As a seasoned crypto investor with a decade of experience in the digital asset market, I can’t help but feel a sense of relief and even optimism following the recent developments regarding the Democratic Party and its stance on cryptocurrencies.

Emphasizing the point, Joe Biden will continue serving as president until the end of his term. The focus shifts towards determining who will challenge him in November’s election against Trump.

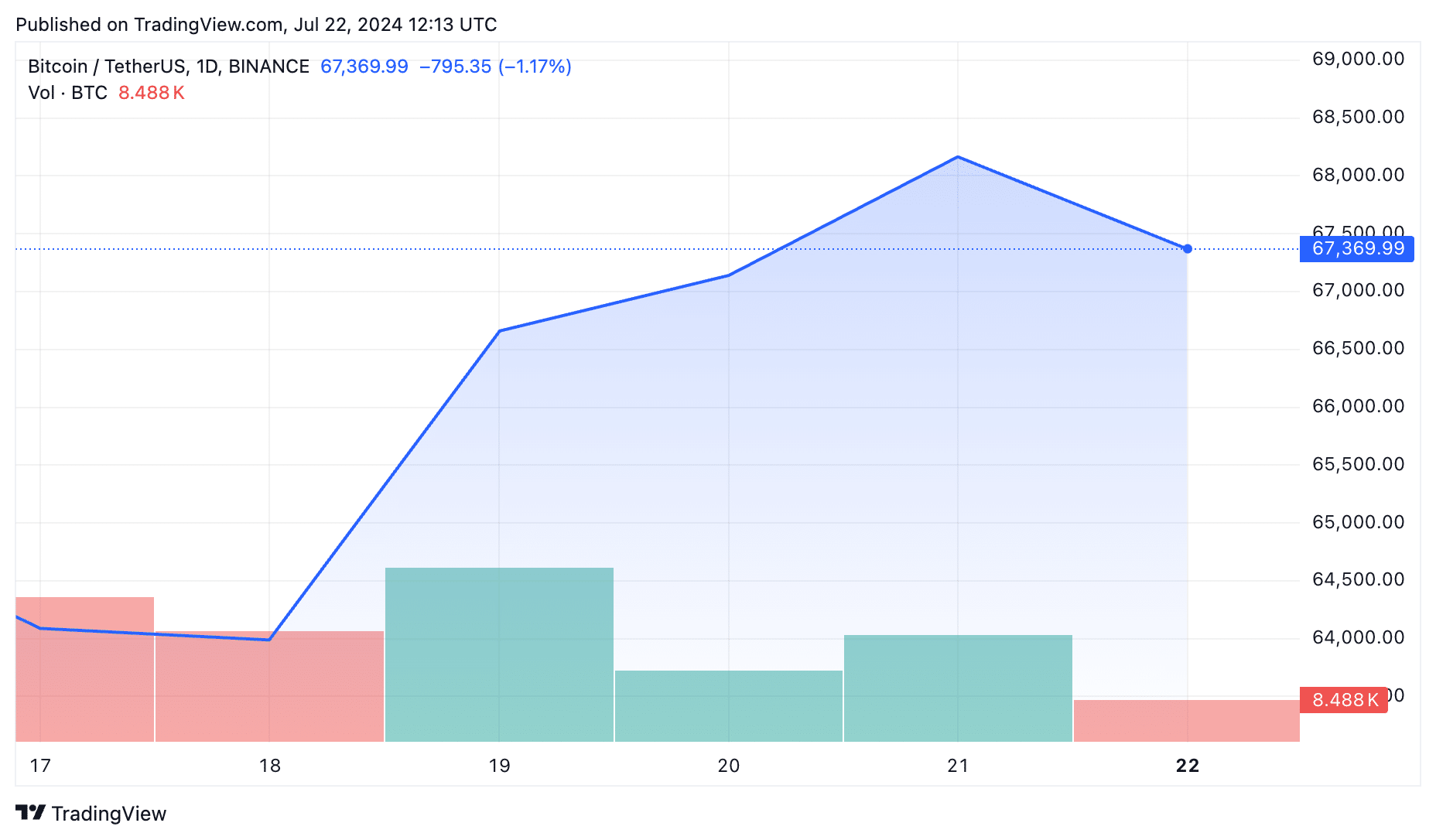

The sudden exit of Joe Biden from the US presidency contest led to momentary apprehension in the cryptocurrency markets at first.

