As a long-time crypto investor and one of the unlucky souls who lost my entire Bitcoin stash in the infamous Mt. Gox hack back in 2014, I can’t help but feel a mix of emotions reading about the recent scares regarding potential attacks on the bankrupt exchange. It’s been a rollercoaster ride these past ten years, filled with endless disappointments and false hopes.

Another Reddit user jokingly commented on the latest setback for those managing the Mt. Gox bankruptcy, suggesting it was a fitting consequence for their past criticisms of the company’s alleged incompetence.

Over the past decade, early Bitcoin investors who had their funds with Mt. Gox have experienced tremendous loss. Approximately 850,000 Bitcoins were taken in the infamous hack, leaving these individuals empty-handed.

After experiencing countless setbacks and disappointments, there’s now a faint possibility that they may soon receive some reimbursement from the failed exchange, which declared bankruptcy.

Creditors faced additional concerns this week, as numerous reports emerged of unauthorized logins into their accounts, prompting many to receive multiple alarming emails about potential security breaches.

An initiative has started to help reunite the rightful owners with the 141,000 BTC that were previously stolen and subsequently recovered. However, there’s a sneaky person who appears to be attempting to claim this crypto as their own.

After everything they’ve experienced, adding to their financial losses with another setback would be particularly disheartening for those who have suffered financially for a long time.

“I’ve recently been notified of 15 attempts to access my account. I’m now unable to log in. Could it be that Mt. Gox is being targeted by an attacker?”

Later on, they were grateful that the online platform didn’t enable users to redirect payment destinations.

It appears that @ovkovk wasn’t the only one with this experience. Many others have reported the same occurrence on the social network.

Based on my analysis, it seems that an intruder may have previously obtained access to numerous gox email accounts and is now attempting to use this information to gain entry through brute force methods. This occurrence has been documented in the past.

On the positive note, it appears that an anomaly in the website’s email system prevented the enigmatic person from gaining access — as indicated by the misleading emails suggesting they had already logged in.

“Their system sends the ‘you have logged in’ email prior to requiring the 2FA code entry, which can be confusing.”

@Joohansson

A user once tried to access their account with an incorrect password as a test. Surprisingly, they received an email notification stating that someone had successfully logged in to their account.

The Mt. Gox bankruptcy supervisors are facing another source of shame, as a Reddit user jokingly commented that this latest scare is a form of retribution for their past criticisms of the incompetence within the organization.

One potential issue with bankruptcy proceedings is that customer details become publicly available, increasing the risk of fraudsters exploiting this information for phishing scams.

The website of Mt. Gox was suddenly taken offline for upkeep as reports surfaced about multiple login attempts; however, a creditor reassured that there was no cause for concern since the digital currency they possessed had previously been transferred to safekeeping.

Who’s selling up?

The looming possibility of 141,000 Bitcoins being released into the market at once has been a source of concern for months, with many fearing that this massive influx could trigger significant selling and negatively impact Bitcoin’s price performance.

In the past few days, Bitcoin, the largest cryptocurrency, has made a comeback. This rebound gained momentum after the German government announced its decision to sell the confiscated 50,000 Bitcoins obtained from a criminal organization was thwarted.

