As a seasoned analyst with over two decades of experience in the financial markets, I have learned to read between the lines and navigate through the ups and downs that come with investing. The current state of Bitcoin is indeed intriguing, given its contrasting performance against other major indices.

Despite significant increases in major stock indices such as the Dow Jones, Nasdaq 100, and Nifty 50 reaching new records, Bitcoin‘s price appears to be headed for a decrease this month.

In August, Bitcoin experienced a nearly 10% decline, whereas the Nasdaq 100 index saw a more than 2% increase and gold reached a record peak of $2,530.

Even though the US dollar index dropped to $100.1, decreasing by more than 6% from its yearly peak, this unusual event didn’t hinder the performance. Interestingly, bitcoin tends to perform well when the U.S. dollar weakens. Remarkably, the growth persisted despite the addition of over $188 million in assets to spot Bitcoin ETFs.

As per Kaiko’s explanation, it appears that investors might be dumping Bitcoins due to growing anxiety over decreasing liquidity within the Bitcoin market and escalating fears that governments may begin offloading their Bitcoin reserves.

In July, the German government chose to dispose of its Bitcoin investments, while an analyst suggested that Britain might consider doing the same with its 61,000 coins to help balance its budget. With the British government recently discovering a budget shortfall amounting to $22 billion, the likelihood of them selling their Bitcoin holdings has become more probable.

Besides myself, the largest Bitcoin holdings are found in the United States, China, and Ukraine, with amounts of approximately 213,246, 190,000, and 46,351 coins, respectively.

Bitcoin spot and futures dropped in August

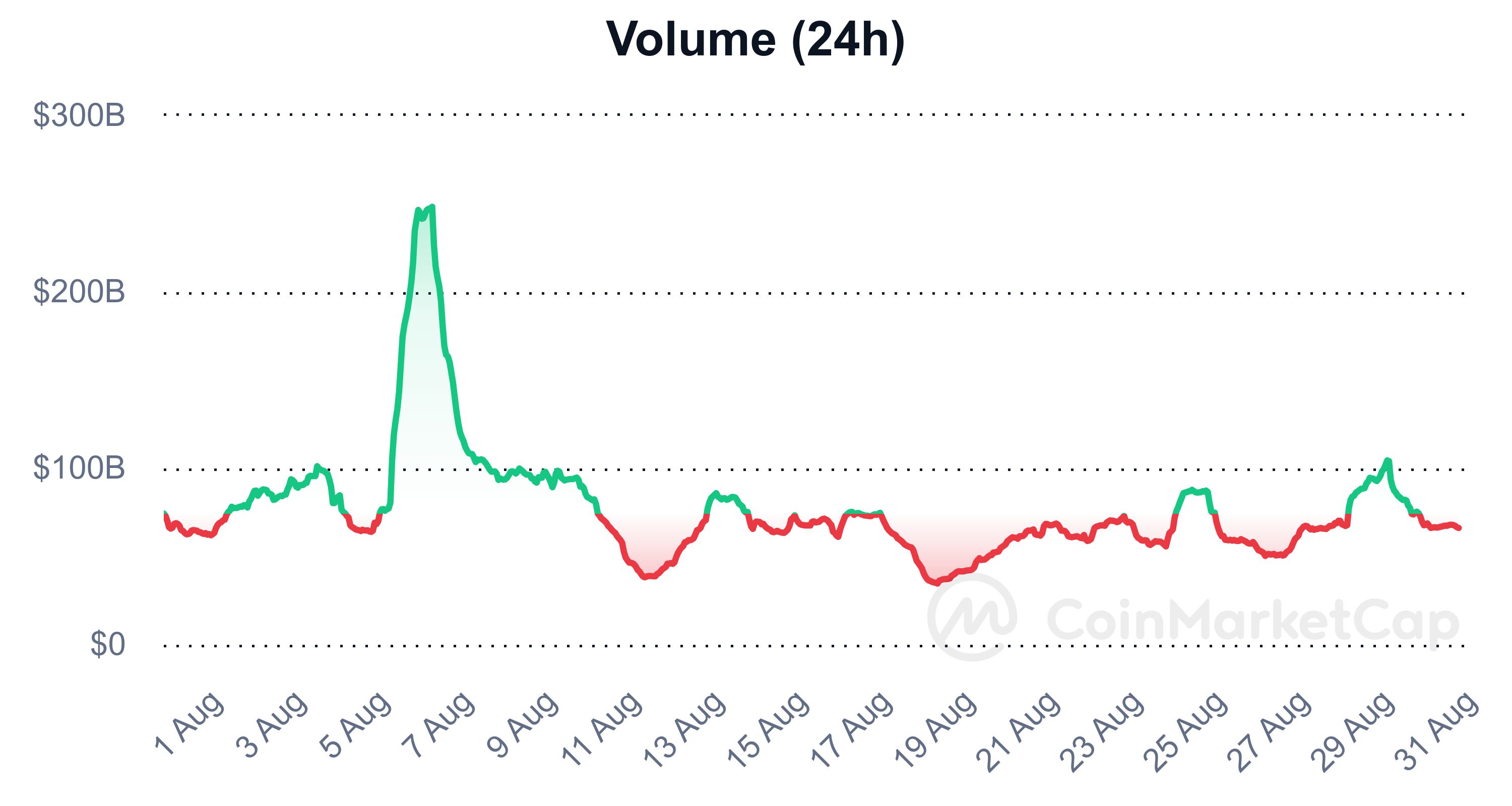

As a researcher, I’ve observed an interesting trend this month – the trading volumes in both the spot and futures markets for cryptocurrencies appear to be relatively low. Typically, we see reduced activity in these markets when prices aren’t doing so well, which seems to be the case here.

