Oh, the carnage! The crypto universe, led by Bitcoin, Ethereum, and XRP, has suffered a brutal assault, seemingly courtesy of the whimsical winds of Trumpism. The total market capitalization of crypto, once a behemoth, now stands at a mere $2.784 trillion, a shadow of its former self. 🙀

Bitcoin’s dance with the S&P 500, a tango of correlation, signals to the wary trader that the king of crypto is merely a pawn in the grand scheme of U.S. equities. With a correlation of 0.75 in the past thirty days, Bitcoin’s fate seems intertwined with the unpredictable narrative of Trumpism. 🎭

But fear not, dear reader, for we have delved into the depths of this debacle to bring you enlightenment. Here’s a taste of what awaits you in our thrilling exposé: 🎉

Why is crypto losing while Trumpism wins? 🏆

U.S. stocks, once the darlings of Wall Street, have succumbed to the dreaded slump. The S&P 500, down nearly 8% in the past month, is a mere shadow of its former glory. The market has lost $4.5 trillion in capital, a staggering figure that leaves even the most seasoned investor gasping for air. 💨

Crypto, the wild child of the financial world, has not escaped unscathed. As traders turn risk-averse, the crypto market has bled, leaving a trail of tears and broken dreams in its wake. 🌧️

Despite the carnage, crypto market capitalization remains nearly 20% above pre-election levels. This resilience, however, is cold comfort to those who have witnessed the decline of Bitcoin, Ethereum, and XRP. 🥶

When Bitcoin soared to new heights, breaking the $100,000 barrier, Ethereum and XRP followed suit. Alas, the market-wide bloodbath has left these once-mighty tokens down 15%, 28%, and 9% in the past month, respectively. 🩸

Trump’s pro-crypto executive orders and the Strategic Crypto Reserve announcement have failed to ignite a spark of hope among traders. The Crypto Fear & Greed Index, a barometer of market sentiment, remains firmly in the “fear” territory. 😱

Crypto market crash, pre and post-election performance of Bitcoin, Ethereum, XRP 📊

The crypto market and the top three tokens have experienced a relentless decline this week, the culmination of nearly four consecutive weeks of correction. As traders grapple with the implications of Trump’s tariff wars and executive orders, institutions and market participants have turned risk-averse, leading to mounting losses in Bitcoin. 📉

BTC finds itself at a crossroads, where financial easing could reignite the flames of hope. However, geopolitical headwinds and the specter of Trumpism continue to cast a dark cloud over the sector. 🌩️

The debate rages on social media platforms: Will the Strategic Crypto Reserve live up to the expectations of the crypto community? What does the inclusion of Ethereum, XRP, Solana, and Cardano mean for token holders? Only time will tell. ⏳

Traders eagerly await the unfolding narrative, aware that a 20-25% drop in Bitcoin’s price is typical during a bull market. However, the current macroeconomic climate and the influx of market movers make predicting BTC price trends a daunting task. 🙈

The $80,000 level serves as a crucial support for Bitcoin. A return to the $100,000 milestone could see BTC rally towards its all-time high. However, a decline from $80,000 could push the token to pre-election levels under $70,000. 📉

Another 15% drop from the current price level could wipe out all post-election gains for Bitcoin. 🙁

Ethereum’s price is 30% below its pre-election level, a stark reminder of the challenges it faces. Lack of institutional interest, concerns regarding changes within the Ethereum Foundation, liquidation of whales, and waning interest from large wallet traders have all contributed to the downward spiral. 😣

Ether trades at $1,846 at the time of writing, with traders hoping for a catalyst, such as SEC approval for staking in existing Ether ETFs in the U.S., to breathe life into the largest altcoin in crypto. 🌟

Amidst the chaos, XRP emerges as the most resilient of the top three cryptocurrencies, trading 75% above its pre-election levels. Catalysts such as its inclusion in the U.S. Strategic Crypto Reserve, Ripple executives’ involvement in Trump’s elite Crypto Summit, and the SEC’s changing stance on litigation against crypto firms have bolstered XRP’s price. 🚀

