Ah, mes amis! Japan’s 40Y Bond Yield, that mischievous little rascal, has pranced up to 2.85%, perilously close to its historic 3% high! One might say, “What a delightful predicament!” But alas, this could unleash a cascade of calamity, sending U.S. yields soaring and the crypto market spiraling downwards like a tragic hero in a Molière play! 🎭

According to the wise sages at Trading Economics, Japan’s 40-year Bond Yield reached its peak on this very day, March 10, based on the whispers of over-the-counter interbank yield quotes. The last time our dear Japan flirted with the 3% high was in January 2011, and lo and behold, it did so again in January 2024! What a dramatic twist! 📈

Now, let us not forget that Japan holds the world’s largest debt pile, a veritable mountain of more than double its $5 trillion economy! Rolling over this debt at higher yields? Oh là là! The costs will rise like a soufflé, and with the Bank of Japan clutching around 70% of their government bonds, one must wonder: is this sustainable? 🤔

For decades, Japan’s monetary policy has been as low as a limbo dancer at a party. But this spike in the 40Y Bond Yield could signal a shift in inflation and interest rates, enticing Japanese investors back to their domestic yields, leaving U.S. yields in the dust! 🏃♂️💨

For context, Japan is a heavyweight in the ring of foreign holders of U.S. Treasuries. As their yields become more attractive, who could blame the Japanese investors for preferring them over the paltry offerings of U.S. debt? This could lead to a reduction in demand for U.S. Treasuries, causing U.S. yields to rise as the government scrambles to compete! What a spectacle! 🎪

And what does this uptick in U.S. yields mean? Higher borrowing costs for both the government and private corporations! Not to mention, elevated yields could give a boost to the U.S. dollar, making it the belle of the ball alongside U.S. Treasuries! 💃

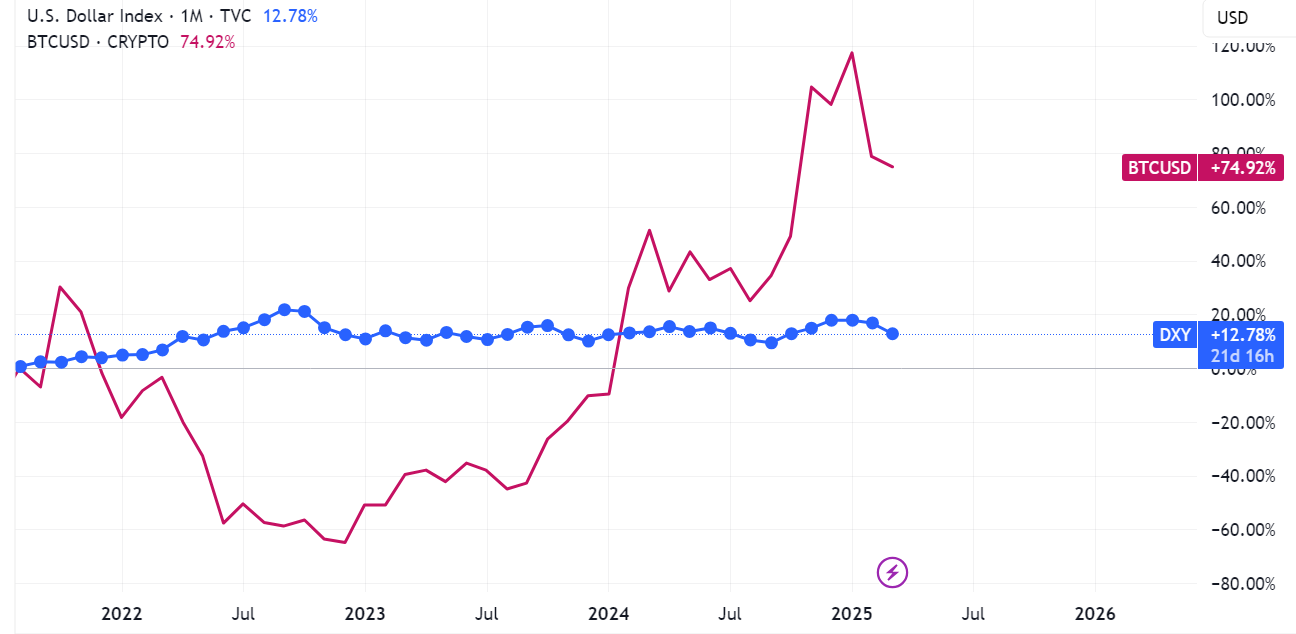

As illustrated in the chart above, the U.S. dollar index and the crypto market (represented by our beloved Bitcoin (BTC) price) share an inverse relationship. When the dollar rises, crypto tends to take a nosedive! What a tragic romance! 💔

When conventional assets like the dollar and U.S. Treasuries offer better returns, investors may flock to them like moths to a flame, diverting their funds from riskier alternatives like stocks and the crypto market. Rising yields on government bonds could also signal tighter global liquidity, a recipe for disaster! 🍽️

For the crypto market, which thrives on loose monetary conditions and ample liquidity, this shift could be catastrophic! The markets are as sensitive as a prima donna to changes in global liquidity and risk sentiment, leading to increased volatility and downward pressure on crypto assets! 🎢

As investors pull their funds from risky assets, the inflows into the crypto market may dwindle, dragging down prices like a heavy anchor! ⚓

In conclusion, Japan’s 40Y Bond Yield could spell trouble for the crypto market. The shift in monetary conditions, driven by this yield reaching its 3% high, could strengthen the dollar, tighten global liquidity, and reduce the flow of investor capital into riskier assets like crypto. What a tragic comedy we find ourselves in! 🎭💰

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

2025-03-10 11:51