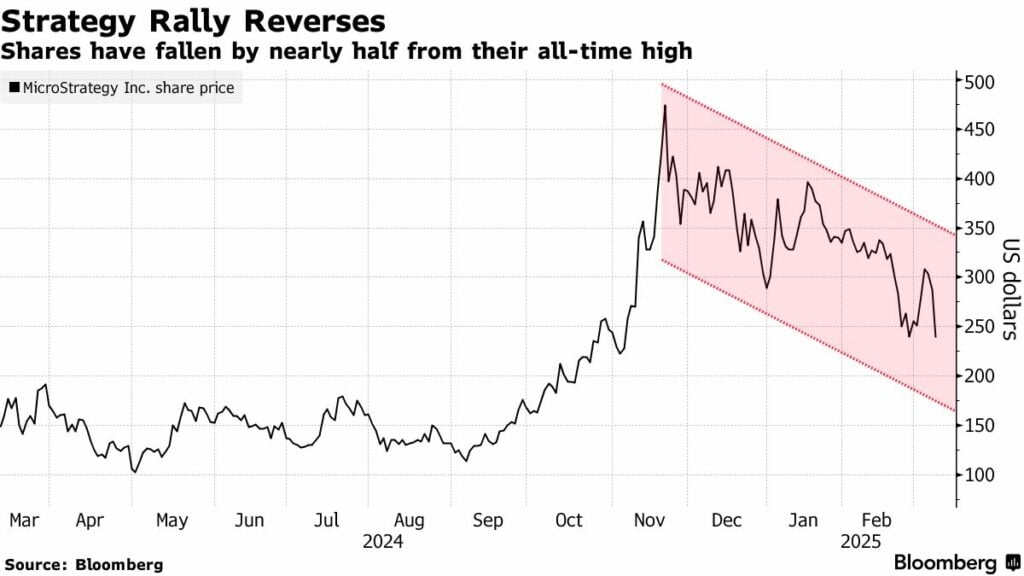

Ah, the tragic tale of Strategy’s stock, which has plummeted nearly 50% from its lofty November heights, yet here we are, watching the company clutch its Bitcoin like a drowning man clings to a life raft in a sea of despair. 🏊♂️

Just yesterday, the stock took a nosedive of 17%, closing at a mere $239.27. This is akin to a barber giving a rather enthusiastic haircut, leaving the stock with a rather unfortunate 50% trim from its glorious peak of $473.83 in November 2024. Bloomberg, in its infinite wisdom, noted that Strategy’s stock was once soaring faster than Bitcoin, all thanks to the whimsical hope that Trump would conjure a strategic Bitcoin reserve. Alas, as Bitcoin (BTC) has relinquished its recent gains, Strategy’s stock has decided to tumble down the rabbit hole even more dramatically. 🎢

Investor sentiment, once a cheerful bird, has turned into a rather sour lemon, especially after Trump’s executive order revealed that the reserve would consist of government-held Bitcoin—acquired, mind you, from the seizure of BTC in criminal cases. It seems no additional purchases will be made, unless they find a budget-neutral fairy godmother. 🧚♂️

Both Bitcoin and Strategy faced further pressure on Monday, as the world collectively decided to flee from risk assets, largely due to Trump’s trade war with Canada, Mexico, and China. Bitcoin, in a fit of despair, dropped 4%, now trading around $80,000. 📉

Despite the stock’s freefall and Bitcoin’s struggle to maintain its dignity, Strategy has announced its grand plan to raise $2.1 billion by selling its Class A strike preferred stock. This money, they say, will be used to buy more Bitcoin. It’s all part of a larger scheme, dubbed the “21/21 roadmap,” led by their executive chairman, Michael Saylor, who seems to believe that raising a total of $42 billion and investing it in Bitcoin is a splendid idea. Meanwhile, they recently snapped up 20,356 BTC for nearly $2 billion at an average price of $97,514, all while their stock was already in freefall. Talk about confidence! 💪

With this latest acquisition, Strategy’s Bitcoin hoard now stands at a staggering 499,096 BTC, purchased with around $33.1 billion, averaging $66,357 per Bitcoin. This was primarily funded through equity sales, because who needs a safety net when you have a grand vision? Their total holdings are now worth around $40 billion, representing a delightful 21% unrealized gain at the current BTC price of $80,381. 🎉

Even though some skeptics raise their eyebrows at Saylor’s Bitcoin buying spree in this turbulent climate, analysts, in a rare show of optimism, generally have a positive outlook on Strategy’s future. In fact, all eleven financial analysts surveyed by Bloomberg recommend that investors buy Strategy’s stock, predicting it will soar past the $540 peak it reached last year. Who knew optimism could be so contagious? 🤷♂️

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2025-03-11 11:53