In summary, Polkadot has been facing criticism for prioritizing marketing efforts over usability, liquidity, and developmental challenges. This approach has eroded trust and diverted funds from crucial areas, potentially putting the project at risk of fading into obscurity like EOS and Tezos. Moreover, financial mismanagement, as seen in FTX’s collapse, is a concern for Polkadot, given its heavy marketing budget and limited runway. However, there are differences between the two projects, with Polkadot being a blockchain platform rather than an exchange, allowing it to potentially correct course and regain community trust through addressing user experience issues, improving liquidity, and better governance. The next few months will be crucial in determining Polkadot’s future trajectory.

How do Polkadot’s financial practices, spending $87M with a net loss of $108M annually, compare to FTX’s pre-collapse habits?

Table of Contents

As a researcher studying the blockchain space, I’ve noticed that Polkadot (DOT) has gained significant attention lately following the release of its most recent treasury report.

In the first half of this year, Polkadot expended an astonishing $87 million on DOT tokens. This represents a significant increase in spending, more than doubling the rate seen during the preceding six months. This sudden surge in expenditure has left many observers and investors questioning the reasons behind it.

Approximately 42.4% or $36 million of Polkadot’s expenditures were allocated for marketing and outreach initiatives. These efforts encompassed various strategies such as advertising, securing endorsements from influencers, organizing events, meetups, and hosting conferences. The primary objective was to bring in new users, developers, and businesses to the Polkadot community.

Approximately 26.7% or $23 million of Polkadot’s budget was designated for development-related expenses. This portion included funding for creating vital tools like wallets and developer kits.

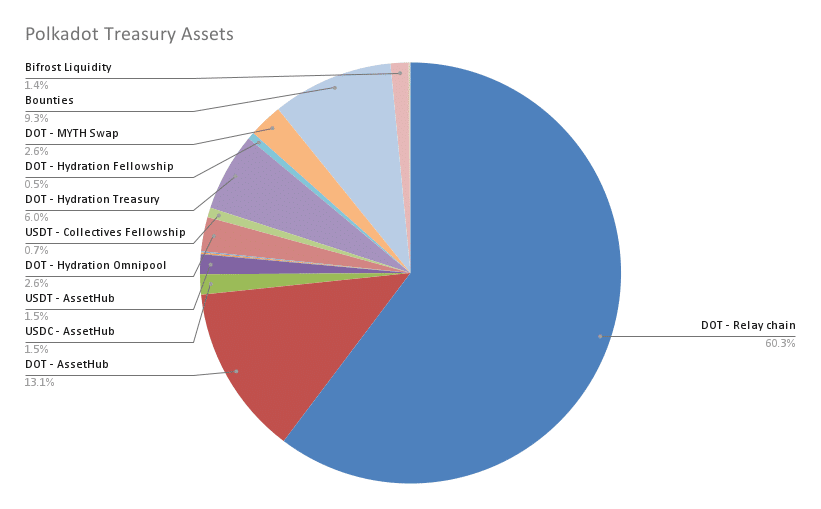

According to Tommi Enenkel, Polkadot’s chief representative, the Treasury possesses around 32 million DOT, equivalent to roughly $200 million, in readily available funds. However, the report indicates an annual deficit of approximately 17 million DOT, or around $108 million.

Based on the current rate, Polkadot has approximately two years worth of funds left before exhaustion, assuming the value of DOT in US dollars stays the same. This finding raises concerns, particularly when considered alongside reported lavish expenditures.

In this situation, I’m reminded of FTX’s case, which displayed a comparable extravagant spending behavior prior to its collapse.

Some critics raise concerns about Polkadot’s significant investment in marketing at the expense of development, which they view as a potential warning sign. Additionally, there are doubts regarding the long-term viability of its financial strategies.

Let’s explore in greater detail the criticisms levied against Polkadot, the controversies surrounding its latest financial decisions, and consider the possibility of a sudden demise for Polkadot akin to FTX.

Public backlash and controversies

The latest treasury update from Polkadot has drawn significant backlash on social media platforms, as numerous users voice their disapproval over the project’s financial management and inner workings.

One debated aspect is Polkadot’s expenditure of around $5 million on influencer marketing during the initial six months of 2024.

