As a seasoned analyst with years of experience navigating the turbulent waters of the crypto market, I find myself intrigued by Lido DAO‘s recent surge. The 33% rise in just 24 hours is certainly eye-catching, especially considering the asset’s current trading price of $1.40 and a market cap of over $1.26 billion.

The Lido DAO experienced a robust surge in value, boosted by optimistic feelings within the cryptocurrency sector. Evidence indicates that large investors (whales) are amassing more of this asset.

Currently, Lido DAO’s token (LDO) has surged by approximately 33% within the last 24 hours and is being traded at $1.40 as we speak. The market value of this digital asset stands at a substantial $1.26 billion, with daily trading volumes exceeding $300 million.

The positive movement in LDO’s price began following Bitcoin (BTC) hitting a record peak above $75,000, which occurred on November 6th, the day Donald Trump was elected as President of the United States.

Despite the price hike, LDO is still down by 92% from its ATH of $18.6 in November 2021.

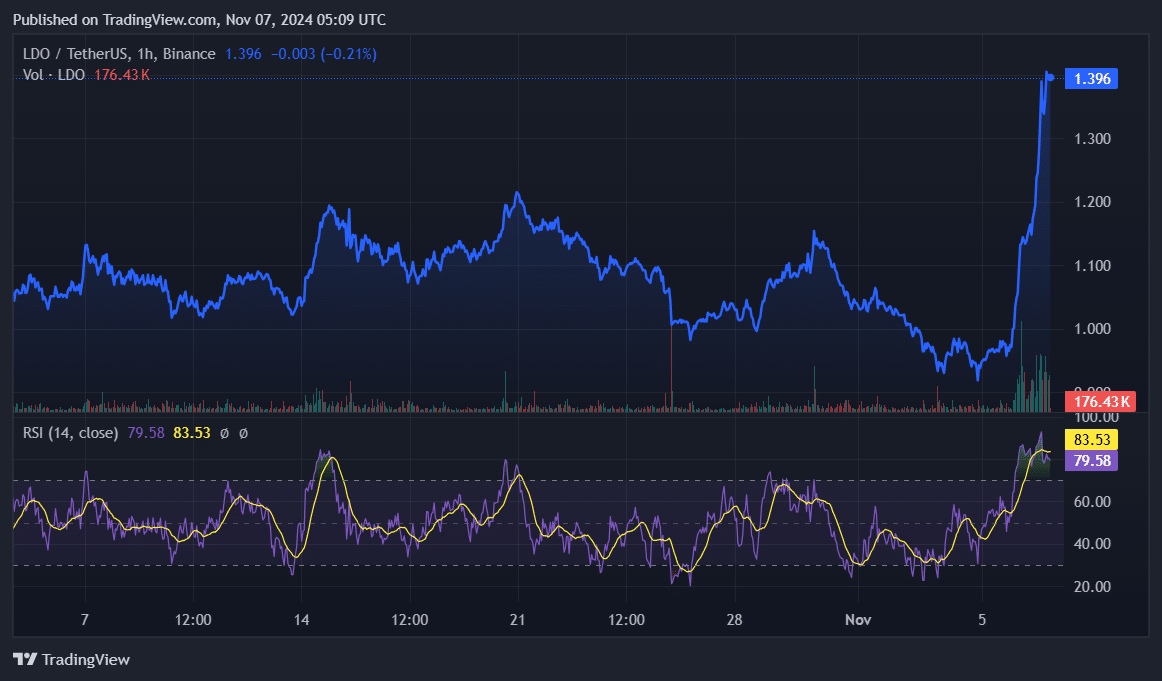

Significantly, it’s been observed that the Relative Strength Index of Lido DAO exceeded 80. This indicator implies that the asset has now moved into an “overbought” state.

