As a seasoned researcher with a keen eye for market trends, I find myself intrigued by the recent developments in the Solana ecosystem and Jupiter (JUP) token specifically. While it’s true that Jupiter has experienced a slight setback, retreating to $0.08 from its high of $0.89 last week, I believe this could be a temporary hiccup rather than a sign of impending doom.

Despite a surge in transaction volume within the Solana ecosystem, the price of Jupiter tokens declined for two straight days.

On September 23rd, the value of Jupiter (JUP) decreased to $0.08, dropping from its peak of $0.89 reached the previous week. This shift resulted in a total market capitalization of more than $1.098 billion for the cryptocurrency.

According to DeFi Llama’s data, transactions on Solana’s decentralized exchanges increased by approximately 18% in the past week, reaching a total of more than $5.27 billion. Interestingly, this growth surpassed Ethereum, whose transaction volume decreased by 29%, resulting in a total of around $5.1 billion.

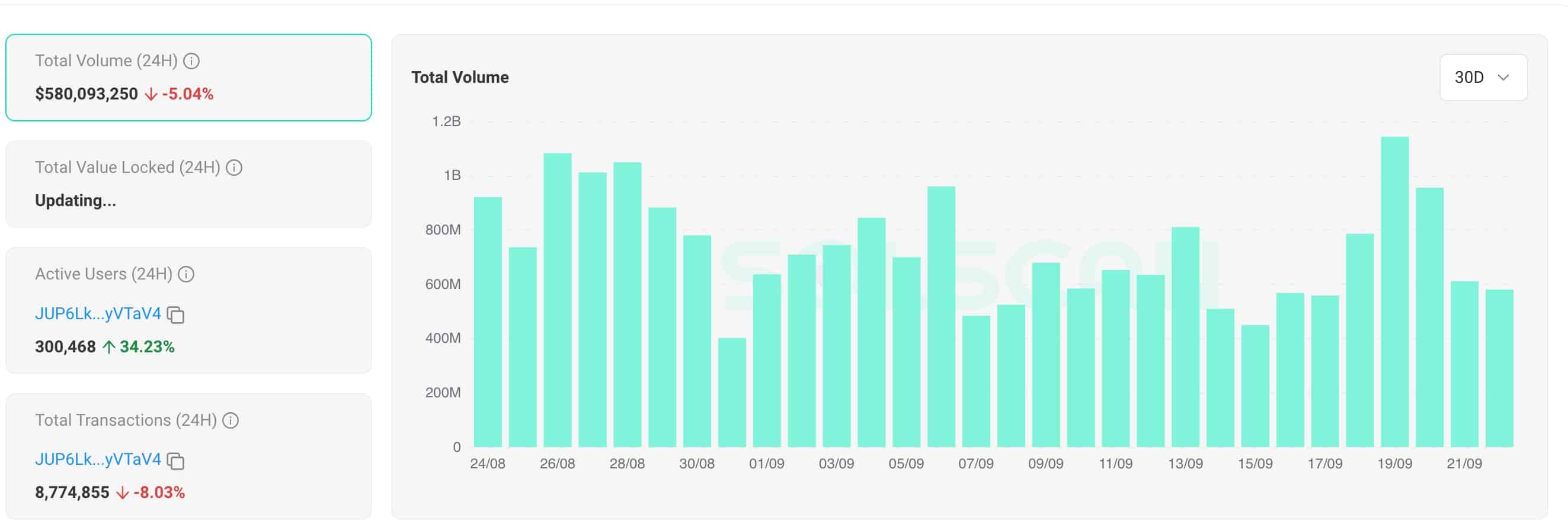

On September 23rd, Jupiter’s transaction volume was significant, as per Solscan data, it processed tokens valued at approximately $587 million. This amounts to a market share of around 37%. Furthermore, it boasts more than 10,400 active wallets.

Additionally, it’s worth noting that other prominent Decentralized Exchanges (DEXs) on the Solana network, such as Raydium, Orca, and Meteora, also experienced increased trading volumes. This surge could be attributed to the resurgence of meme coins like Popcat (POP) and Dogwifhat (WIF).

More recently, indications point towards a decrease in the momentum of Jupiter’s size. After reaching an astounding peak of $1.14 billion on September 19, its value has now fallen to approximately $580 million.

In just the past thirty days, Jupiter’s wealth has grown by more than 5% and now exceeds $1.17 billion, positioning it as the third most significant entity within the system.

A week following the purchase of SolanaFM, a prominent blockchain explorer, Jupiter’s token retreated. Experts believe this takeover could expand Jupiter’s network of infrastructure systems, fostering growth within its ecosystem.