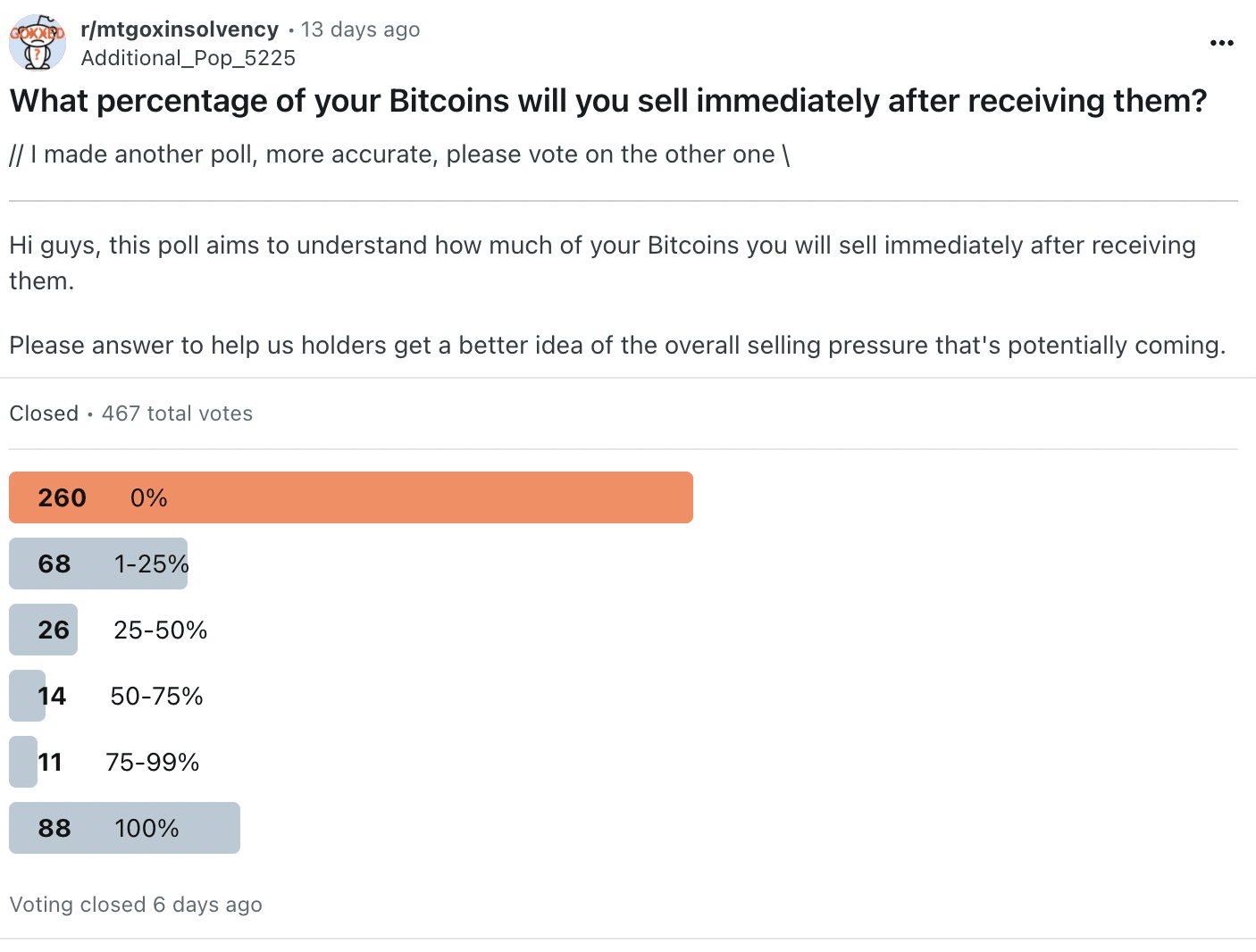

Around two weeks ago, a survey was conducted among members of the r/mtgoxinsolvency community to determine if they intended to sell their Bitcoins upon receiving them, despite the compensation Bitcoin amounts being significantly lower than their balances at the time of the hack. Regardless, this influx of Bitcoin will translate into substantial gains in monetary value when converted to cash.

As a crypto investor, I recently participated in a survey along with 467 other individuals. Among us, a significant number, representing approximately 55% of the respondents, declared that they have no intention of selling even a single satoshi of their cryptocurrency holdings. On the other hand, around 14.5% of us indicated our plans to sell up to a quarter of our current investments. The remaining 18.8% disclosed their intent to part with their entire crypto holdings.

It’s no exaggeration to say that the current values of these figures are quite anticipated given the early adoption of Bitcoin. In February 2014, the value of Bitcoin was approximately $600 – a price point reached following the Mt. Gox attack. Therefore, these creditors were among Bitcoin’s initial supporters. Since then, Bitcoin has experienced an astounding increase of over 10,733%.

Individuals who held faith in Bitcoin back then are highly probable to still hold that belief today, despite any past losses or setbacks.

Despite this, it’s highly unlikely that they’ll be disappointed to part ways with Mt. Gox and will instead focus on moving forward in their lives. As for those intending to hold onto their cryptocurrencies, they may no longer trust exchanges as a result.

Read More

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD JPY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- EUR CNY PREDICTION

2024-07-18 20:34