Bitcoin, Ethereum, and XRP on-chain analysis 🕵️♀️

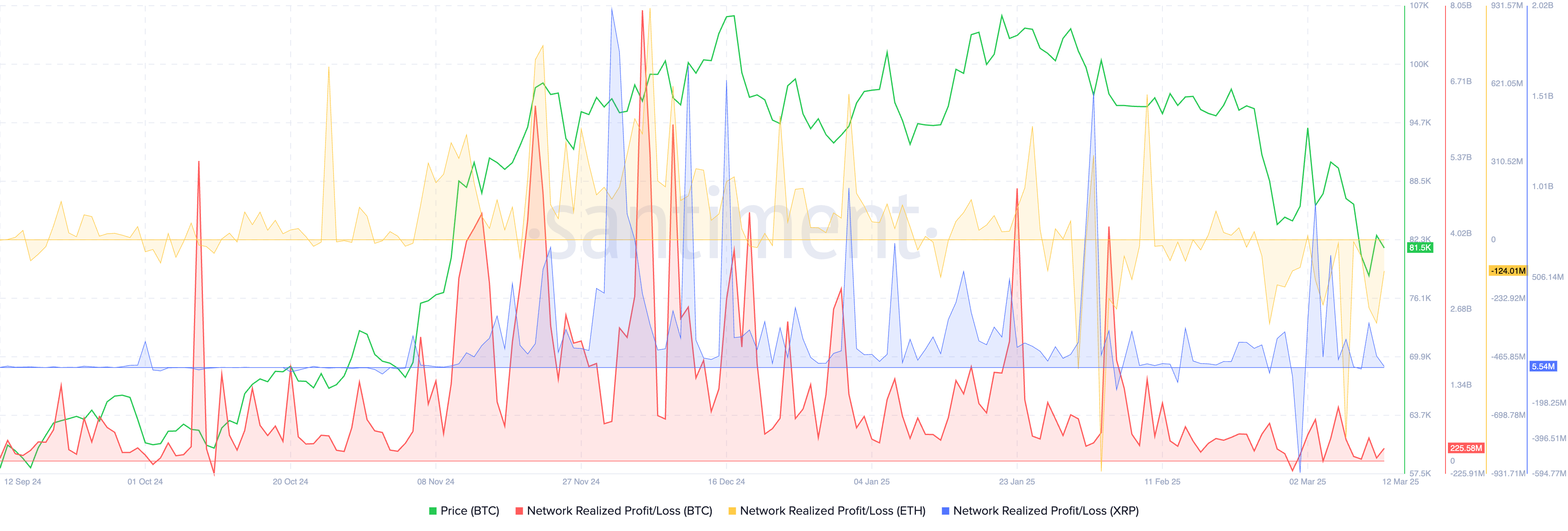

Bitcoin and XRP traders have been cashing in their winnings since mid-February, a stark contrast to the capitulation witnessed in Ethereum. Traders have realized losses on their Ether holdings, as evidenced by the negative spikes in the Network realized profit/loss metric on Santiment. 📉

Stability may follow capitulation, but only time will reveal whether Ether can recover in the coming weeks and months. 🕰️

The total open interest in USD for the three tokens has been on a steady decline since the last week of February, mirroring the risk-off sentiment and the U.S. stock market’s bloodbath. 🩸

//crypto.news/app/uploads/2025/03/Bitcoin-BTC-21.12.02-12-Mar-2025.png”/>

Is it the end of the Bitcoin bull run? 🐃

Not so fast, says the enigmatic crypto analyst @davthewave. According to their analysis, the worst of the crypto market correction may be behind us, and the Bitcoin bull run is far from over. 🙌

The average correction in Bitcoin’s price during the last three bull runs was between 24 and 32% in the years 2016-17, 2020-21, and 2023-24, respectively. The recent correction falls within this range, suggesting that the bull market may not be dead yet. 🙏

The crypto Bitcoin bull run index, a metric that analyzes nine different statistics to determine the stage of the market cycle, supports this optimistic view. Indicators such as the PI Cycle, MVRV Z-Score, and Reserve Risk are used to identify whether we are in a Bitcoin bull or bear market. 📈

In the last three cycles, whenever the CBBI crossed 90, Bitcoin hit a new all-time high. This has not occurred in the ongoing cycle, indicating that the bull market may still have legs and that BTC could reach new heights in the coming months of 2025. 🌄

Expert commentary 🗣️

Agne Linge, Head of Growth at WeFi, provided written commentary to Crypto.news, shedding light on the rising market volatility in Bitcoin. Linge observed, “Bitcoin has oscillated between $79K and $85K over the past two weeks, a reflection of heightened market volatility driven by mounting geopolitical and macroeconomic pressures. The market sentiment is tense, with trade tensions escalating and new tariffs set to be implemented on April 2nd. The European Union plans to retaliate with countermeasures on goods worth 26 billion euros starting next month. Heightened macro volatility and geopolitical tensions have pushed investors toward safe-haven assets like U.S. Treasuries, while Germany’s decision to raise debt for military spending has triggered a selloff in German government bonds.” 📉

Bitfinex analysts chimed in, “Widespread capitulation often precedes market stabilization, although geopolitical and macroeconomic concerns remain significant overhangs.” 🌮

Dr. Sean Dawson, Head of Research at Derive.xyz, added, “The market is facing significant challenges as the macroeconomic environment deteriorates. Crypto assets are not immune to these pressures. Bearish sentiment is building, and traders are exploring downside hedging strategies, especially as volatility surges across traditional and crypto markets. The coming weeks will be critical in assessing how the broader economic situation impacts digital asset prices and trading behavior.” 🕵️♂️

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2025-03-12 21:50