As a seasoned analyst with a background in studying market trends and technical indicators, I share John Bollinger’s cautious perspective on Bitcoin’s immediate future based on the two-bar reversal at the upper Bollinger Band. Although this pattern does not necessarily indicate a bearish trend, it suggests that a consolidation or pullback period is possible.

Experienced trader John Bollinger, the inventor of Bollinger Bands, has issued a warning regarding Bitcoin‘s near-term prospects.

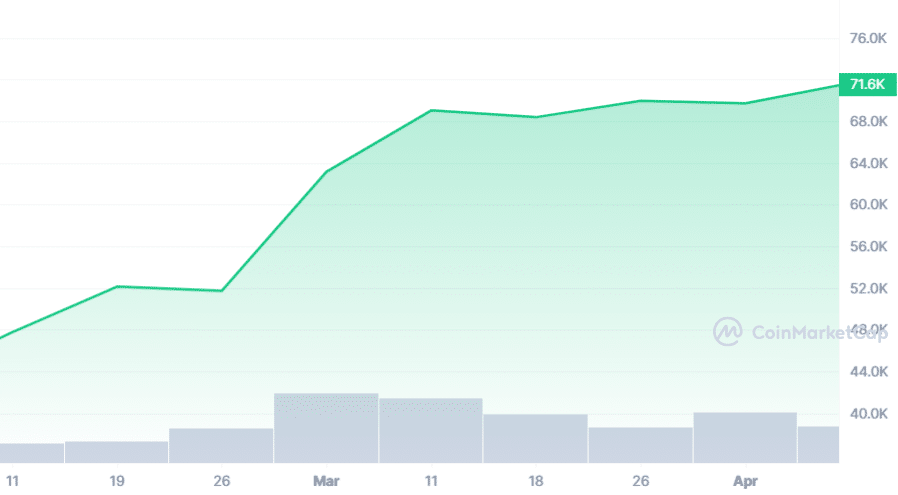

Over the past week and a half, Bitcoin has experienced a significant increase of approximately 13%, pushing its price up to around $71,000 per BTC. This surge has caused market experts and traders to reevaluate their tactics as Bitcoin approaches its record high of $74,000.

As a researcher studying the cryptocurrency market, I’ve noticed that despite the overall positive sentiment, Bollinger Band indicators have signaled a potential concern for Bitcoin’s price. Specifically, I’ve observed a two-bar reversal pattern at the upper Bollinger Band on Bitcoin’s chart. This pattern has historically indicated a brief market correction or period of consolidation.

As an analyst, I express reservations towards the two-bar reversal occurring at the upper Bollinger Band for Bitcoin against the US Dollar (BTCUSD). This indicates a potential correction or consolidation in the near term. However, my overall stance remains neutral rather than bearish.— John Bollinger (@bbands) May 21, 2024

As a dedicated researcher in the realm of financial markets, I can’t help but appreciate the significance of Bollinger Bands in my analysis. These versatile tools, widely adopted by traders, offer valuable insights into market volatility and potential price shifts. By calculating and plotting standard deviations above and below a simple moving average, Bollinger Bands effectively highlight the boundaries within which prices typically fluctuate. This information can be invaluable for anticipating price reversals and managing risk.

As a researcher studying the Bitcoin market, I’ve observed John Bollinger’s analysis indicating potential short-term concerns. However, I personally hold an optimistic view regarding Bitcoin’s long-term prospects. This perspective is grounded in my technical interpretation of the market indicators, rather than being influenced by any fundamentally bearish outlook.

From my perspective as a crypto investor, Bollinger’s outlook aligns with the prevailing market feeling. I share the optimism regarding Bitcoin’s long-term growth prospects, but I also acknowledge the presence of short-term market swings that could cause volatility.

Currently, Willy Woo, a well-known crypto analyst and the co-founder of venture capital firm CMCC, has brought attention to a distinct characteristic in Bitcoin’s market trends.

In his May 22 entry on X, Woo pointed out that although Bitcoin’s price hadn’t noticeably climbed during the previous two months, a substantial amount of Bitcoin was being amassed without a corresponding rise in paper Bitcoin.

Woo believes it is only a matter of time before Bitcoin surpasses its all-time highs.

That day, the Bitcoin Fear and Greed Index registered a reading of 76. A score between 75 and 100 indicates an extreme degree of greed among traders, signaling their strong inclination to purchase more Bitcoins.

Bitcoin Fear and Greed Index is 76 — Extreme Greed

Current price: $70,192— Bitcoin Fear and Greed Index (@BitcoinFear) May 21, 2024

when markets rise, individuals often acquire greater quantities of cryptocurrencies, fueling increased greed and resulting in larger price fluctuations.

At a pivotal moment, Bitcoin’s latest price fluctuations and experts’ opinions hold significant importance. The cryptocurrency currently sits only 6% below its all-time high. With an upward trend in place, many investors are eagerly anticipating whether Bitcoin will exceed its previous record-breaking price, a feat that appears increasingly plausible given the current market dynamics.

As I analyze the current cryptocurrency market trends, I observe that at this moment, the largest crypto asset is priced at $69,973 according to CoinMarketCap’s data. This represents a 1.5% decrease in value over the past 24 hours.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- EUR CNY PREDICTION

2024-05-22 14:28