- Ah, the whales are back! Inflows and rising net exchange netflows whisper of a possible short-term distribution. 🐋💸

- But wait! A bullish sentiment and a 33% NVT drop signal that on-chain fundamentals might just be flexing their muscles. 💪📈

In a twist worthy of a Dostoevsky novel, Ripple [XRP] has catapulted to $2.43, riding the wave of short-term momentum. Yet, the exchange activity now suggests that profit-taking might be lurking just around the corner, like a cat waiting to pounce on an unsuspecting mouse. 🐱💰

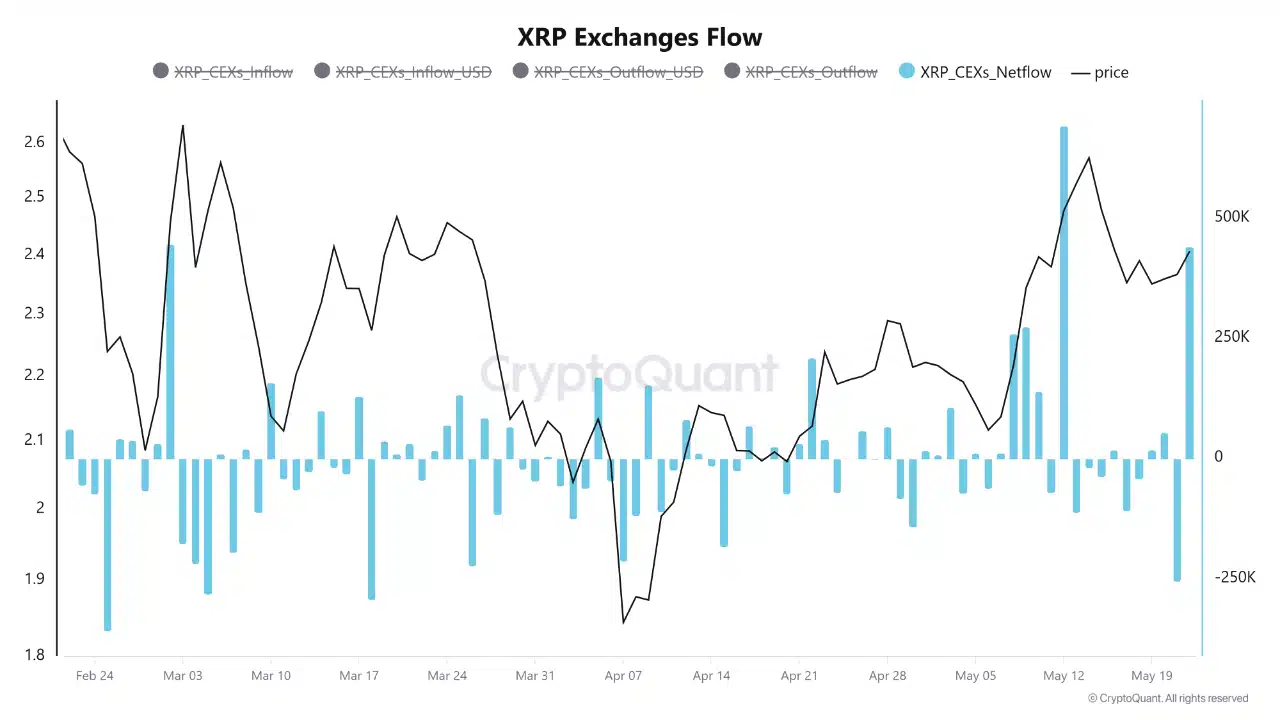

Whale inflows and centralized exchange netflows have surged dramatically, with a staggering 440K XRP recorded in a single day. It’s as if the financial gods are playing a game of Monopoly, and the stakes are higher than ever! 🎲💵

This behavior often signals a distribution phase after a period of accumulation. Historically, such inflows hint at a shift in sentiment among the large holders, especially when the price flirts with resistance levels. 💔

While this doesn’t guarantee an immediate correction, the timing and scale of the inflows suggest that traders should proceed with caution, like a tightrope walker in a circus. 🎪

Despite the ominous signs of profit-taking, sentiment remains broadly positive. Market Prophit data shows crowd sentiment at 0.25 and smart money sentiment at 0.09 — both indicating bullish expectations. It’s like a party where everyone is dancing, but the music might just stop! 🎉🕺

This divergence between sentiment and on-chain flow data creates a mixed picture, much like a painting that leaves you questioning the artist’s sanity. 🎨

Has XRP broken out for good?

XRP has indeed broken out of a multi-month descending channel, confirming a bullish reversal pattern. However, the token now faces resistance at $2.60, with another ceiling at $3.00. It’s like climbing a mountain, only to find a grumpy troll at the top! 🧙♂️

The recent close above $2.43 strengthens the bulls’ case, especially if buyers maintain control. But beware! A rejection from these levels could attract short sellers like moths to a flame. 🔥

Thus, XRP’s structure looks promising, but upside follow-through must be sustained above the breakout. Until a clear move past $2.60 occurs, traders should watch for potential reversal signals that may emerge in this key resistance zone. 👀

A sign of strength or a setup for volatility?

Spot exchange data shows $205.12M in inflows against $195.25M in outflows — a net inflow that hints at increasing sell-side pressure. It’s like a tug-of-war, and the rope is fraying! 🪢

This shift comes after a period dominated by outflows and self-custody trends, suggesting a potential transition to distribution. Such changes often precede market pullbacks, especially when large holders start offloading into strength. 🏋️♂️

XRP derivatives activity has surged, with a 58.5% rise in volume and a 25.26% spike in Open Interest. Additionally, Options volume increased by 10.95%, and Options Open Interest jumped 13.73%. These figures highlight growing speculative demand and leverage, like a rollercoaster ride that’s just begun! 🎢

While this often supports momentum, it can also lead to rapid liquidations if sentiment shifts. Hold on to your hats, folks! 🎩

Setting up for a squeeze or leading the charge?

According to Binance’s Long/Short Ratio, 74.63% of XRP traders hold long positions, compared to 25.37% on the short side. This imbalance shows strong market conviction, but also sets the stage for vulnerability. When long positions dominate, a surprise move against the trend can lead to liquidations, increasing downside volatility. It’s like a game of Jenga, and the tower is wobbling! 🏗️

XRP’s Network Value to Transactions (NVT) ratio plunged by 33.14% in 24 hours to 136.01. This drop suggests that XRP’s on-chain transaction volume is growing faster than its market cap — a sign of stronger utility and activity. It’s like a sprinter outpacing a tortoise! 🐢💨

Lower NVT ratios often indicate healthier network usage, especially during rallies. Therefore, this development adds a bullish undertone to the current technical structure. 🎶

Will bullish conviction absorb the distribution pressure?

XRP remains technically strong, with bullish sentiment and improving on-chain utility metrics. However, rising netflows to exchanges and whale activity suggest increasing sell-side pressure. Therefore, while optimism is still dominant, the potential for short-term volatility has increased. A move above $2.60 could restore momentum, but a rejection might reinforce distribution signals. Traders must weigh sentiment against selling pressure in this critical range, like balancing a delicate soufflé! 🍰

Read More

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Silver Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2025-05-22 23:40