As someone who has weathered multiple market cycles over the past few decades, I must say that the recent 50 bps rate cut by the Fed has certainly piqued my interest. The parallels drawn by The Kobeissi Letter between this move and those from the past are indeed troubling, especially given my personal experiences during the 2001 and 2007 market crashes.

Why has the Federal Reserve decreased interest rates by 0.5 percentage points, which is the most significant reduction since 2020? Are there potential risks they’re aiming to avoid, and might this move inadvertently harm the economy instead?

Table of Contents

Fed drops a “bomb”

On September 18th, the U.S. Federal Reserve took an action that sparked attention globally within the financial sector – it reduced its key interest rate by 0.5%. This is the first reduction since the onset of the pandemic in March 2020.

This adjustment brought the rate down to a range of 4.75% to 5%, a larger drop than many analysts had expected. For context, the rate had previously been at a 23-year high, hovering between 5.25% and 5.50%.

Following some encouraging updates about inflation, the Fed made their decision. In August, the annual rate of U.S. consumer prices decreased to a level not seen since February 2021, reaching 2.5%, which was just slightly lower than the predicted 2.6%.

On the other hand, the inflation rate excluding food and energy costs increased by 0.3%. This suggests that there are ongoing price pressures beneath the surface. Meanwhile, employment growth has decelerated, and although the unemployment rate has slightly risen, it continues to be comparatively low.

In their recent statement, the Federal Open Market Committee affirmed their dedication to reducing inflation to 2%, suggesting a possible move towards an extended phase of accommodative policies. This decision is particularly relevant given that U.S. inflation peaked at an astounding 9.1% in June 2022 during the Biden-Harris administration.

Given the current situation, we wonder if this event will increase liquidity in the cryptocurrency market and drive up prices, or if it will cause investors to remain cautious due to uncertainty.

Stocks and crypto in green

After an unanticipated interest rate decrease by the Fed, the stock market showed a blend of positive and negative feelings initially. On September 18, the substantial 0.5% cut was met with approval from traders, causing major indices such as the Dow Jones Industrial Average and S&P 500 to rise in value.

Nevertheless, as the trading day concluded, optimism began to wane. The stock market ultimately closed with losses, indicating a rise in worries that the Federal Reserve could be preparing to counteract possible economic vulnerabilities.

On September 18th, the Dow Jones Industrial Average decreased by 103 points (equating to 0.25%) and ended at 41,503. Initially in the day’s trading, it climbed more than 375 points before pulling back. Meanwhile, the S&P 500 fell by 0.29%, finishing at 5,618. Additionally, the Nasdaq Composite dipped by 0.31% to close at 17,573.30.

However, by September 19th, the markets have warmly received the interest rate reduction. As I write this, the trading day is not yet over, but the indexes have significantly increased.

BREAKING: Stock market futures soar to new record highs as traders react to the first Fed rate cut since March 2020.

The S&P 500 and Nasdaq are now up over 20% this year alone.

Since September 6th, the S&P 500 has added $3 TRILLION in market cap.

Truly remarkable.

— The Kobeissi Letter (@KobeissiLetter) September 19, 2024

Today, the Nasdaq surged by approximately 476 points, representing an increase of more than 2.7%. This uptick brought its peak to around 18,050. On the other hand, the S&P 500 experienced a climb of 93 points, translating to a growth of over 1.66%. Now, it stands at approximately 5,711.

Over the past day, the cryptocurrency market has seen a surge, with its total value jumping by approximately 6.5%, now standing at around $2.18 trillion.

