As a seasoned trader with over two decades of experience in both traditional and decentralized financial markets, I must admit that the recent surge in Perpetual Decentralized Exchange (Perp DEX) trading volumes has caught my attention. Growing up in a family of tech-savvy entrepreneurs, I’ve always been fascinated by innovative technologies and their potential to disrupt established industries.

In the past few years, I’ve observed the DeFi landscape evolve from its humble beginnings into a thriving ecosystem. While it’s essential to maintain a healthy skepticism when dealing with new technologies, I can’t ignore the impressive growth and momentum that Perp DEXs have gained in 2024.

Having witnessed firsthand the advantages of centralized exchanges like speedy transactions, user-friendly interfaces, and robust security measures, it’s intriguing to see these features becoming available on decentralized platforms. The innovative models such as virtual Automated Market Makers (AMMs) and multi-asset liquidity pools are a testament to the relentless ingenuity of developers in the blockchain space.

However, I’m not blind to the challenges that lie ahead for Perp DEXs. The industry must continue addressing concerns around security, usability, and liquidity while navigating emerging regulations. As someone who has experienced both successes and failures in various markets, I can attest that it’s crucial for platforms to learn from past mistakes and adapt quickly to ensure long-term sustainability.

That said, if the industry manages to surmount these obstacles, 2025 could mark a significant turning point for Perp DEXs. Institutional participation, increased liquidity, and user growth will be key indicators of mainstream adoption. I’m excited about the possibilities that this new technology brings but also remain cautious, as in any industry, there are always ups and downs to navigate.

In the end, it’s all about finding the right balance between seizing opportunities and being aware of potential pitfalls. As a trader who’s seen it all, I can tell you that this sector is no exception! And as they say in my hometown, “The best way to predict the future is to create it yourself.” So let’s see what 2025 has in store for Perp DEXs and us traders who dare to ride the wave of innovation.

Oh, and just one last thing – I always tell people that when trading, it’s important to remember: Never trade more than you can afford to lose… unless, of course, you’re playing a game of poker with your friends!

2024 saw a significant rise of Decentralized Permanent Exchanges (Perp DEXs), and they’re poised to continue their dominance in 2025. In December 2024, Perp DEXs shattered all past records with an astounding trading volume of $344.75 Billion. This monumental achievement underscores the increasing trust among users towards DeFi and the escalating market demand for these exchanges.

On these platforms, traders can participate in continuous future contracts directly, eliminating the need for intermediaries. This setup provides an unparalleled degree of accessibility and adaptability compared to what traditional decentralized exchanges typically offer.

What Is Decentralized Perpetual Exchange (Perp DEXs)?

Decentralized Crypto Exchanges specializing in perpetual contracts, often abbreviated as Perp DEXs, enable users to trade these futures contracts directly, without the involvement of any intermediaries. These exchanges operate solely on blockchain technology and do not necessitate identity verification or account creation, unlike traditional centralized crypto exchanges that require such steps. One of the primary advantages of using a Perp DEX is its simplicity – users can begin trading simply by linking their cryptocurrency wallet to the platform.

On these platforms, they employ cutting-edge systems like virtual Automated Market Makers (vAMMs) or diverse liquidity pools holding multiple assets, facilitating trading activities. Additional benefits include the use of leverage and effortless, permission-free access.

What sets apart Perpetual Decentralized Exchanges (Perp DEXs) from conventional Centralized Exchanges (CEX) is their underlying structure. Perp DEXs leverage blockchain technology and smart contracts for trading operations, automating processes, and maintaining transparency. This decentralized system boosts security and makes complex financial tools accessible to a worldwide user base.

How to Use A Perpetual Decentralized Exchange

- Using a Perp DEX platform is simple. Users have to connect their wallet to the platform site, with no need for account registration or any identity checks making it better than a traditional financial platform.

- After connecting the wallet to the platform, fund it with cryptocurrencies like USDT or other stablecoins.

- Users will need ETH for gas fees to make transactions and start trading. However, the digital currency may change depending on the blockchain to blockchain.

