As an experienced financial analyst specializing in cryptocurrencies and blockchain technology, I have closely followed the recent developments in Bitcoin’s network fees and miner behavior. The Kaiko research report sheds light on a critical issue that could potentially influence the Bitcoin market.

According to analysts at blockchain company Kaiko, the upcoming Bitcoin halving could potentially lead miners to offload their cryptocurrency reserves.

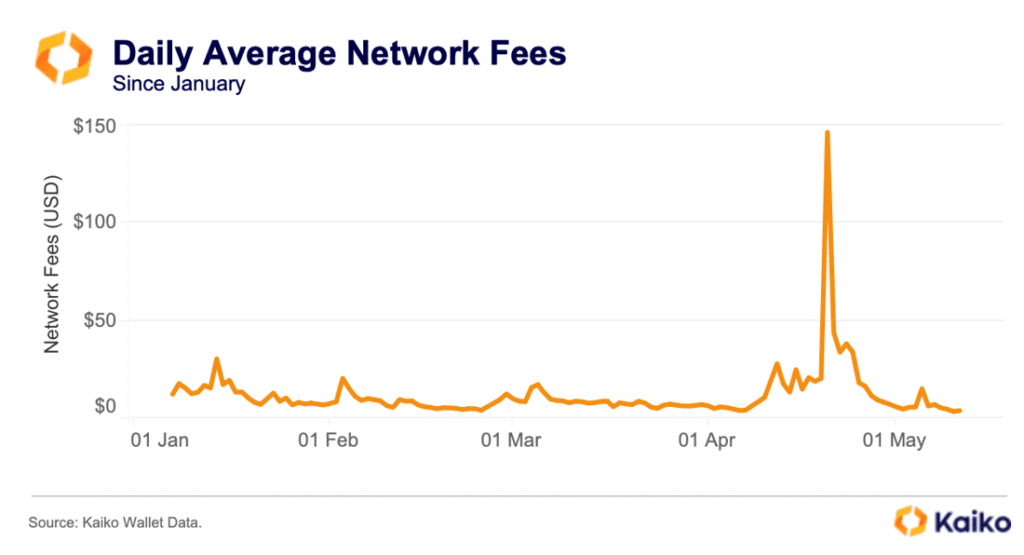

Bitcoin miners are experiencing relief as the average daily network fees, which surged following the halving event, have started to decrease, reports suggest from Kaiko’s analytical team.

In their latest study, analysts at the Paris-based company observed a significant increase in average daily network fees post-halving event. This uptick in fees brought some respite for Bitcoin miners. However, according to the firm, these fees have since decreased as the initial excitement surrounding the Runes protocol subsided.

As a Bitcoin analyst, I have observed historically that during halving events, miners face increased costs when creating new blocks on the network. To cover these expenses, they often sell their crypto holdings. Although the recent rise in average network fees has reduced the necessity for selling, according to Kaiko’s analysis, the current decrease in fees might bring back selling pressure among miners.

Miners are beginning to turn off unprofitable rigs

We write about it here in detail

— James Butterfill (@jbutterfill) May 13, 2024

As a researcher, I’ve come across an intriguing observation from James Butterfill, the head of research at CoinShares. He noted that Bitcoin miners are now opting to switch off less profitable rigs in order to control expenses rather than offloading their Bitcoin holdings immediately. The exact timing of any potential selling, however, remains uncertain.

Kaiko observes that miners categorize their Bitcoins as “liquid assets” on their financial statements because they can quickly convert them into cash for business expenses. For example, Marathon Digital owns 17,631 BTC worth more than $1.1 billion, while Riot Platforms manages another 8,872 BTC valued above $500 million. The analysts emphasize that if miners were compelled to sell only a portion of their holdings in the coming month, this could result in a downward trend for the markets.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-05-14 14:12