As a crypto investor, I’ve noticed that based on the average cost per view of 5 cents, Polkadot’s videos should have amassed around 100 million views for the amount invested in marketing. Yet, the project’s presence on social media platforms like Twitter (let’s call it X from now on) remains relatively low-key.

In a shift to discussing influencer ads, which amounted to a total expenditure of $4.9 million, we now delve into this aspect. With an average cost per view set at five cents, it’s calculated that Polkadot would have garnered approximately 100 million views for this investment. However, on platform X, they remain largely undetected, with the majority of conversations revolving around their Treasury expenditures.

— Stacy Muur (@stacy_muur) July 2, 2024

Exploring the details of the expenses provides insight into the reasons behind the raised concerns. In relation to this, Polkadot worked with multiple marketing agencies, one being EVOX, a web2 firm based in Italy specializing in Esports and Gaming, which received a $2.2 million contract.

At the Web3 firm, Lunar Strategy, we managed to garner an impressive 2.7 million views and 180 collaborations, with a financial investment of $1.3 million. This translates to an average cost of approximately $0.48 per view and a substantial $7,000 for each collaboration. These numbers leave some feeling that the price tag is rather steep.

In the realm of influencer marketing, I have a wealth of reports at my disposal and view it as a catastrophe if costs climb above $0.1 per impression.

When it comes to media placements, however, the objective is primarily geared towards raising awareness and bolstering reputation. Unfortunately, it proves to be an ineffective means for garnering new users.

The performance of Polkadot leaves me utterly dismayed.

— Stacy Muur (@stacy_muur) July 2, 2024

Additionally, critics have harshly criticized expenses like the $500,000 spent on an extravagant CoinMarketCap animated logo and the use of branded private jets, labeling them as unnecessary and excessive.

It’s interesting to note that Polkadot reportedly paid Coinmarketcap half a million dollars for featuring an animated logo on their homepage.

— Taiki Maeda (@TaikiMaeda2) July 2, 2024

Polkadot has faced allegations of biased treatment towards certain developer groups, most notably those with Asian heritage, in addition to financial examinations.

Recently, a developer named Victor from the Polkadot China community expressed concerns about perceived unfairness towards Asian developers, particularly those from China, within the ecosystem.

Through my intervention, I aspire that the key figures within the Polkadot project will address this concern openly: Is there any unjust or prejudiced treatment occurring towards Asian developers, specifically those from China? Had I remained silent during yesterday’s discussion, neither the Polkadot team nor non-Asian developers would have been prompted to consider and address this issue.

— victorji.eth ✨🌊✈️EthCC (@victorJi15) July 3, 2024

Victor claims that his complaints echo the sentiments of other developers in the Polkadot ecosystem, such as those from Bifrost, Phala Network, and OneBlock. These developers, according to Victor, have expressed similar concerns about alleged discrimination and the perceived absence of genuine democratic processes within Polkadot.

With increasing critique, it becomes clear that Polkadot’s resource management and community engagement strategies require substantial revision.

The project’s significant prioritization of marketing efforts over development and allegations of discriminatory behavior among its team members cast doubt on its long-term viability and moral foundation.

Are marketing and development Aligned?

As a researcher examining Polkadot’s financial allocations, I have found that their marketing expenses outweigh their development investments, suggesting a potential misalignment of priorities.

At first, Polkadot generated significant excitement, particularly with the introduction of its DOT token. Institutional investors expressed optimism, and according to Messari’s data, it was the third most-owned token among institutional investors, trailing behind Bitcoin (BTC) and Ethereum.

With an abundant value estimated in the billions of dollars tied up in DOT tokens, the prospects appeared vastly promising. Nevertheless, it became apparent that beyond staking, limited functionalities were available to utilize these DOT tokens.

In the past, the promised features in Decentralized Finance (DeFi) often fell short or were barely functional. Users encountered significant difficulties when utilizing decentralized exchanges (DEXs), a stark contrast to the smooth experiences provided by rival platforms such as Ethereum and Solana (SOL).

Governance’s entry added another layer of complexity, transforming it from a catalyst for progress into a contested terrain where swindlers sought to misappropriate funds. Resources intended for groundbreaking projects were instead siphoned off, depriving development of much-needed financial support.