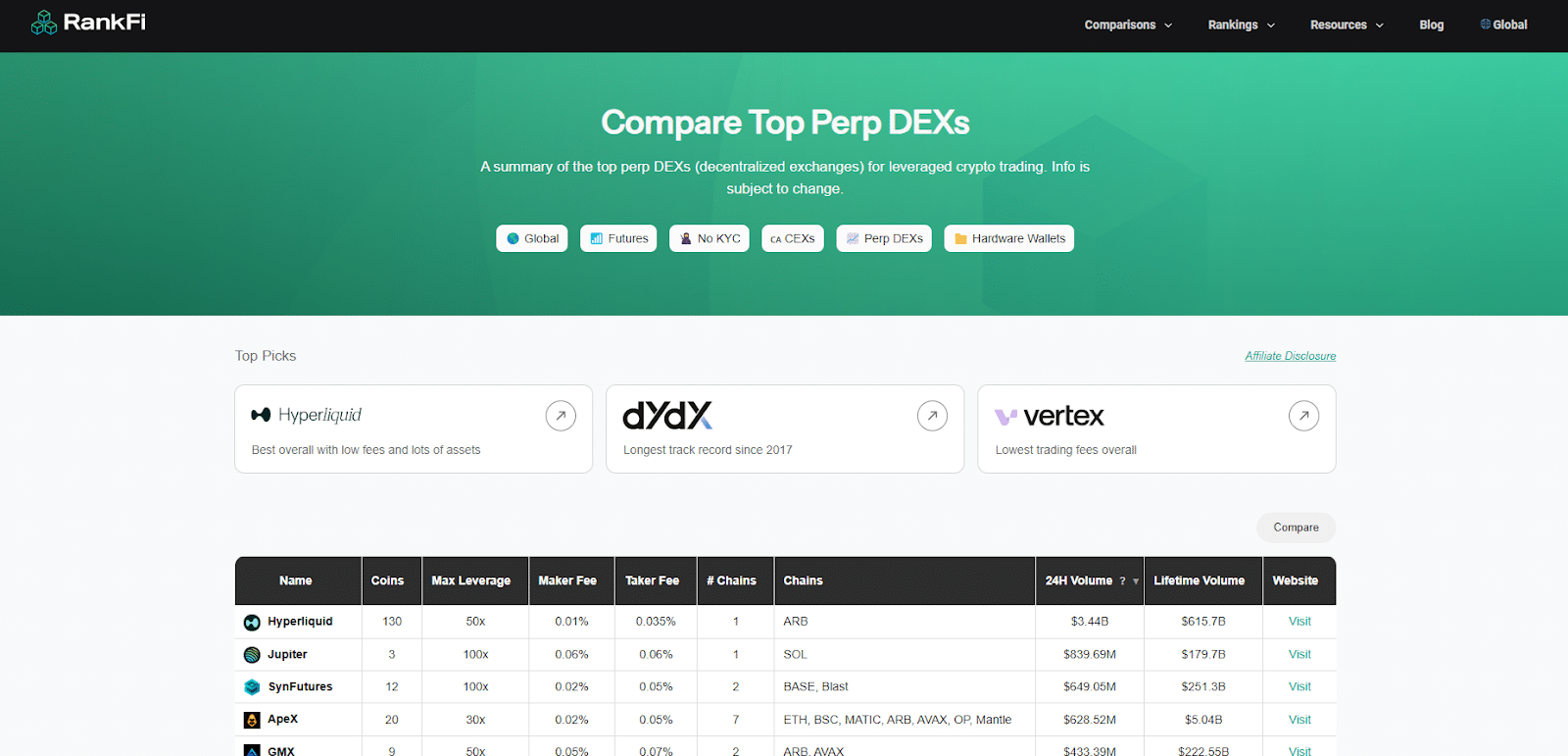

Platform To Compare Top Perp DEXs

As a crypto investor embarking on my leveraged trading adventure, I recommend selecting a fitting perpetual DEX platform. RankFi is an ideal tool to compare leading perpetual DEXs for enhanced crypto trading. This platform offers a comprehensive list of the top perpetual DEXs, providing concise summaries that help navigate the world of leveraged crypto trading.

