As a researcher with experience in the cryptocurrency market, I find Kaspa’s recent price recovery and outperformance of larger cryptocurrencies noteworthy. The cryptocurrency has now risen for four consecutive days, with its trading price reaching $0.18, up 32% from its lowest level this month.

The cost of Kaspa is on the mend and is approaching its peak value for the year, while other digital currencies continue to struggle. Kaspa’s price has risen uninterrupted for the past four days and was last recorded at $0.18, marking a 32% increase from its lowest point this month.

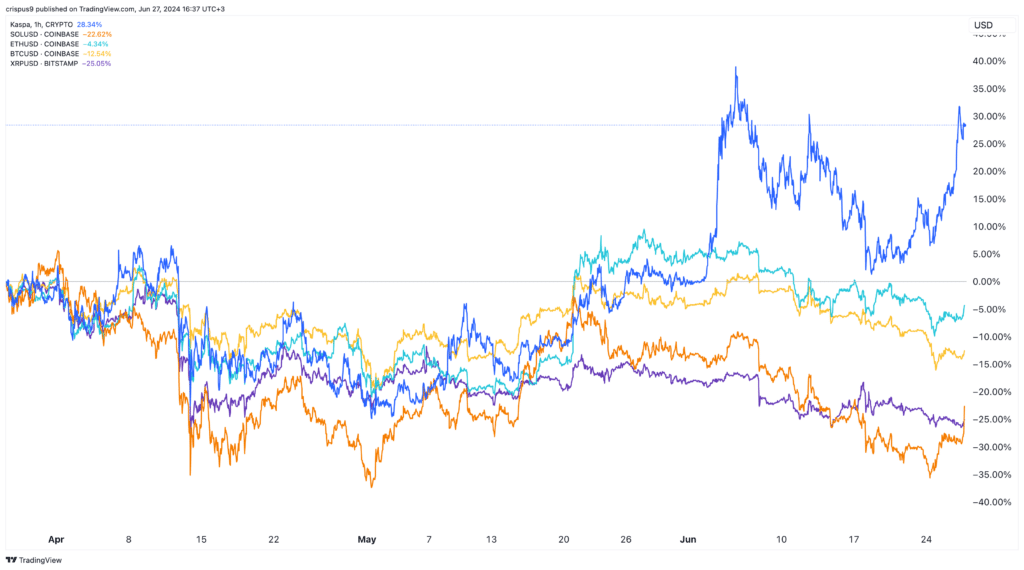

In the second quarter, Kaspa surpassed the majority of large-cap cryptocurrencies in terms of growth. Contrastingly, Bitcoin, Ethereum, Solana, and Ripple‘s XRP experienced declines of 12.5%, 4.35%, 22%, and 25% respectively.

Kaspa vs Bitcoin vs Ethereum vs Solana vs XRP

The surge in Kaspa’s rebound occurred concurrently with a seven-day streak of increasing open interest in the futures market. This level peaked at a high not seen since June 7th, amounting to $61 million. The majority of this activity was observed on the exchanges Bybit, Binance, and Bitget.

On Thursdays, Marathon Digital, a major Bitcoin mining firm, disclosed that they have been actively mining the cryptocurrency, resulting in a rally.

In our latest development, we are pleased to disclose that we have been persistently engaging in the process of extracting Kaspa’s cryptocurrency rewards. Our commitment to diversification, a cornerstone of our energy solutions and technology advancements investments, continues to hold significance in our digital asset computing activities. For further details, kindly refer to our comprehensive press release.

— MARA (@MarathonDH) June 26, 2024

At a point when several Bitcoin mining businesses are seeking expansion following the latest halving, Riot Platforms has put forth an unwelcome takeover offer for Bitfarms, while Hut 8 secured a $150 million fund to construct artificial intelligence facilities.

As an analyst, I would describe Kaspa as follows: Similar to Bitcoin, Kaspa operates on a proof-of-work (PoW) consensus mechanism and boasts a maximum supply of 28.7 billion tokens. To date, 24 billion of these tokens have been mined, leaving approximately 4.7 billion tokens left for future mining efforts. Miners are currently engaged in a competitive process to extract these remaining coins.

The mining performance of Kaspa has significantly improved as indicated by new data. Its hash rate has reached an all-time high of 362.89 Petahashes per second (PH/s). This metric is crucial in evaluating the effectiveness of mining hardware. Additionally, the mining difficulty for Kaspa has surged to a record level of 357.36p, which is notably higher than the 141p mark at the beginning of the year.

Despite a significant discrepancy in trading activity between Kaspa and Pepe, with Kaspa’s 24-hour volume amounting to only $128 million compared to Pepe’s robust $700 million.

Kaspa price nearing key level

KAS price chart

As an analyst, I’ve noticed that Kaspa’s price rebound has brought it close to two significant resistance levels. The first one is at $0.1893, which represents its peak on February 20th and marks the upper boundary of the cup and handle pattern indicated by the green line. A cup and handle pattern is known for being quite bullish in the market.

As a researcher studying the cryptocurrency market, I’ve observed that Kaspa is approaching a significant resistance level at $0.1940. This price point holds historical significance as it was where Kaspa previously formed a false breakout earlier this month and reached its all-time high. If Kaspa manages to surpass this barrier, it could be an indication of further upward momentum in the short term.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-06-27 17:19