As a researcher with a background in finance and experience following the cryptocurrency market, I find the recent surge in institutional investment in U.S. spot Bitcoin ETFs to be an intriguing development. According to the data, as of March 31, 937 institutions had invested over $11 billion in these products, representing 18.7% of the total funds managed by BTC-based products. This is a significant increase from the 95 firms that invested in gold ETFs over the same period.

As of March 31, 937 institutions had invested over $11 billion in U.S. spot Bitcoin ETFs.

At K33 Research, Senior Analyst Vetle Lunde explains that the value of $11.05 billion holds a 18.7% share in the overall funds controlled by Bitcoin investment products. In contrast, just 95 entities participated in gold ETF investments during the same timeframe.

Based on 13F filings, a total of 937 institutional investors held positions in U.S. spot exchange-traded funds (ETFs) by the end of Q1. Conversely, gold ETFs attracted investments from 95 professional firms during the same period (as per Bitwise data). The retail sector, however, accounts for the larger share of these funds, with a total value of $11.06 billion in professional holdings.

— Vetle Lunde (@VetleLunde) May 16, 2024

As a crypto investor, I can tell you that Morgan Stanley has recently joined the ranks of over 900 other firms by investing a significant amount in Grayscale’s GBTC exchange-traded fund. Specifically, they have allocated $269.9 million towards this investment, making them the second largest holder of this ETF after Susquehanna International Group, which holds approximately $1 billion worth.

The top investment in GBTC from institutions reached a total of $4.38 billion. In second place is IBIT from BlackRock, which has received approximately $3.23 billion in investments. Lastly, FBTC from Fidelity ranks third with investments amounting to $2.1 billion.

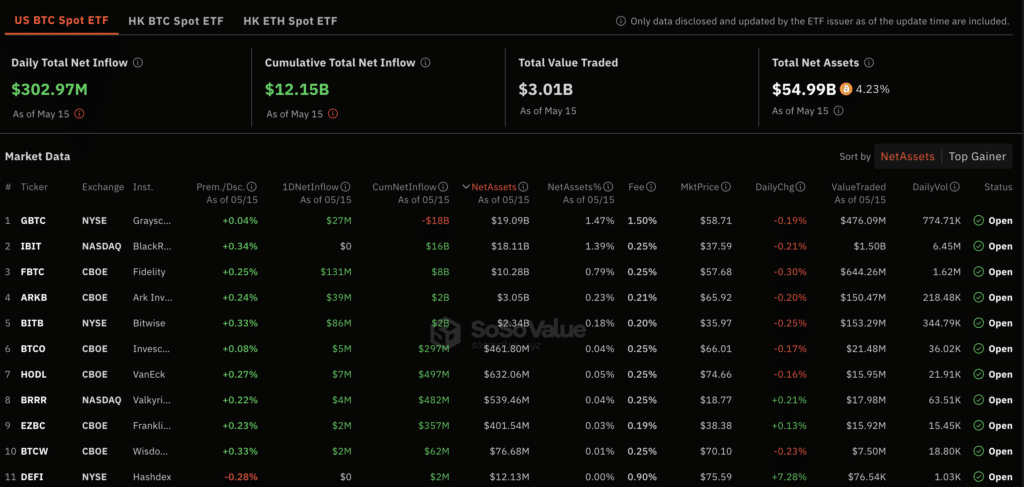

On May 15th, there was a net investment of $303 million into Bitcoin spot Exchange-Traded Funds (ETFs), with $131 million going into FBTC and $86.3 million into BITB. Since their approval, over $12 billion has been poured into these Bitcoin ETFs, marking the third consecutive day of inflows based on data from SoSoValue.

On May 13th, Matt Hougan, the Chief Investment Officer at Bitwise, highlighted that institutional investors are increasingly opting for Bitcoin Exchange-Traded Funds (ETFs). He mentioned that approximately 563 investment firms have collectively poured around $3.5 billion into these funds.

Hougan draws a parallel between the recent spike in popularity for Bitcoin spot ETFs and the boom in gold-centric ETFs back in 2004. The gold ETF funds experienced remarkable success, amassing more than $1 billion in investments within their first five days of trading.

Read More

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Gold Rate Forecast

- USD JPY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- EUR CNY PREDICTION

2024-05-16 18:17