As an analyst with over two decades of experience in the finance and technology sectors, I’ve seen my fair share of partnerships that have raised eyebrows. The recent decision by BitGo to partner with Justin Sun’s BiT Global for the custody operations of Wrapped Bitcoin (WBTC) is one such instance that has left me feeling a bit uneasy.

As an analyst, I’m currently observing a passionate discussion within the cryptocurrency community regarding Justin Sun’s role in the management of Wrapped Bitcoin (WBTC). The recent move by BitGo to hand over WBTC control to a partnership with BiT Global, led by Sun, has sparked considerable apprehension, especially among DeFi enthusiasts.

In simple terms, BitGo, a prominent digital asset custody service, has revealed its intention to transfer custody of Wrapped Bitcoin (WBTC) to a new partnership with BiT Global, a firm linked to Justin Sun, the contentious creator of TRON. This shift, scheduled within the next two months, has ignited strong criticism from different sectors within the cryptocurrency industry.

Sun’s history within the cryptocurrency sector has been marked by numerous contentious incidents. The administration of TRON, for instance, has drawn criticism due to its perceived centralization. Furthermore, the crypto community often voices disapproval over his lack of openness. This figure has been embroiled in a variety of legal predicaments, such as accusations of fraud, misguiding investors, and facing investigation from regulatory bodies in China and the U.S., among other allegations.

Additionally, it’s worth noting that Justin Sun’s previous Bitcoin-related product, HBTC, didn’t perform exceptionally well. At the moment, one HBTC is priced at around $13,300 on CoinGecko, which is significantly lower than the price of Bitcoin.

Mike Belshe, BitGo CEO, has dismissed such concerns, implying that the uproar stems more from people’s perceptions rather than concrete facts. However, he was unable to disclose the true ownership, directors, and executives of BiT Global. He also cautioned that if BiT Global were to be completely compromised, the treasury could potentially be in danger.

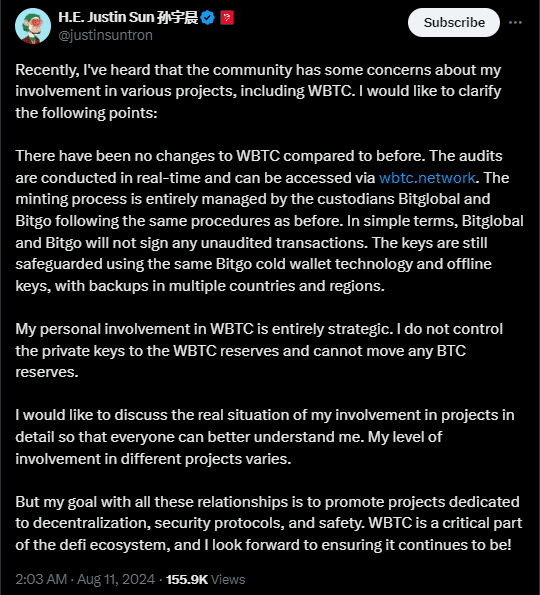

Sun has attempted to ease concerns among stakeholders, emphasizing that his involvement with WBTC is strategically focused and that he doesn’t possess control over the private keys or the authority to transfer Bitcoin reserves.

Although these assurances have been made, significant DeFi players like MakerDAO have shown deep concerns about the matter. Specifically, MakerDAO’s risk assessment team, BA Labs, has suggested removing Wrapped Bitcoin (WBTC) from their lending platforms due to potential risks linked to Sun’s participation. This decision was based on similar issues with transparency that Sun faced in the past, specifically with TUSD, such as its questionable disclosure practices.

Advocates within the cryptocurrency circle propose that it’s more prudent to entrust custody with well-established financial entities such as conventional banks or companies like Coinbase. They reason that while BitGo is renowned for its long-standing reputation, partnering with them might potentially harm this standing if any complications should arise.

As a crypto investor, I can’t help but share my concerns about Wrapped Bitcoin (WBTC). The crypto community and I are worried that it might depeg, a situation where its value deviates significantly from the price of Bitcoin. This could potentially trigger cascading liquidations due to WBTC’s extensive use as collateral in Decentralized Finance (DeFi). It’s something we keep a close eye on, hoping for stability and minimal impact on the broader crypto market.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-12 23:16