As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market volatility and unpredictability. This latest dip in Bitcoin price, despite its steepness, doesn’t come as a complete surprise to me.

Currently, as I’m typing this, Bitcoin has dropped by more than 6%, hovering slightly above the $95,000 mark. This sudden drop follows the Federal Reserve’s recent decision to lower interest rates by 0.25%.

Jerome Powell’s statement that the Federal Reserve won’t purchase or hold Bitcoin sparked a strong negative response in the cryptocurrency market, causing further anxiety among investors.

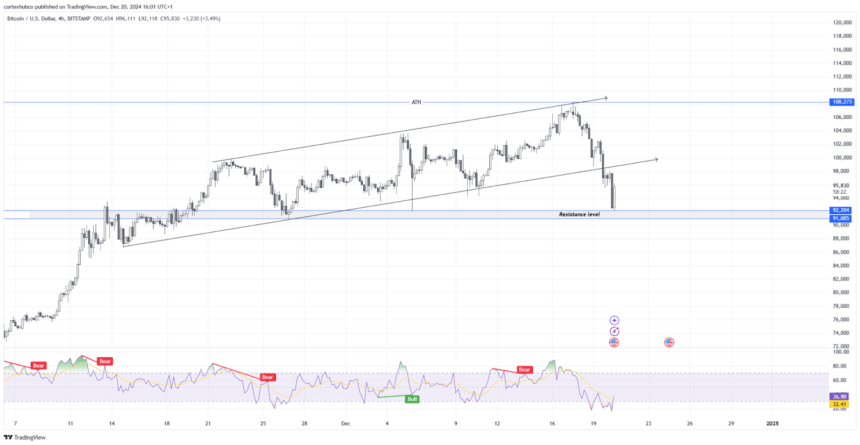

At the moment, crucial support points for Bitcoin have been identified at approximately $91,000 to $92,000. If there are additional price drops, it’s possible that the value could decrease further to around $82,500. This decline is happening amidst high-volume trading, with over $1 billion in leveraged positions being liquidated. The fall in Bitcoin’s price follows its recent record high of $108,000.

In recent weeks, the market has shown strong performance, largely due to Mara Holdings’ acquisition of 15,757 Bitcoins and growing enthusiasm towards Bitcoin mining hardware.

Furthermore, the victory of U.S. President Donald Trump and his endorsement of cryptocurrencies boosted investor optimism. However, despite these positive indicators, the market found itself unprepared for such a swift decline caused by the Federal Reserve’s monetary policy adjustments.

The prediction made by Binance CEO Changpeng Zhao in 2020 bears a striking similarity to recent speculation about Bitcoin, as he had tweeted on December 17, “Anticipating the next headline: #Bitcoin ‘FALLS’ from $101,000 to $85,000. Bookmark this tweet.

The occurrence of the predicted drop by CZ led to fresh discussions about the volatile and hard-to-forecast character of cryptocurrency markets in relation to X.

Simultaneously, this decline is causing mixed reactions among cryptocurrency enthusiasts, with some viewing it as a normal correction, while others anticipate it could mark the beginning of an extended downturn. According to a financial expert, breaking the $100,000 barrier has been challenging for Bitcoin.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-12-20 21:57