As someone who has closely followed the crypto market and its trends, I can’t help but feel a sense of excitement and validation as I witness Bitcoin outperforming the Japanese yen. Having lived through Japan’s economic struggles with hyperinflation in the late 1980s, I understand the importance of having a reliable store of value.

In simpler terms, Bitcoin outperforms the third most frequently exchanged traditional currency, Yen, in the forex market.

The Japanese yen reached a 34-year low, as reported by Bloomberg, due in large part to the challenge of controlling inflation within Japan’s economy. A significant disparity exists between local and U.S. federal interest rates, primarily contributing to this issue with the Japanese sovereign currency.

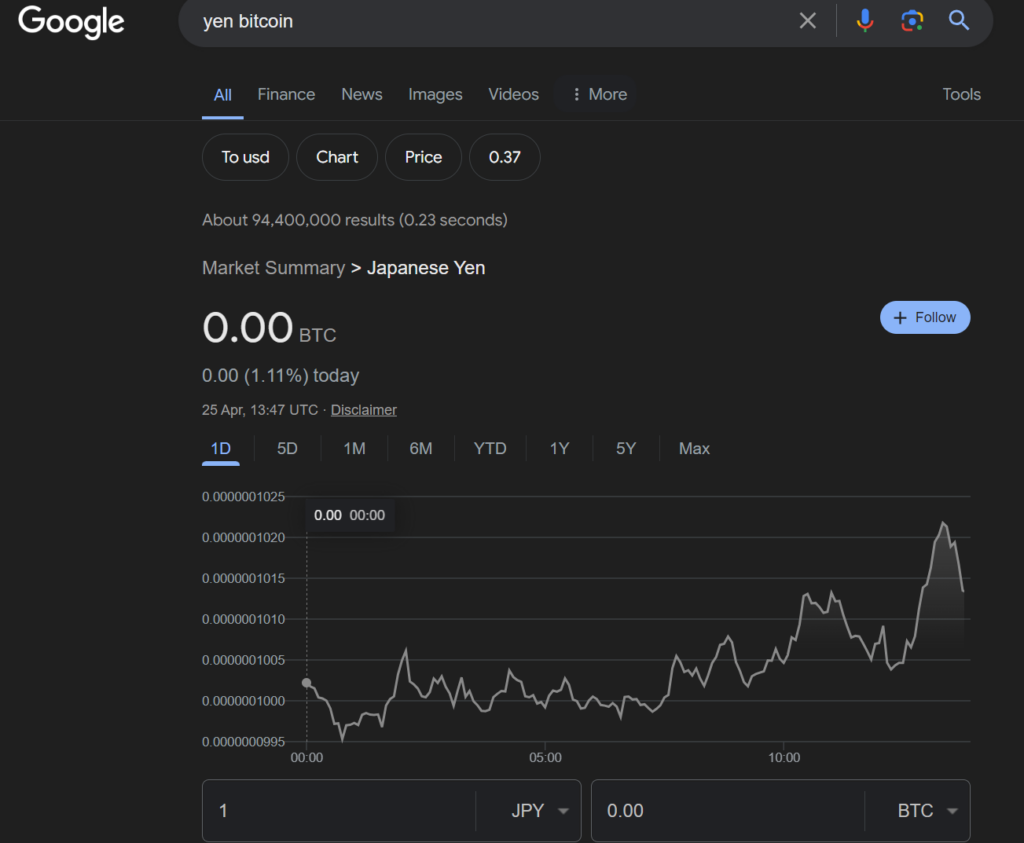

As an assistant observing the situation, I’d put it this way: “Currently, the Japanese government is grappling with a complex issue. Meanwhile, Bitcoin (BTC) has surpassed the value of the Japanese yen in terms of direct monetary worth. To put it into perspective, as of April 25th, according to Google Finance, one Japanese yen was equivalent to zero Bitcoins.”

I’ve noticed an impressive rally of Bitcoin (BTC) against various fiat currencies in February, reaching new peak prices in as many as 14 different countries. This surge was fueled by the excitement and optimism within the industry following the approval of the first-ever spot Bitcoin Exchange Traded Funds (ETFs).

Crypto community reacts to Bitcoin-yen

As an observer of the financial world, I’ve noticed a surge of appreciation for Bitcoin in various social media circles. Many people are hailing it as a form of “solid currency” or “real money,” and praising its potential to offer financial autonomy outside the constraints of the global traditional economic system.

Users echoed Michael Saylor’s perspective, referring to Bitcoin as “Satoshi Nakamoto’s wisely designed system” with a limiting supply of just 21 million units.

The cap on new Bitcoins being created is non-negotiable and embedded within Bitcoin’s blockchain. A halving event occurs every few years, which decreases the number of newly issued Bitcoids. This reduction in supply helps regulate inflation. Last week marked the occurrence of the latest halving, and according to Bitwise CIO Mat Hougan, this development could positively impact Bitcoin’s market worth over an extended period.

Same for dollar

— Ivan Sherbakov (We’re hiring!) (@sherbakov_btc_) April 25, 2024

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-04-25 18:00