Record-Breaking Performance Sets the Stage

2024 proved to be a remarkable year for Perpetual Decentralized Exchanges (Perp DEXs), demonstrating its promising future. These exchanges surpassed all previous benchmarks by amassing an astounding $344.75 billion in trading volume. In the month of November 2024, the sector maintained a steady upward trend, recording a trading volume of $258 billion, marking an impressive 80% growth from October’s figure of $141.6 billion.

This sector’s accomplishment underscores a consistent trend of expansion and a transformative change in the strategies used by cryptocurrency traders for derivative trading.

2024 marked a significant milestone in December as the total trading volume on Decentralized Exchanges (DEX) hit an unprecedented $434.8 billion. Established players such as Uniswap ($106.4 billion), PancakeSwap ($96.4 billion), and Raydium ($58 billion) were at the forefront of this growth spree. This broad expansion across the DEX landscape paves the way for Perp DEXs to expand and develop further.

Why Perp DEXs Are Gaining Traction

Several factors contribute to the increasing popularity of Perpetual DEXs:

- Accessibility and User Experience: Unlike traditional exchanges, Perp DEXs have destroyed significant barriers to entry. Users need only connect their crypto wallets to begin trading, bypassing lengthy registration processes and identity verification requirements. This streamlined approach aligns perfectly with the crypto community’s values of privacy and accessibility.

- Innovation in Trading Infrastructure: Perp DEXs have transformed the trading experience through innovative models like virtual AMMs and multi-asset liquidity pools. These technological advances enable features previously exclusive to centralized exchanges, such as leverage trading and sophisticated order types, while maintaining the benefits of decentralization.

- Enhanced Security Measures: Leading platforms have prioritized security through regular audits, bug bounty programs, and insurance funds. While incidents like DYDX’s September 2023 frontend compromise serve as reminders of potential vulnerabilities, the industry’s swift response and emphasis on protecting user assets have helped maintain trust.

Market Catalysts and Future Outlook

Several factors suggest 2025 could indeed be the year Perp DEXs achieve mass adoption:

- Regulatory Environment: The anticipation of favorable U.S. regulations following recent political developments has injected renewed optimism into the DeFi market. Clearer regulatory frameworks could provide the certainty needed for institutional adoption while maintaining the decentralized essence of these platforms.

- Cross-Chain Integration: The success of platforms across different blockchains – from Ethereum to Solana – demonstrates the sector’s ability to adapt and thrive in various ecosystems. This diversity provides users with options while spreading risk across multiple networks.

- Technical Innovation: Ongoing improvements in areas like gas efficiency, transaction speed, and user interface design continue to make Perp DEXs more accessible to casual traders. Features like one-click trading are bringing the user experience closer to that of centralized exchanges.

What to Watch in 2025

Moving forward into 2025, some crucial benchmarks will serve as guides for tracking our advancement towards widespread acceptance: these markers will provide insights into our rate of progress.

- Institutional Participation: Watch for increased institutional trading volume and liquidity provision as a sign of broader market acceptance.

- Technical Developments: Improvements in scalability solutions and cross-chain functionality could further reduce barriers to entry.

- User Growth Metrics: The rate of new wallet connections and active trader numbers will indicate whether the platforms are attracting users beyond the crypto-native audience.

- Regulatory Developments: Clear regulatory frameworks could provide the certainty needed for mainstream financial institutions to participate.

Final Thoughts

By the end of 2024, the significant surge in Decentralized Exchange (DEX) trading volumes has laid a robust foundation for increased adoption in 2025. With massive trading volumes, advanced infrastructure, and an expanding ecosystem, these platforms are poised to bridge the gap between decentralized and conventional finance.

Not every time does success come easily. The industry must continue to tackle issues related to security, improving service usability, maintaining high liquidity levels, and adapting to new regulations. If these hurdles can be overcome, 2025 might just be the year when Decentralized Exchanges (Perpetual DEXs) become widely accepted.

In essence, for traders and investors scrutinizing this field, the crucial aspect to consider is that these platforms offer significant opportunities, yet they also pose certain risks. Given the dynamic nature of this industry, individuals who can discern both the advantages offered by the technology and the potential hurdles it presents will be better equipped to capitalize on this emerging technology.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2025-01-02 16:54