Ah, dear reader, as the sun rises on this fine Thursday, June 12, 2025, we find ourselves in the curious world of cryptocurrency, where fortunes are made and lost faster than one can say “blockchain.” With a growing sense of investor confidence, a surge in open interest in futures, and the audacious launch of tokenized U.S. Treasuries on the XRP Ledger, it seems XRP is preparing to flirt with the psychological barrier of $3.00. How delightful! 🎉

Institutional Interest on the Rise

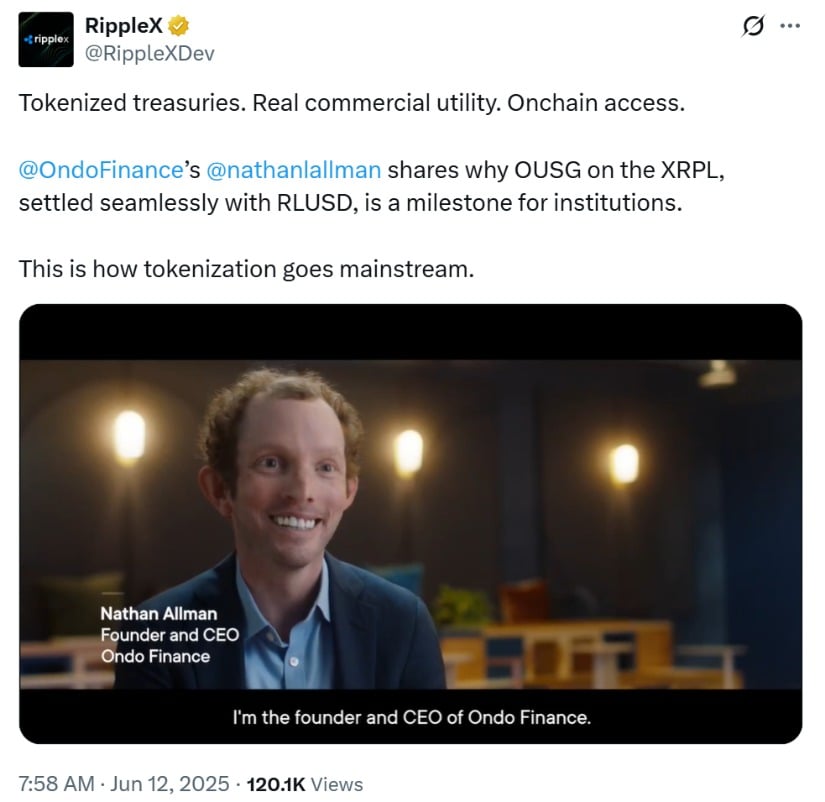

It appears that XRP is gaining momentum, much like a train that has just discovered its brakes are broken. A significant contributor to this bullish buzz is none other than Ondo Finance, which has rolled out tokenized short-term U.S. Treasury funds—dubbed OUSG—on the XRP Ledger (XRPL). A bold step, indeed, in the grand ballet of traditional finance and decentralized finance (DeFi). 💃

In layman’s terms, this launch opens the floodgates for institutional-grade financial products to waltz into the crypto space. Ondo’s goal? To offer high-quality tokenized assets for large investors, all while powered by the magic of blockchain technology. Because who doesn’t want their assets to be a little more… digital?

Now, qualified investors can mint and redeem these OUSG tokens using RLUSD, Ripple’s own U.S. dollar-pegged stablecoin. This means 24/7 access, increased liquidity, and a delightful mix of funds managed by the likes of BlackRock, Franklin Templeton, and WisdomTree. It’s like a buffet, but for your investments! 🍽️

And let us not forget the timing of this launch, which is as impeccable as a well-timed punchline. Ripple’s ecosystem is already making waves, with VivoEnergy announcing plans to deploy a staggering $100 million worth of XRP on the Flare blockchain. Real-world adoption? It seems we are not just dreaming! 🌊

