As a researcher with extensive experience in the cryptocurrency market, I’ve closely monitored Jasmy’s recent downturn and its correlation to Bitcoin’s price action. The harsh reversal this month, with Jasmy falling more than 30% from its highs, is disheartening but not unexpected given the broader market trends.

The value of Jasmy has experienced a significant downturn this month, plunging into a bear market as it dropped over 30% from its peak prices.

Just like other cryptocurrencies, Jasmy has been influenced by the latest fluctuations in Bitcoin‘s price. Bitcoin reached a peak of $72,000 early this month but then created a double-top formation and experienced a significant decline of more than 14%.

I’ve analyzed the recent Bitcoin market trends and here’s my take: The selling pressure from Bitcoin ETF outflows and Germany’s crypto sell-off intensified, causing a noticeable price drop. Additionally, some mining companies surrendered their coins in a sign of capitulation. Consequently, exchange balances have slightly increased over the past few days as depicted below.

Bitcoin balances in exchanges

The Fed is indicators that it may be among the final central banks to lower interest rates, given the persistent high inflation in the US. In contrast, some other central banks, including the Bank of Canada, European Central Bank, and Swiss National Bank, have initiated rate cuts.

As a crypto investor, I’ve noticed that Jasmy’s price retreat occurred concurrently with a decrease in social media buzz and trading volume for the token. The daily average trading volume of JASMY on exchanges has dipped below $160 million over the past few days according to data.

Recently, the average figure surpassed $500 million. A comparable occurrence is noted in the futures market, where there has been a significant decrease in open interest – falling from $82 million on June 5th down to $40 million currently.

Jasmy open interest

Jasmy price forms a bearish pattern

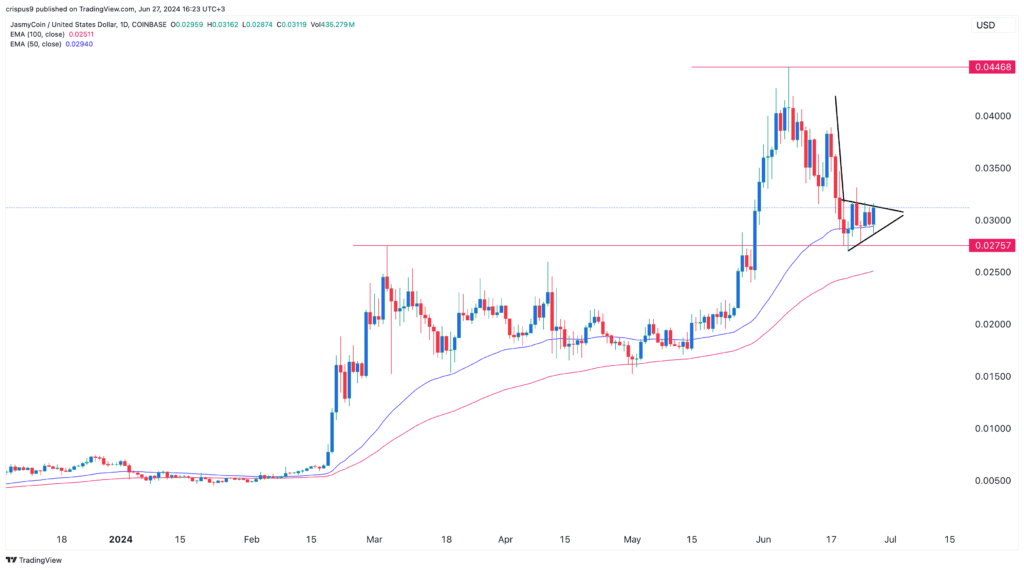

JasmyCoin price chart

The recent downturn in the JASMY token market began around June 4th, with the appearance of a long-bodied “doji” candlestick formation. This pattern is often seen as a significant indicator of an impending price change in technical analysis, frequently signaling a possible trend reversal.

I’ve analyzed JASMY’s price chart and identified a bearish pennant pattern emerging. This technical formation consists of a prolonged flagpole followed by a symmetrical triangle. historically, such patterns have signaled a potential bearish breakout once they reach their confluence point. Consequently, if market conditions don’t improve, it appears that JASMY’s price may take a downward turn soon.

Luckily, JasmyCoin’s price has consistently stayed above its 50-day moving average and a significant support level at $0.02757, which marked its highest swing in March. Therefore, a further decline would be signaled if the price falls beneath that value.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-06-27 16:36