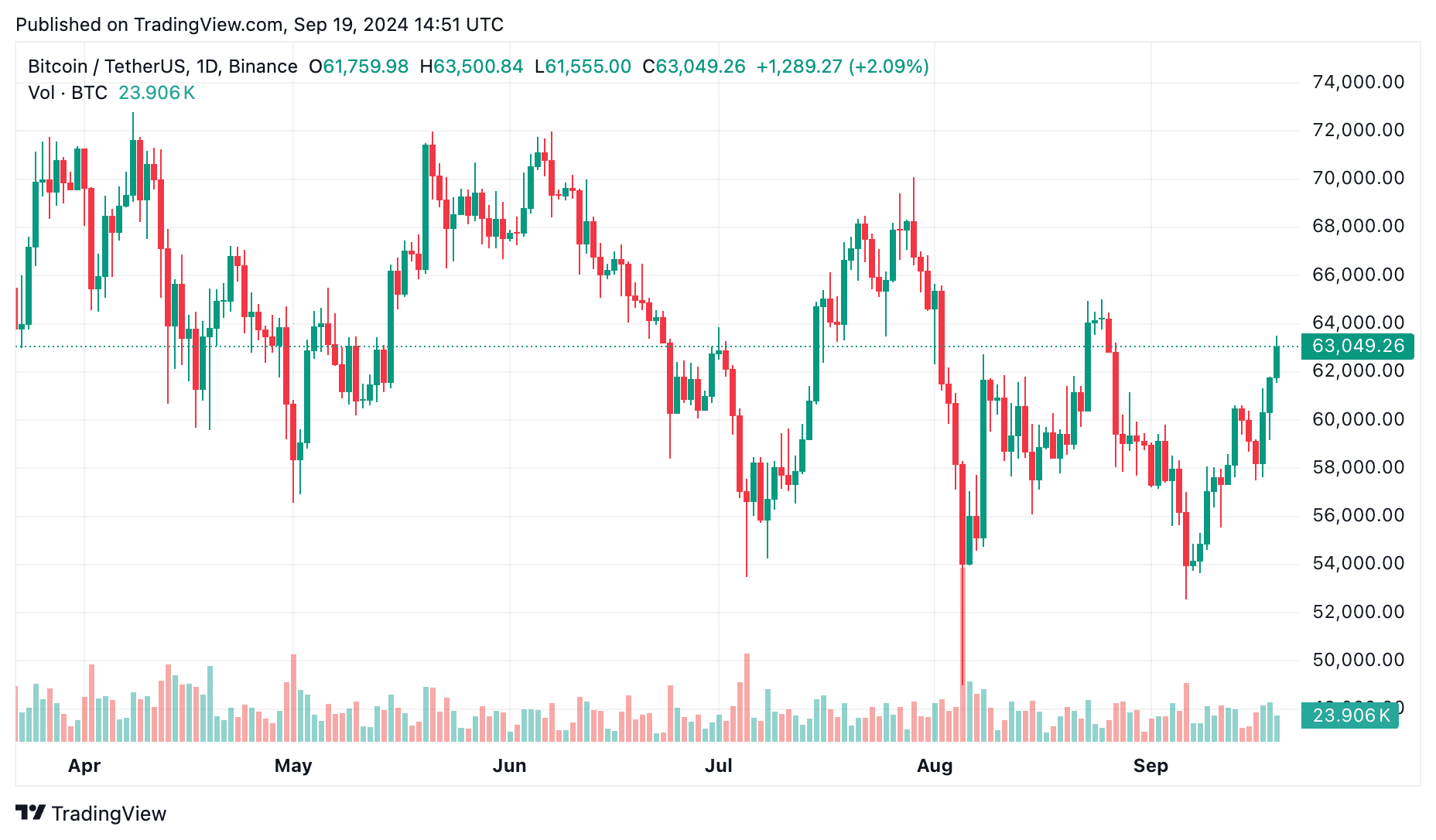

This represents a significant change in direction from previous apprehensions. On the 18th of September, Bitcoin (BTC) surpassed the resistance level at $62,000, a barrier it had been unable to cross since late August. Earlier, BTC was trading around $64,000 but dropped down to $54,000 by September 9.

Currently, Bitcoin (BTC) is picking up speed with a robust surge, increasing by around 6.5% in the last 24 hours and trading at approximately $63,500 as of this moment. Similarly, Ethereum (ETH) is on an upward trend, sitting at $2,430, marking a rise of over 6%.

In simpler terms, many digital currencies outside the top 100 most valuable (often referred to as ‘altcoins’) have experienced significant growth recently, with gains ranging from 15% to 30%. This surge is one of the biggest daily increases we’ve seen in a while.

Looming concerns surrounding the financial markets

The recent 50 bps rate cut by the Fed has sparked serious concerns across the financial community. One perspective came from The Kobeissi Letter, a well-regarded financial newsletter that has drawn alarming parallels between this rate cut and those from the past.

In the discussion on their X thread, they highlighted an unusual occurrence – this is merely the third occasion in contemporary times where the Federal Reserve has initiated a rate-reduction sequence with such a significant decrease, an action that certainly warrants attention.

It’s official.

The Fed has kicked off the interest rate cut cycle with a 50 basis point rate cut.

This is only the THIRD time in recent history that the Fed has started rate cuts with a 50 bps cut.

The previous 2 times, the economy crashed.

Is this time different?

(a thread)

— The Kobeissi Letter (@KobeissiLetter) September 18, 2024

As per The Kobeissi Letter, the Federal Reserve’s previous instances of significant rate reductions occurred in 2001 and 2007. In each case, it wasn’t merely a minor stumble that the economy experienced – instead, there was a catastrophic collapse.

Starting in 2001, when the Federal Reserve lowered interest rates by half a percentage point, the Nasdaq index experienced a decline of approximately 76% from its peak to its lowest point over a span of three years.

In simpler terms, technology stocks tanked, marking one of the worst bear markets in history.

2007 saw little improvement as the Federal Reserve’s interest rate reductions collided with the global financial crisis. Consequently, the Nasdaq plummeted an astounding 56%, leading to extensive damage in the technology sector and far beyond.

By the year 2024, we find ourselves in a dramatically changed landscape. Tech stocks are at record levels, with the Nasdaq experiencing significant growth. However, The Kobeissi Letter poses an intriguing query: “Given that 2024 is distinct from both 2001 and 2007, why is the Federal Reserve reducing interest rates so drastically?

The issue at hand is centered around the idea that past events show trouble when the Federal Reserve initiates a significant reduction in interest rates, as it did before, leading to severe economic downturns, stock market collapses, and extensive financial hardship across industries.

Looking ahead to 2024, the economy appears robust with some notable trends. While job growth might be moderating and unemployment rates slightly increasing, they remain at exceptionally low historical figures. Moreover, inflation is on a downward trend, reaching a low of 2.5% in August – the least since February 2021.

However, it’s possible that there are deeper concerns hidden below the apparent calm of the financial markets. The Federal Reserve’s unexpectedly bold interest rate reduction might suggest that they perceive dangers that the broader market has not fully grasped yet.

They might be preparing for a potential decrease in economic expansion or aiming to soften the impact of increasing debt amounts, which have been escalating due to surging borrowing rates during the latest phase of tightening.

It’s important to mention that the stock market showed conflicting responses. At first, the rate cut was met with approval by traders, pushing the Dow and S&P 500 to record highs. However, as the day ended, a sense of reality settled in, causing both indices to close lower. The coming months will be crucial in predicting whether we’re in for turbulent times or if this instance truly signals a break from the usual pattern.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-09-19 18:15