One way to rephrase this statement in a natural and easy-to-read manner could be: “One significant hurdle for Jupiter’s token lies in its ownership structure, which is heavily concentrated among a few key players. As reported by SolanaFM, the top ten addresses within the network hold nearly 92% of all existing tokens. This high concentration of tokens can potentially pose a risk if these holders decide to sell their stakes.

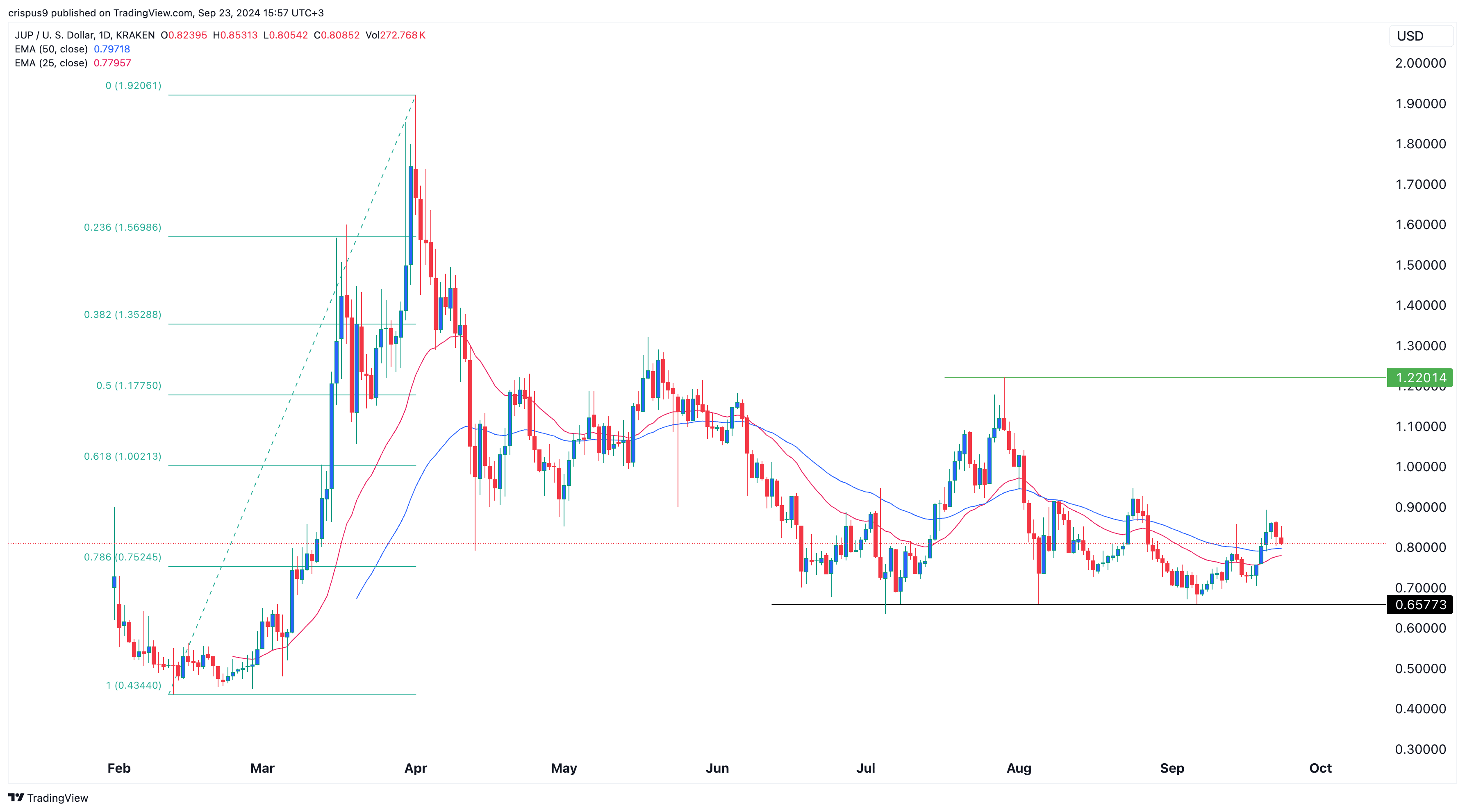

Jupiter found a strong support

In the day-to-day graph, the Jupiter token experienced robust resistance at $0.6577 – a point it had difficulty surpassing in July, August, and September. This suggests that it has built a triple-bottom pattern with a horizontal line of resistance at approximately $1.2200.

Jupiter continues to stay above the significant 78.6% Fibonacci level and is currently positioned over its 50-day and 25-day average trends.

Given that Jupiter continues to stay above its two moving averages and surpassing last week’s peak at $0.8932, it seems probable that Jupiter will continue its upward trajectory.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-09-23 16:31