As an analyst with a background in financial regulation and cryptocurrencies, I find Joseph Lubin’s comments on the SEC’s regulatory approach to cryptocurrencies quite intriguing. Lubin’s experience as a co-founder of Ethereum and CEO of Consensys gives him unique insights into the industry and its regulatory landscape.

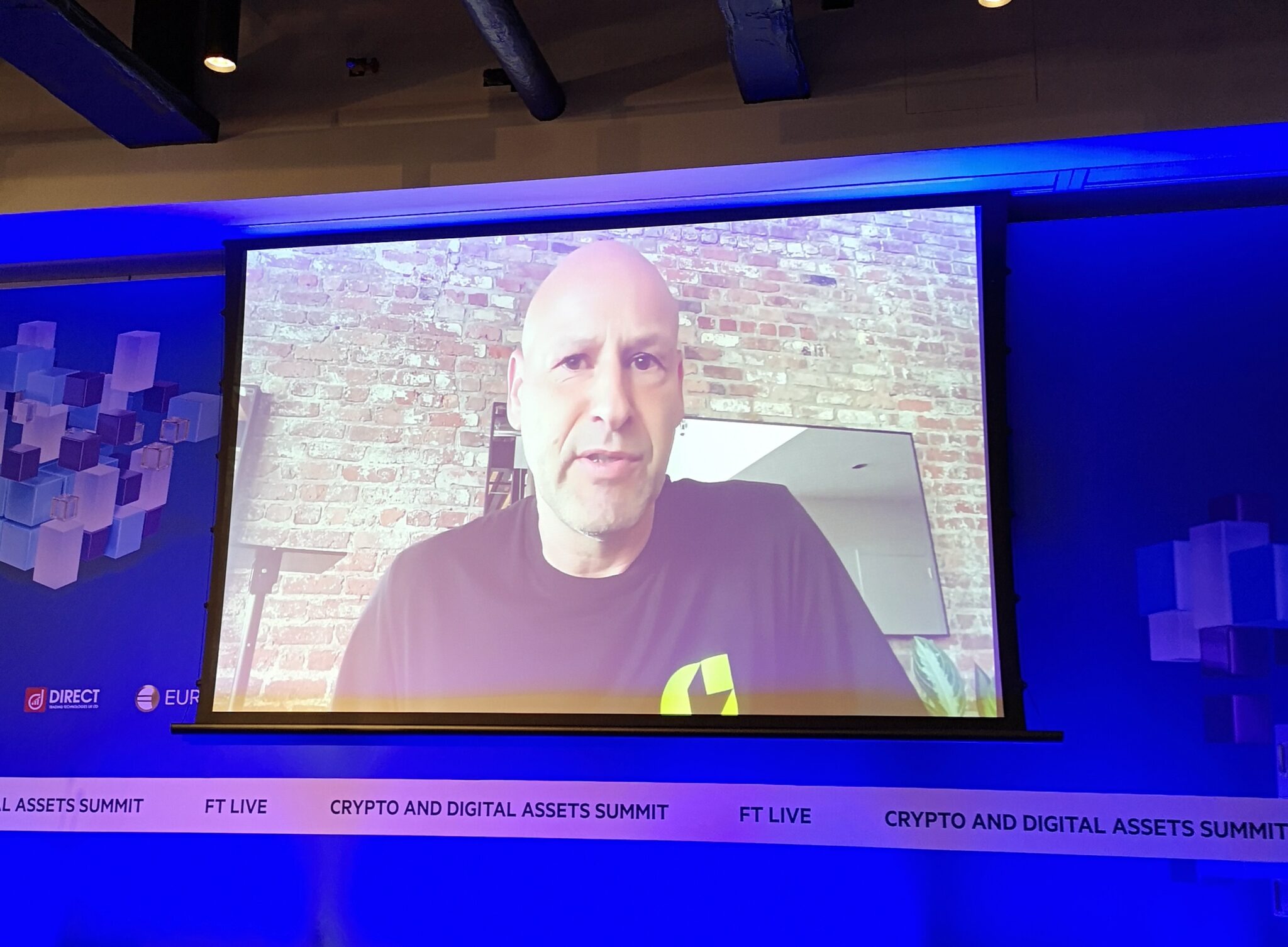

As a researcher studying the regulatory landscape of cryptocurrencies, I’ve observed firsthand the ongoing tension between Ethereum co-founder Joseph Lubin and the U.S. Securities and Exchange Commission (SEC). During a recent event at FT Live’s Crypto and Digital Assets summit in London, Lubin voiced his concerns over the SEC’s approach to regulating cryptocurrencies. He argued that instead of engaging in open dialogue and establishing clear guidelines, the SEC is relying on strategic enforcement actions.

After receiving a Wells notice from the SEC, indicating possible regulatory proceedings, Consensys chose to file a lawsuit.

SEC’s Security Classification of Ether

Lubin pointed out that it appears the SEC has privately reclassified Ether as a security, without notifying the affected parties. He contends that this sudden announcement aims to instill fear, uncertainty, and doubt among participants in the cryptocurrency market.

He highlighted the fact that the Commodity Futures Trading Commission (CFTC) previously identified Ether as a commodity, expressing concern over the inconsistencies in regulatory frameworks.

As a crypto investor, I’ve noticed Lubin’s suggestion that the SEC’s recent actions against certain crypto projects could be linked to the upcoming decision on Ether ETFs approval. He implied that the regulatory body might use these enforcement actions as justification for denying the ETFs, thus legitimizing their stance.

Furthermore, Lubin hypothesized that the Securities and Exchange Commission (SEC) might have concerns over an abundance of funds in the cryptocurrency sector, potentially endangering conventional financial systems.

Lubin highlighted the importance of the SEC’s stance towards wallets like MetaMask, stating that labeling them as broker-dealers might bring about significant repercussions for the tech sector in the United States.

Read Also: Ripple vs. SEC: Judge May Toss SEC’s $2 Billion Fine

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Gold Rate Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-05-09 23:49