According to DeFi Llama, decentralized exchanges traded over $167 billion worth of assets in August, which is lower compared to July’s $193 billion figure. Meanwhile, a report by CoinMarketCap indicates that the trading volume peaked on August 5 and subsequently continued its decline.

In a optimistic forecast, a Fundstrat analyst has suggested that following the Labor Day holiday, Bitcoin’s trading activity typically rebounds, indicating potential increased activity in the Bitcoin market during September.

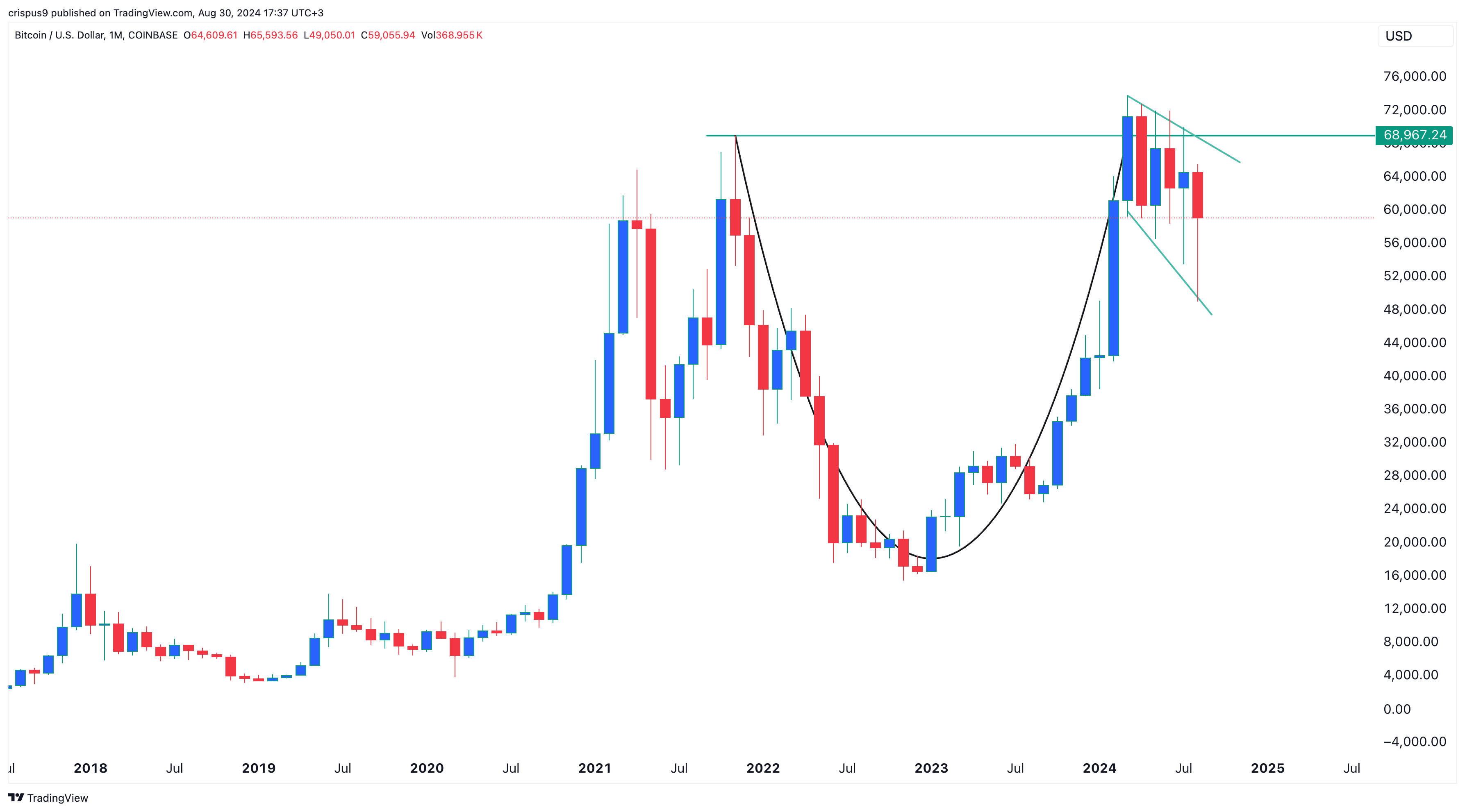

A beneficial aspect is that Bitcoin appears to have created a ‘hammer’ chart configuration on its monthly graph, suggesting a possible recovery. Additionally, it seems to have formed a ‘cup and handle’ pattern, as depicted above. These ‘hammer’ and ‘cup & handle’ formations are often seen as extremely bullish signs within the marketplace.

On the other hand, it’s important to note that Bitcoin tends to experience a downtrend in September. In fact, it has decreased during this month in eight out of the last eleven years.

Historically, September has been a challenging month for Bitcoin, with minimal gains only occurring three times in the last decade. This year, however, things might not follow the usual pattern – could it be an exception to the rule?

— Lark Davis (@TheCryptoLark) August 27, 2024

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-08-30 18:30