As a crypto investor, I’ve noticed that one of the main challenges with Polkadot is its lack of emphasis on user-friendliness and market liquidity. The user interface, specifically Polkadot JS, has drawn considerable criticism due to its complexity. Even with wallets like NovaWalletApp and FearlessWallet, the process of interacting with the platform remains a laborious experience for many users.

The ease with which users can exchange tokens or acquire stablecoins like USDC and USDT on Decentralized Exchanges (DEXs) is another significant challenge. The process entails intricate procedures, which discourages a large number of potential users.

These habits have significantly undermined trust and shifted resources away from essential development projects. On the other hand, Polkadot’s strategy for addressing its development issues has placed greater emphasis on public relations than on significant technological progress.

According to the latest treasury report, Chainwire, a well-known press release distributor, received a payment of $490,000, while Unchained, another frequently used agency name, was paid $460,000.

Despite encountering challenges such as high transaction fees and network congestion that other chains like Ethereum and Solana experienced, they managed to draw in users and developers by providing substantial value and fostering a robust community.

Instead of Polkadot, which seemed to place greater emphasis on marketing and public image, frequently critiquing rival initiatives instead of tackling its own weaknesses internally.

Polkadot may lose prominence and become less well-known than other projects, such as EOS and Tezos, if it fails to make significant improvements without alteration, despite its initial promise and technological edge.

Could Polkadot collapse like FTX?

There’s been much concern lately about the possibility that Polkadot may experience a collapse similar to FTX, considering the recent scrutiny of its financial dealings. To gain insight into the potential hazards, it would be helpful to examine the similarities and differences between the two.

As a crypto investor, I’ve noticed the significant growth of FTX in the digital asset exchange scene. Through bold marketing strategies and high-profile partnerships, this platform managed to capture the attention of numerous users swiftly. The substantial investment in advertising campaigns, celebrity endorsements, and even naming rights for sports arenas played a crucial role in its meteoric rise to fame.

Despite presenting a prosperous image, FTX concealed significant financial mismanagement and undisclosed debts. The revelation of these troubles triggered a disastrous downfall, resulting in the loss of billions for investors.

Polkadot, just like other projects, has been allocating a significant portion of its expenses towards marketing. In fact, approximately 40% of its total budget goes towards marketing efforts. This is notably higher than the average marketing expenditures of 8-15% for most other projects.

In contrast, despite Polkadot’s significant strides, its visibility and user engagement haven’t kept pace. To illustrate, a comparable situation exists with FTX, which places greater emphasis on public perception than underlying substance.

From a financial perspective, Polkadot’s latest treasury report presents cause for worry. Over the past six months, $87 million has been expended, and the project is currently incurring an annual loss of approximately 17 million DOT, equivalent to around $108 million. This spending pattern leaves Polkadot with a runway of roughly two years if current expenses persist. The financial instability that arises from this situation raises doubts about the long-term viability of the project, particularly in light of potential market downturns and revenue decreases.

One way to rephrase this in clear and natural language is: FTX’s internal strife and erroneous judgments played a role in its collapse. Critics have raised concerns about Polkadot’s governance, specifically the approval of dubious proposals and ineffective spending, which has siphoned funds away from essential development projects.

It’s worth mentioning that there were significant distinctions between the failure of FTX and other cases. The fact that FTX functioned as a cryptocurrency exchange made its liquidity problems more precipitous.

As opposed to traditional blockchain platforms, Polkadot’s failure would unfold gradually. It’s more probable that this outcome would stem from eroding trust among users and developers, rather than an abrupt liquidity crises.

As a crypto investor in Polkadot, I believe the project’s success relies heavily on its capacity to adapt and evolve. To achieve this, addressing user experience concerns is essential. We need to make interacting with DOT simpler and more intuitive for the average user.

As an analyst, I would say: Instead of FTX, Polkadot holds the potential to adjust its approach and capitalize on its technological advantages to rebuild the confidence of its community.

Polkadot has the potential to steer clear of the issues that caused FTX’s sudden downfall. The upcoming months are crucial for Polkadot as they reassess their approaches and strive to maintain their expansion.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- Brent Oil Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-07-03 16:50