Rally triggered by whales

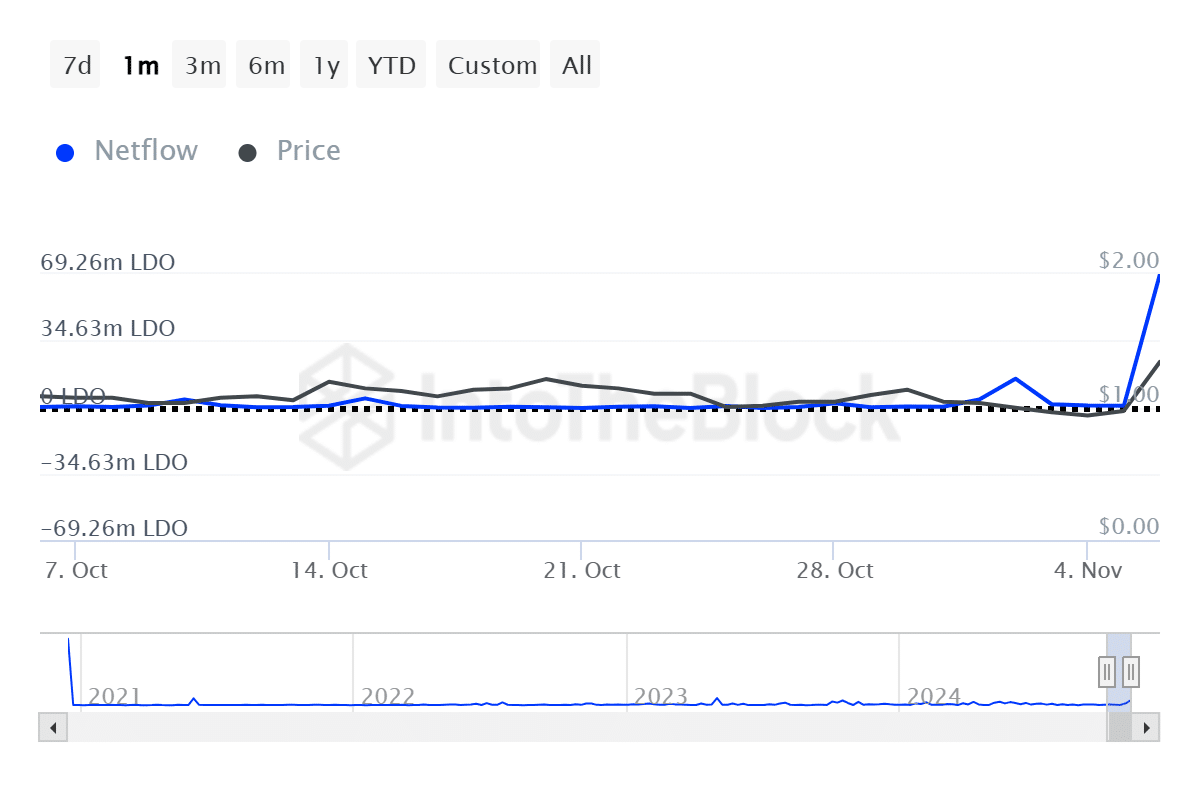

It appears that there has been a significant rise in whale activity related to the LDO token prior to its price surge. As reported by IntoTheBlock, the amount of LDO tokens held by large investors (whales) increased dramatically, rising from 645,000 LDO to approximately 69.26 million LDO within the last day.

The current inflow of whales into the LDO network is at its maximum since May 2023, a time when the asset price was nearly $2.

The actions suggest that whales are amassing significant holdings in LDO, demonstrating their keen interest. Typically, an increase in large investor deposits might instill a sense of ‘fear of missing out,’ often abbreviated as FOMO, within the investment community.

Given that more than 60% of Lido DAO’s tokens are held by large investors (often referred to as “whales”), a sudden increase in price might cause significant price swings, according to ITB. Additionally, the widespread fear of missing out (FOMO) across the market could exacerbate the volatility in LDO’s price.

Read More

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- USD MXN PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-11-07 09:22