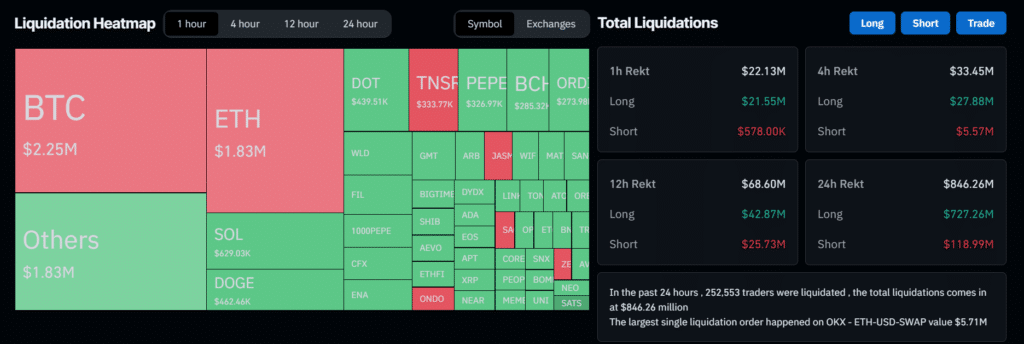

Over the past day, approximately 261 thousand traders felt the impact, and a substantial sum of $860.82 million in cryptocurrency assets was sold off as the total value of the crypto market dropped by almost 5%.

QCP Capital identified that the Ethereum risk reversal indicator significantly influenced the recent market turbulence leading to liquidations. On Friday, they pointed out that this indicator showed a substantial negative slope, indicating a possible price decrease for Ethereum.

A bearish skew in the risk reversal for ETH suggests that investors placed wagers on the cryptocurrency’s price decline. This perspective may have been fueled by ETH’s role as a hedging instrument.

The technical indicator proved reliable as Ethereum’s value fell more than 5% to $3100. Normally, investors holding long positions in altcoins employ ETH put options to hedge against market downturns. Consequently, shifts in investor sentiment significantly impact ETH prices.

The apprehension among crypto investors was evident, as shown by the drop in perpetual swap funding rates.

The rates dropped more than 40% below zero, representing the most pronounced negative funding of the year and reflecting a powerful bearish attitude.

Furthermore, the anxiety caused a significant drop in the forward curve, resulting in the front-end dipping below 10%. This indicates a pessimistic viewpoint regarding the near-term prices of cryptocurrencies.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-04-13 20:10