Market Fundamentals Strengthen

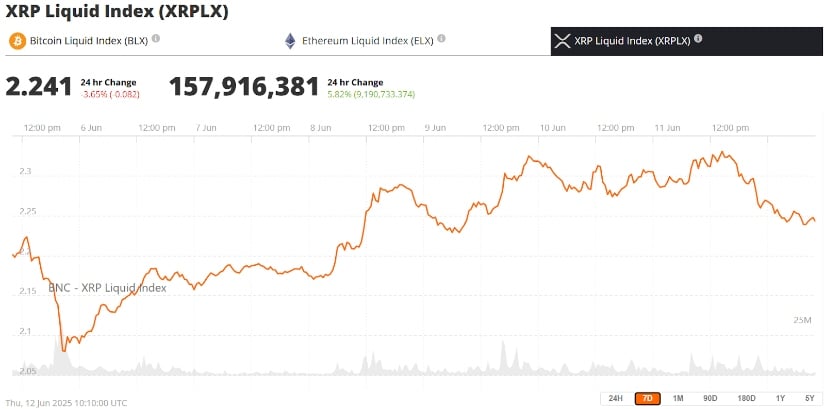

XRP has clawed its way back from a low of $2.09, now standing at around $2.31—a modest increase of 2.2% in the last 24 hours. On-chain indicators reveal a steep spike in activity, with volumes increasing by more than $800 million. It appears that both retail and institutional investors are preparing for a larger move, perhaps a dance of sorts. 💃🕺

But wait! The most thrilling development is the explosion in XRP futures open interest, which has skyrocketed to 1.85 billion XRP—or about $4.26 billion. This sudden surge in leveraged positions reflects a growing confidence in the event of a breakout. It’s like watching a pot of water come to a boil—exciting, yet slightly nerve-wracking!

“The market is clearly preparing for a major move. When this level of capital enters futures markets, it’s rarely speculative—it often signals conviction,” noted a trader in a recent YouTube market review. Ah, the wisdom of the internet! 📺

Technical Signals Support the Bullish Case

From a technical perspective, XRP appears to be forming a bullish “double bottom” pattern, with key resistance between $2.35 and $2.36. If this barrier is cleared, analysts are eyeing short-term targets at $2.44 and $2.60, with $3.00 serving as the next major psychological milestone. A milestone, indeed! 🎯

The Moving Average Convergence Divergence (MACD) indicator has recently flashed a buy signal on the daily chart. The Money Flow Index (MFI) has also crossed above the midline, indicating increased capital inflows into XRP. These indicators point to favorable momentum for bulls in the near term. But let’s not get too carried away, shall we? 🐂

That said, Ripple XRP news analysts caution against overexuberance. The rising funding rate—currently at 0.01% every eight hours—could trigger short-term volatility. If funding rates climb without a corresponding increase in price, long positions may face liquidation pressure. In that case, support lies at $2.25, followed by deeper levels at $2.11 and $1.95. A veritable rollercoaster of emotions! 🎢

Macro Environment Adds Tailwinds

Broader economic indicators also appear to be supporting bullish market conditions. The U.S. Consumer Price Index (CPI) rose slightly to 2.4% in May, below the forecasted 2.5%. This lighter-than-expected inflation data has helped strengthen risk sentiment across crypto markets. A sigh of relief, perhaps?

Bitcoin and Ethereum both recorded gains, with BTC trading near $110,500 and ETH rising over 7% on the day. This optimism has spread across the Ripple market, giving altcoins like XRP more room to grow as investor appetite improves. It’s a feast, and everyone is invited! 🍽️

With the Federal Reserve expected to hold interest rates steady at its upcoming meeting on June 18, market conditions remain favorable for digital assets. A toast to stability! 🥂

XRP Lawsuit Update and Regulatory Climate

Despite the momentum, XRP continues to face uncertainty from the long-standing XRP SEC lawsuit. Though progress has been made, the final resolution between Ripple and the SEC remains pending. However, many analysts believe the worst is behind Ripple following favorable court decisions in 2023. Fingers crossed! 🤞

CEO Brad Garlinghouse recently reiterated Ripple’s commitment to clarity and regulatory compliance, particularly as the firm continues global expansion and explores partnerships, including those rumored with Ripple Bank of America. A partnership that could change the game! 🎮

Ripple’s strong fundamentals, combined with easing inflation, increasing institutional exposure, and potential legal clarity, could serve as a trifecta that propels XRP beyond current resistance zones. A trifecta, indeed! 🎉

Outlook: Can XRP Hit $3.00?

With technical indicators aligned, growing interest in tokenized treasuries, and favorable macroeconomic conditions, XRP seems well-positioned for a breakout. If XRP can breach the key resistance at $2.35 and sustain upward momentum, the next price target at $3.00 becomes a realistic possibility, representing a 28% gain from current levels. A dream come true for many! 🌈

Still, investors are advised to monitor support levels and funding rates carefully, as short-term corrections may occur before the next leg up. As it stands, XRP is back in the spotlight, and Ripple news is once again capturing attention across both crypto and traditional finance circles. A tale as old as time! 🎭

Read More

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Silver Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2025-06-12 18:09