In approximately thirty minutes, Bitcoin experienced a significant decline of nearly $1,500 due to investors processing recent news and apprehension regarding the potential Democratic nominee.

The reversal proved unexpectedly brief, as traders came to acknowledge that this crypto policy shift might actually be a positive sign.

Industry experts are frustrated with the Biden administration’s handling of digital assets, as criticism mounts that their policies have hindered innovation and potentially put consumers at risk.

In March 2022, there was enthusiasm following the president’s signing of an executive order on cryptocurrencies, which instructed various government departments to examine both the potential risks and advantages of these digital assets.

During that period, Coinbase expressed a relatively impartial position regarding cryptocurrencies, indicating the White House’s recognition of the potential of this technology.

Approximately half a year after, President Biden unveiled a formal plan delineating the regulatory approach towards cryptocurrencies. However, this announcement raised concerns within the sector due to its perceived lack of specificity and depth.

A point of contention arose regarding which regulatory bodies were responsible for overseeing the market, leading to confusion and tension between the Securities and Exchange Commission and the Commodity Futures Trading Commission.

Coinbase’s chief legal officer, Paul Grewal, issued a warning in June 2023, emphasizing that the US is lagging behind other countries in terms of regulatory action regarding cryptocurrencies.

“The United States is seeing tech and crypto innovators migrate abroad because of unclear guidelines and regulations. Meanwhile, other countries aren’t idling by, and they’re capitalizing on the U.S.’s regulatory void.”

Paul Grewal

As a crypto investor, I’ve witnessed firsthand the commendable bipartisan initiatives taken by Congress to establish a regulatory framework for our industry. However, despite their praiseworthy efforts, we’re still waiting for concrete legislation to materialize.

As a crypto investor, I’ve been closely following the developments regarding the Securities and Exchange Commission (SEC) accounting policy known as SAB 121. Most recently, President Biden made headlines by controversially vetoing a bill that aimed to eliminate this contentious rule. From my perspective, this decision has stirred up quite a debate within the investment community.

Kirstin Smith, the head of the Blockchain Association as CEO, stated that this regulation was merely a “punitive, anti-digital asset measure,” making it excessively challenging for financial institutions to securely store cryptocurrencies on behalf of their clients. During that period, the president commented:

My administration firmly believes in safeguarding the interests of both consumers and investors in the realm of cryptoassets. Necessary regulations, acting as protective barriers, must be put in place to allow for the full realization of the advantages and prospects that cryptoasset innovation holds.

Joe Biden

The president expressed a willingness of his administration to collaborate with Congress on creating a thorough and fair regulatory framework, but no such framework has materialized as of now.

Occasionally, the Biden administration found itself unwittingly entangled in one of the most significant crises to impact the crypto sector: the unexpected downfall of FTX.

In the year 2020, Sam Bankman-Fried, who later faced disgrace as a CEO, was the second largest donor to Joe Biden’s presidential campaign, having given $5.2 million.

Prior to the collapse of his business empire, SBF (Subtle Brilliance Fellow) had donated large sums of money, amounting to tens of millions of dollars, to Democratic political candidates. It was later disclosed that customer funds had been mishandled.

Later on, journalists put Karine-Jean Pierre of the White House in an awkward spot as they inquired about the timeline for returning the funds to aid the affected individuals.

What happens now?

Biden is currently taking time to recover from COVID-19 in Delaware, but rest assured, he will continue serving as president for the remainder of his term.

As a political analyst, I’m observing the ongoing race for the Democratic nomination. While Vice President Kamala Harris currently holds a strong position, it’s essential to remember that no candidate is guaranteed the nomination at this stage.

Jake Chervinsky, the legal head at Variant Fund, expresses that the party now holds a significant chance to regain a substantial portion of the cryptocurrency community’s support.

On X, he called for the new candidate to:

- Recognize crypto as an important technology and commit to ensuring it flourishes

- Accept that the SEC’s approach to regulation has failed

- Set out policies that strike a balance between innovation and consumer protection

- Outline who would lead key agencies such as the SEC and CFTC

- Collaborate with entrepreneurs and investors in the crypto industry

As an analyst, I can anticipate that in the near future, it will be more evident which Democratic nominee will challenge Trump in November. However, it’s important to note that regardless of the specific Democrat, they are highly unlikely to be as supportive of cryptocurrencies as the Republican ticket.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-07-22 16:02